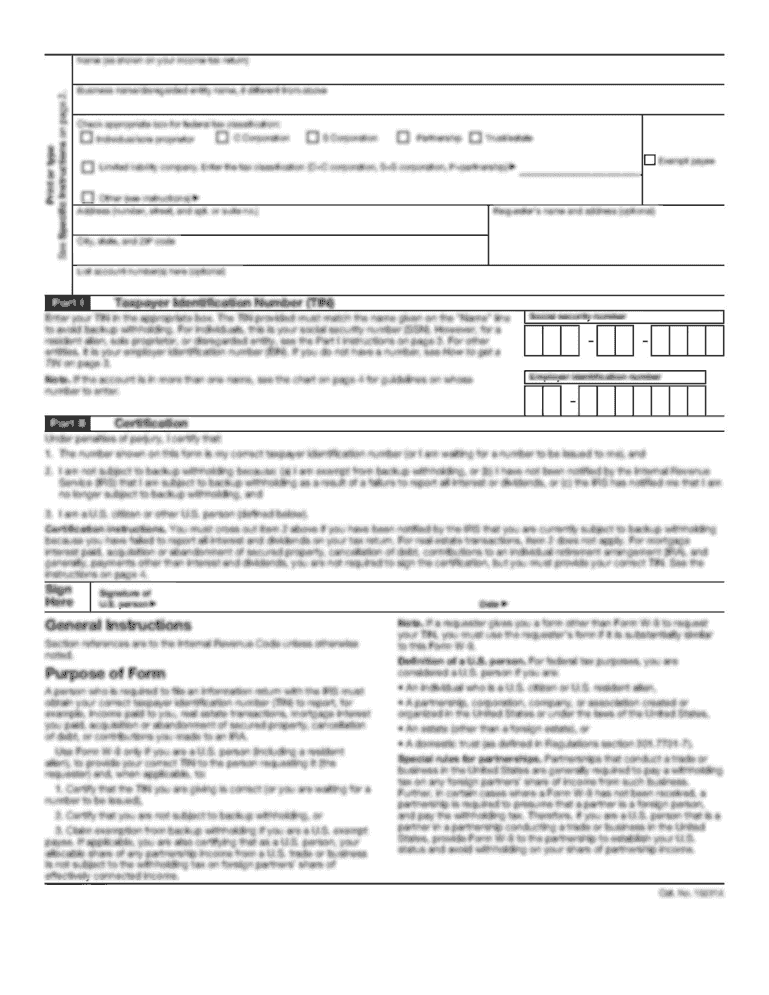

Definition and Purpose of Form 1041-A

Form 1041-A, the U.S. Information Return for Trust Accumulation of Charitable Amounts, is a key document used by trustees of certain trusts. This form is essential for reporting income, deductions, and distributions related to charitable purposes as mandated by the Internal Revenue Service (IRS). The form serves to maintain transparency and compliance, detailing how trust funds are managed and allocated towards charitable activities. By ensuring accurate reporting, Form 1041-A helps in promoting accountability and supporting the integrity of charitable trusts.

How to Use Form 1041-A

Trustees need to comprehend several specific steps when utilizing Form 1041-A. The process begins with collecting all pertinent financial data from the trust, including income accrued and expenses deducted over the fiscal year. Trustees must then categorize this information as per the form’s sections on income, charitable distributions, and required schedules.

- Prepare Financial Documentation: Gather financial statements, receipts, and previous year’s tax documents for accurate reporting.

- Complete Income and Deductions Sections: Enter details of all income types and authorized deductions as directed on the form.

- Detail Charitable Distributions: Specify how funds were allocated for charitable purposes within the tax year.

- Review and Submit: Double-check entries for errors and submit the form to the IRS by the stipulated deadline.

Obtaining Form 1041-A

Accessing Form 1041-A is straightforward. Trustees can download and print the form directly from the IRS website, ensuring they have the latest version. Alternatively, it might be available through professional tax software platforms accredited by the IRS, offering digital convenience for filers.

- IRS Website: Official source for downloading the form in PDF format.

- Tax Software: Integration with platforms such as TurboTax or QuickBooks might offer an electronic version pre-filled with previous data.

- Request by Mail: For those preferring physical copies, requests can be made to the IRS for a mailed version.

Steps to Complete Form 1041-A

Completing Form 1041-A involves meticulous adherence to IRS guidelines to ensure accuracy and compliance:

- Understand Each Section: Familiarize yourself with the four primary sections covering income, deductions, and distributions.

- Enter Income Details: Include all taxable income collected by the trust during the reporting period.

- List Deductions: Deductible expenses related to managing the trust and its charitable contributions must be clearly documented.

- Document Distributions: Specify how much of the income has been set aside or distributed for charitable purposes.

- Prepare the Balance Sheet: Report the trust’s financial position at the beginning and end of the tax year with precision.

Key Elements of Form 1041-A

Understanding the essential components of Form 1041-A is crucial for effective completion.

- Income Section: This part catalogues proceeds received by the trust from various sources such as interest, dividends, and gains.

- Deductions Section: Documents all allowable expenses incurred by the trust in earning income and managing charitable distributions.

- Charitable Distributions: Designated area for indicating funds allocated to charitable activities, ensuring compliance with trust agreements.

- Balance Sheets: Reflects the fiscal health of the trust, showing assets, liabilities, and equity changes.

Filing Deadlines and Important Dates

Timely submission of Form 1041-A is critical. For most trusts aligned with the calendar year, the deadline is on or before April 15 of the following year. Trustees need to prepare ahead to avoid penalties:

- Annual Deadline: Generally, April 15 for trusts operating on a calendar year.

- Extensions: Potentially available if submitted through a formal request to the IRS.

- Late Filing Penalties: Failure to file timely can result in IRS penalties, increasing compliance costs.

Required Documents for Form 1041-A

Compiling the necessary documentation streamlines the reporting process. Trustees must assemble:

- Annual Income Statements: From banks and investment accounts.

- Expense Receipts: To justify all claimed deductions.

- Prior Year’s Tax Return: For reference and consistency in reporting.

- Charitable Receipts: Proof of funds allocated towards charity.

Penalties for Non-Compliance

Non-compliance with Form 1041-A submission carries potential penalties that can impact the trust’s operations negatively.

- Monetary Fines: These increase the longer the filing is delayed.

- Interest on Unpaid Taxes: May accrue if the reporting neglects potential tax liabilities.

- Audit Risks: Incomplete or inaccurate filings might trigger detailed IRS reviews of the trust.

Software Compatibility for Form 1041-A

Utilizing compatible software can enhance accuracy and ease the completion process:

- TurboTax and QuickBooks: Offer structured forms and guidance tailored to charitable trust filings.

- Integration with Cloud Services: Provides easy access and document storage for trustees operating remotely or across multiple jurisdictions.

- Electronic Filing Options: Available through certain platforms, ensuring quicker IRS processing and confirmation.