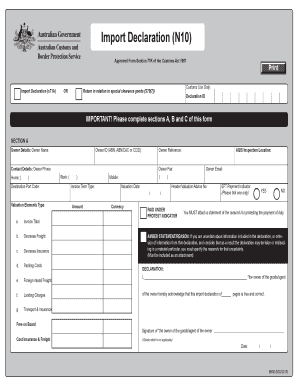

Definition and Meaning of the Mobile Coverage Claim Form

The Mobile Coverage Claim Form Security Service - ssfcu is a documented procedure utilized by members of the Security Service Federal Credit Union (SSFCU) to submit claims for mobile device protection. This form serves as both a declaration and a request for coverage under a member services agreement. It itemizes the steps necessary for claim submission, including detailing the requisite member and device information, necessary supporting documentation, and conditions for eligibility. The form's completion does not automatically ensure coverage, as it is contingent upon meeting specific terms and conditions outlined within the plan.

How to Use the Mobile Coverage Claim Form

To effectively utilize the Mobile Coverage Claim Form, members must follow a systematic approach. Begin by gathering all relevant information about the mobile device, including its make, model, and unique identifying numbers such as serial or IMEI numbers. Document the circumstances of loss or damage to the device meticulously, as this information is crucial for assessing eligibility.

- Gather Device Information: Ensure you have all details about the mobile device and the nature of the issue.

- Complete the Form: Fill out each section carefully, ensuring accuracy to prevent delays.

- Attach Documentation: Include any necessary attachments such as repair estimates or replacement receipts.

- Submit the Form: Follow the prescribed methods for submission—either online, by mail, or in person.

How to Obtain the Mobile Coverage Claim Form

Members can access the form through several channels to suit their preferences. It is available for download and print from the official SSFCU website, providing a convenient option for those who prefer digital solutions. Alternatively, members can procure a physical copy from the nearest SSFCU branch, ensuring accessibility for those who favor traditional paper forms.

- Download: Access and print from the official website.

- In-Person: Visit a branch to obtain a physical copy.

Steps to Complete the Mobile Coverage Claim Form

Completing the form requires careful attention to detail and adherence to the instructions provided, which maximize the likelihood of a successful claim. Here’s how to approach it:

- Personal Information: Enter your full name, SSFCU account number, and contact details accurately.

- Device Details: Include the device make, model number, and any unique identifiers.

- Incident Description: Provide a comprehensive description of the incident, including date and location.

- Supporting Documentation: Attach any relevant documents like proof of purchase, repair quotes, or police reports.

- Signature: Sign the form to verify the information provided is true to the best of your knowledge.

Key Elements of the Mobile Coverage Claim Form

The form comprises several key elements that are crucial for the claim process:

- Member Information: Ensures that the claim is associated with the correct account.

- Device Description: Provides critical details about the mobile device covered by the policy.

- Incident Report: Captures the specifics of the event prompting the claim.

- Document Attachments: Amplifies the form through tangible evidence supporting the claim.

- Acknowledgment of Terms: Members must accept the terms and conditions stipulating the coverage limits and exclusions.

Who Typically Uses the Mobile Coverage Claim Form

The form is predominantly utilized by SSFCU members who have opted for mobile device coverage under their member services agreement. It caters to individuals who might experience accidental damage or theft to their mobile devices and require financial remediation. This process is integral for members who rely heavily on their mobile devices for professional or personal use and cannot afford prolonged downtime or unexpected expenses due to loss or damage.

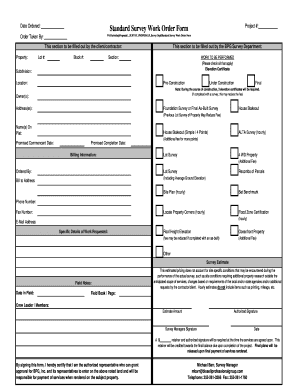

Required Documents for Submission

Supporting documents are vital for corroborating the claims made in the form. These documents include:

- Proof of Purchase: To confirm ownership and coverage eligibility.

- Repair Estimates: For devices that have been damaged but not yet repaired.

- Police Report: In the event of theft, this document is necessary to validate the claim.

- Warranty Information: To rule out conflicts with existing warranties that might cover the incident.

Form Submission Methods

Submission of the Mobile Coverage Claim Form can be executed through multiple mediums, each providing its own advantages:

- Online: Convenient and quick, utilizing the document management platform to upload completed forms and supporting documents.

- Mail: Traditional submission method, suitable for those who prefer hard copies and direct mailing for record-keeping.

- In-Person: Facilitates personal interaction with SSFCU representatives, allowing for immediate assistance and clarification if needed.

Eligibility Criteria

To qualify for coverage, members must meet certain criteria set forth in their agreement. These criteria often include:

- Active Membership: The claimant must be a current member of SSFCU with an active account.

- Coverage Activation: The device must be under a valid mobile coverage policy at the time of the incident.

- Timely Reporting: Claims should be submitted within a stipulated period after the incident to remain valid.

These criteria are foundational to the claim approval process, establishing a framework within which claims are reviewed and considered for approval.