Definition & Meaning

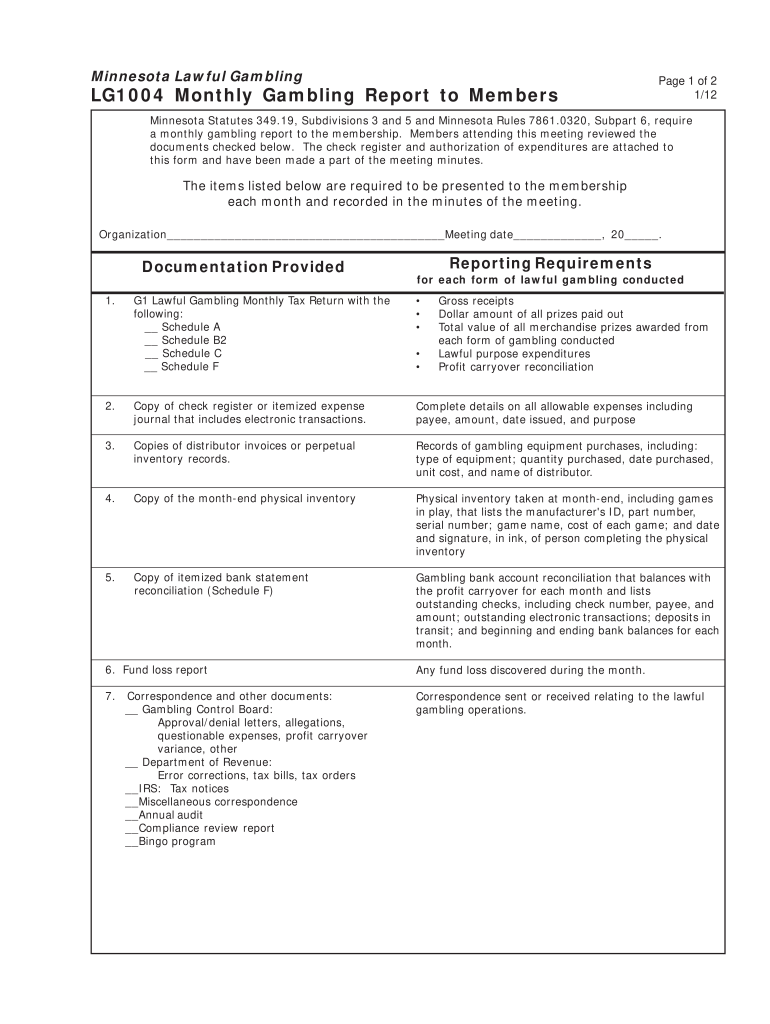

The "LG1004 Monthly Gambling Report to Members - Gambling Control" is a crucial document mandated by Minnesota state law for organizations engaged in lawful gambling activities. This report serves as a structured record that outlines the financial and operational aspects of gambling-related activities conducted within a given month. It ensures transparency and accountability by providing details on financial transactions, inventory management, and compliance with legal requirements.

Importance of the Report

- Facilitates transparency for members in gambling operations.

- Ensures compliance with state regulations.

- Provides a framework for tracking expenditures and revenues.

- Includes necessary documentation for lawful gambling activities.

How to Use the LG1004 Monthly Gambling Report

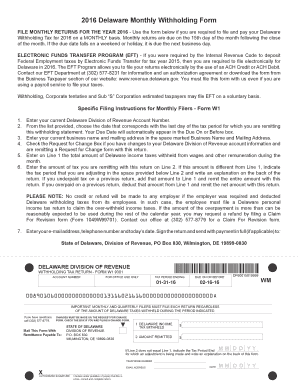

Organizations must use the LG1004 Monthly Gambling Report as a tool to present accurate financial information to their members. It should be compiled monthly and submitted at membership meetings. The report includes various financial aspects such as tax returns, expense journals, and bank reconciliations. It forms the basis for member approval on expenditures and helps track lawful purpose expenditures.

Preparing the Report

- Collect Financial Information: Gather tax returns, expense journals, and bank statements.

- Compile Transaction Details: Include all transactions related to gambling operations.

- Draft the Report: Organize the information under relevant headings and sections.

Steps to Complete the LG1004 Monthly Gambling Report

Completing the LG1004 Monthly Gambling Report requires careful attention to the form's requirements to ensure accuracy and compliance.

Detailed Steps

-

Gather Necessary Documents:

- Tax returns

- Expense journals

- Bank reconciliations

- Inventory records

-

Document Transactions:

- Record all gambling-related transactions.

- Include income and expenditure details.

- Prepare balance sheets.

-

Draft and Review:

- Compile the report using the collected data.

- Review for accuracy and completeness.

-

Submit to Members:

- Present the report at membership meetings.

- Ensure member approval for expenditures.

Required Documents

To complete the LG1004 Monthly Gambling Report, specific documents are needed to ensure full compliance and accuracy.

Essential Document List

- Expense Journals: Detailed records of all gambling-related expenses.

- Tax Returns: Annual or monthly tax documentation relevant to gambling operations.

- Inventory Records: Detailed logs of gambling goods and services.

Legal Use of the LG1004 Monthly Gambling Report

The LG1004 Monthly Gambling Report serves a legal framework, ensuring that organizations comply with state regulations concerning lawful gambling.

Compliance Requirements

- Lawful Purpose Expenditures: Must clearly outline expenditures for legal activities.

- Approval Processes: Report must gain member approval for noted expenditures.

- Regulatory Adherence: Align with Minnesota gambling laws and guidelines.

Key Elements of the LG1004 Monthly Gambling Report

Success in completing the LG1004 form hinges on understanding its key components and ensuring they are filled accurately.

Core Components

- Financial Overview: Statements summarizing income and expenses.

- Transaction Records: Detailed logs of all financial movements.

- Member Approval Sections: Areas indicating required member authorization.

Filing Deadlines and Important Dates

Adherence to filing deadlines ensures compliance and avoids penalties. The LG1004 Monthly Gambling Report requires timely submission.

Critical Deadlines

- Monthly Submission: Report due by the end of the month following the reporting period.

- Annual Review: Must be included in the organization's annual financial review.

Penalties for Non-Compliance

Failure to submit an accurate and timely LG1004 Monthly Gambling Report can lead to significant repercussions for the organization.

Possible Penalties

- Fines: Monetary penalties imposed for late or inaccurate submissions.

- Licensing Issues: Potential revocation of gambling licenses for non-compliance.

- Legal Consequences: Possible legal action for repeated non-compliance.

By ensuring comprehensive completion of the LG1004 Monthly Gambling Report, organizations can maintain legal standing and uphold the integrity of their gambling operations.