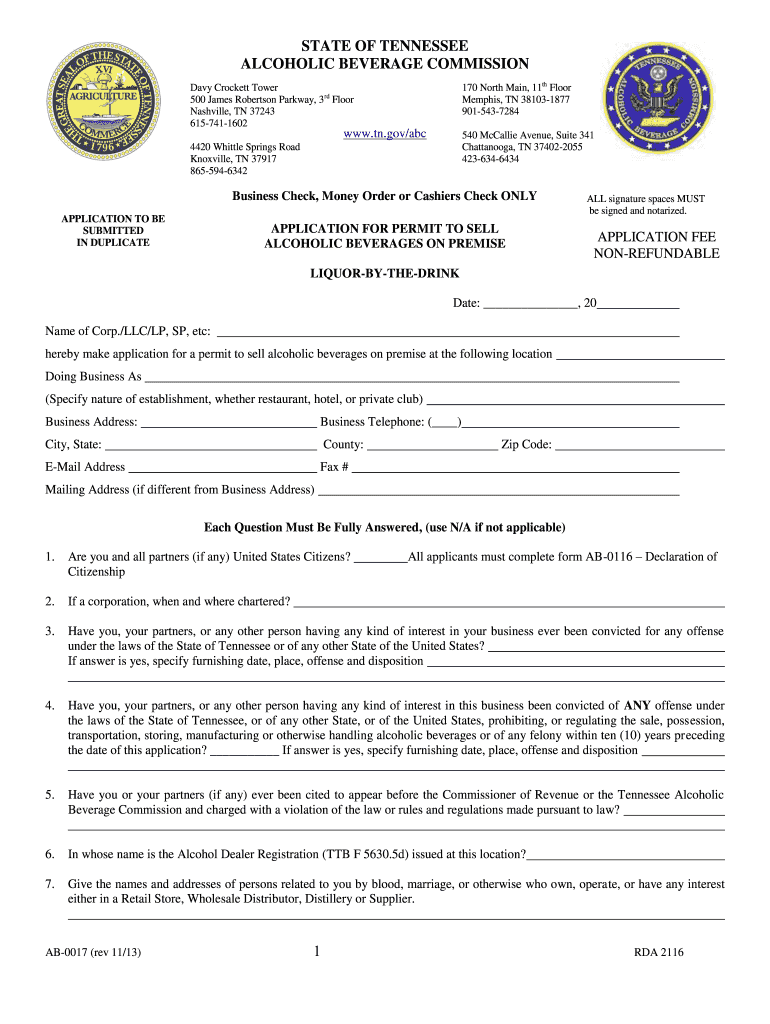

Definition and Purpose of AB-0017 - TN - tn

The AB-0017 - TN - tn form is a critical application for businesses seeking the legal right to sell alcoholic beverages on their premises within Tennessee. This document facilitates compliance with state regulations, safeguarding both the business and public interest. The form ensures that applicants provide all necessary personal and business details, including adherence to legal compliance related to past convictions and existing business interests. Notarized signatures and an application fee are integral to completing this form, which collectively ensure the authenticity and seriousness of the application process.

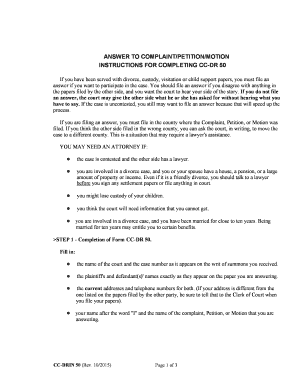

Steps to Complete AB-0017 - TN - tn

-

Gather Preliminary Information: Before filling out the form, collect necessary personal and business information, such as identification numbers, business licenses, and ownership details.

-

Fill Out Personal and Business Sections: Include detailed personal information along with business-related data. It's essential to correctly input names, addresses, and contact information to avoid the rejection of the application.

-

Disclose Legal Compliance: Provide an honest disclosure of previous legal convictions or business interests that might affect eligibility. This is crucial for maintaining transparency and adhering to regulatory standards.

-

Notarize the Document: Ensure that the completed form is notarized. This step provides legal validation of the signatures on the form.

-

Pay the Application Fee: Submit the correct application fee as instructed. This non-refundable fee is a necessary part of the application process.

-

Submit the Form: Send the form to the appropriate Tennessee authority via mail or any specified method. Ensure that all parts of the form are completed accurately to avoid processing delays.

Legal Use and Compliance of AB-0017 - TN - tn

Legal compliance with the AB-0017 - TN - tn form is imperative for businesses in Tennessee intending to sell alcoholic beverages. This form aligns with state laws, ensuring businesses operate within legal frameworks. Applicants must disclose any previous criminal records or business interests that could influence their application. Adherence to these requirements not only facilitates approval but also safeguards business operations against legal penalties or license retraction due to non-compliance.

Notarization and Fee Payment

- Notarization: Provides a layer of authenticity and legal strength to the signatures.

- Fee Payment: Reflects the non-refundable nature of the application fee, emphasizing the financial commitment to legal compliance.

Required Documents for AB-0017 - TN - tn

Applicants must prepare a suite of documents when completing the AB-0017 - TN - tn form:

- Business License: Proof of business legitimacy and location within Tennessee.

- Personal Identification: Copies of licenses or identification documents for verifying identity and ownership.

- Legal Disclosures: Any historical legal documents relating to past convictions or compliance discrepancies.

These documents support the information provided on the form and form a basis for its approval.

Examples of Using AB-0017 - TN - tn

Consider a restaurant owner in Nashville aiming to add alcoholic beverages to their menu. They must submit the AB-0017 - TN - tn form, including background checks and notarized signatures, to obtain a license that allows them to sell alcohol openly in compliance with Tennessee's legal frameworks. Another example involves a new bar opening in Memphis, where acquiring this form is essential for legally serving their patrons.

Eligibility Criteria for AB-0017 - TN - tn

To apply for the AB-0017 - TN - tn form, businesses must meet specific criteria, including having a physical location within Tennessee and adhering to operational standards set by state authorities. The criteria also necessitate full disclosure of any past legal offenses related to alcohol sales and evidence of compliance with existing business regulations. Only businesses meeting these requirements will successfully receive approval to sell alcoholic beverages on their premises.

State-Specific Rules for AB-0017 - TN - tn

Understanding Tennessee's unique legal landscape is vital for anyone applying for the AB-0017 - TN - tn form. Unlike other states, Tennessee may have distinct regulations regarding alcohol sales, such as specific operational hours or licensing renewal periods. Familiarity with these state-specific regulations ensures businesses not only secure a license but also maintain it without infractions that could jeopardize their operational legality.

Who Typically Uses the AB-0017 - TN - tn

The primary users of the AB-0017 - TN - tn form are business entities that aim to legally sell alcoholic beverages within Tennessee. This typically includes:

- Restaurants and Bars: Eager to offer liquor, wine, or beer as part of their dining experience.

- Catering Companies: Looking to expand their services to include alcohol catering.

- Event Venues: Seeking the ability to serve alcohol during events hosted on their premises.

Each of these users must complete the application to legally align their business with state alcohol regulations.