Definition and Meaning of 2016 DE W1 9301

The 2016 DE W1 9301 form refers to the Delaware Monthly Withholding Form used for reporting and paying Delaware State Withholding Tax on a monthly basis. This form is crucial for businesses operating in Delaware as it outlines the requirements necessary for employers to withhold, report, and remit taxes from their employees' wages to the Delaware Division of Revenue. Understanding its purpose is essential for businesses to maintain compliance with state tax laws and avoid legal penalties.

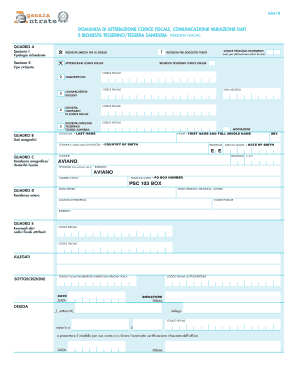

Key Elements of the Form

- Payer Information: Includes details about the employer, such as business name, address, and federal employer identification number (FEIN).

- Tax Withholding Data: Employers are required to report the total amount of Delaware State Tax withheld from employees during the reporting period.

- Due Dates: Clearly specifies dates by which the taxes must be filed and paid.

How to Use the 2016 DE W1 9301

Utilizing the 2016 DE W1 9301 involves several key steps designed to ensure accurate monthly tax reporting and payment.

- Accurate Record-Keeping: Employers must keep precise records of all employees' wages and amounts withheld for Delaware State Taxes.

- Report Generation: Use payroll systems or manual calculations to generate accurate reports of withheld taxes for submission.

- Form Submission: Complete and submit the form to the Delaware Division of Revenue along with any payments due.

How to Obtain the Form

- Online Access: Most businesses access the form via the Delaware Division of Revenue's official website, where it can be downloaded and printed.

- Tax Software: Some payroll or tax software may directly integrate with state forms, providing automated access and submission features.

- Mail: Request a physical copy by contacting the Delaware Division of Revenue.

Steps to Complete the 2016 DE W1 9301

Completing the 2016 DE W1 9301 requires attention to detail and following a series of specific steps:

- Gather Required Information: Collect all payroll details, including total wages paid and taxes withheld for the reporting period.

- Enter Employer Details: Fill in your business's name, address, and FEIN in the designated sections.

- Fill Out Withholding Figures: Input the total amount of tax withheld from all employees during the month.

- Review and Calculate: Double-check calculations for accuracy before submission to ensure compliance.

Important Terms Related to 2016 DE W1 9301

- Withholding Tax: The amount of an employee's pay withheld by the employer to be sent directly to the government as partial payment of the employee's state income tax.

- FEIN: A unique identification number assigned to a business for tax purposes.

- Reporting Period: Refers to the specific month for which tax deductions are being reported in the form.

Why Use the 2016 DE W1 9301

The primary reason for using the 2016 DE W1 9301 form is to comply with state laws related to employee withholding taxes. It ensures that businesses accurately report and remit taxes, which helps prevent legal issues and potential financial penalties.

Who Typically Uses the Form

- Employers in Delaware: Any business that employs individuals in Delaware must use this form for monthly tax filing.

- Payroll Officers: Individuals responsible for managing and processing payroll within a company are frequently involved in completing and submitting this form.

- Accountants and Tax Professionals: Professionals who assist businesses in maintaining compliance and managing tax liabilities.

Legal Use of the 2016 DE W1 9301

Using the 2016 DE W1 9301 legally involves adhering to all guidelines provided by the Delaware Division of Revenue.

- On-Time Filing: Ensuring that the form is submitted and payments are made by the due date each month.

- Accurate Reporting: Providing truthful and precise data about the wages and taxes withheld.

- Full Compliance: Employers must follow all regulations to avoid penalties from incorrect or late submissions.

Filing Deadlines and Important Dates

Being aware of the form's filing deadlines is crucial to avoid penalties. The 2016 DE W1 9301 typically requires submission by the 15th of each month following the reporting period.

Penalties for Non-Compliance

Failure to file the form or remit withheld taxes on time can result in:

- Monetary Penalties: Fines are imposed for late or inaccurate submissions.

- Interest on Unpaid Taxes: Accumulates daily until the full amount is paid.

- Legal Action: Persistent non-compliance may lead to more severe legal repercussions.

Submission Methods for 2016 DE W1 9301

Employers have multiple options for submitting the 2016 DE W1 9301 form to suit different business needs.

- Online Submission: The most convenient and efficient method using the Delaware Division of Revenue's e-filing system.

- Mail: Sending a hard copy through postal services, ensuring that it arrives by the due date.

- In-Person: Dropping off the completed form and any payments directly at a Delaware tax office for immediate processing.

By understanding these aspects and correctly using the 2016 DE W1 9301 form, businesses can efficiently manage their Delaware State Tax obligations, ensuring compliance and minimizing potential risks of penalties.