Definition & Meaning

The RDC RDC- Research and Development Tax Credit Application is a form used to apply for tax credits associated with research and development expenses. This tax incentive is designed to encourage innovation by reducing tax liability for eligible entities. The application involves assessing qualified research activities and expenditures, which must meet specific criteria outlined by U.S. tax regulations.

Key Definitions

- Qualified Research: Activities intended to develop new or improved business components, processes, techniques, or products that involve engineering, computer science, or similar disciplines.

- Base Amount: A calculated average based on past expenditures or other pre-defined methods as a benchmark to measure new research expenses.

- Research Expenditures: Qualified costs incurred in the research process, including wages, supplies, and contract research.

Steps to Complete the RDC RDC- Research and Development Tax Credit Application

- Gather Required Documentation: Collect data on all qualified research projects, costs, and related documentation. This includes payroll records, invoices, and technical reports.

- Calculate Qualified Research Expenditures (QREs): Use financial records to identify eligible costs and compute the total QREs by evaluating expenses that directly support R&D activities.

- Determine Base Amount: Calculate using the prior research expenditure formula or a defined base period method to establish a benchmark for credit eligibility.

- Fill Out the Form: Enter calculated data and project descriptions accurately on the application, ensuring compliance with the latest IRS guidelines.

- Review and Validate: Ensure all sections are completed, double-check calculations, and verify that all information aligns with supporting documents.

- Submit Application: Compile additional necessary supporting documents and submit the form by the designated deadline, either electronically or via traditional mail, to secure the tax credit.

Eligibility Criteria

Eligible entities for the RDC RDC- Research and Development Tax Credit include businesses engaging in qualifying research activities. To qualify:

- The research must be intended for new or improved business components.

- Activities must pass the IRS's "four-part test," involving elimination of uncertainty, process of experimentation, technological in nature, and intended for a permitted purpose.

- Expenditures should qualify under regulations, predominantly focusing on U.S.-based research.

Businesses Typically Eligible

- Small Businesses: Often benefit by offsetting payroll taxes.

- Startups: Eligible for immediate tax relief through modified tax credit applications.

- Established Corporates: Utilize tax credits to lower federal tax liabilities from ongoing R&D investments.

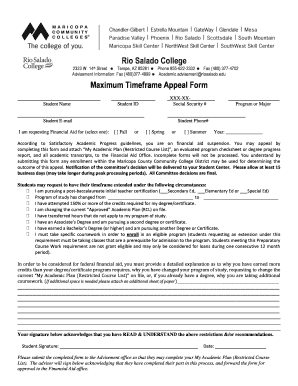

How to Obtain the RDC RDC- Research and Development Tax Credit Application

Entities interested in applying can obtain the application form in several ways:

- IRS Website: Forms are available for download, offering the official guidelines and instructions.

- Tax Software: Programs like TurboTax and QuickBooks often include interactive versions that simplify the application process.

- Professional Services: Many tax advisory firms provide assistance in completing and filing the form.

Filing Deadlines / Important Dates

The RDC RDC application must be submitted by April 1 each year. Ensuring timely submission is critical for availing the tax credit. Extensions may align with general tax filing extensions; however, timely submission of supporting documents remains important.

Key Considerations

- Compliance: Adhering to deadlines avoids penalties or loss of credit opportunities.

- Extensions: If necessary, follow IRS guidelines for applying for an extension, ensuring compliance while availing additional preparation time.

IRS Guidelines

The IRS outlines specific guidelines on what constitutes qualified research and eligible expenses. Key guidelines include:

- Clarity on the four-part eligibility test.

- Differentiation between direct and indirect research costs.

- Definitions and restrictions on research activities that do not qualify, such as funded research or research outside the U.S.

Key Elements of the RDC RDC- Research and Development Tax Credit Application

Core Sections

- Identifying Information: Includes business entity details and tax identification.

- Detailed Research Activities: Comprehensive account of R&D initiatives, stating objectives, methods, and outcomes.

- Expenditure Details: Breakdown and substantiation of costs associated with qualified research.

Critical Attachments

- Supporting Documentation: Essential for substantiating claims, including detailed project descriptions and financial records.

- Calculational Sheets: Detail the computation of the base amount and credit calculations to aid IRS review.

Software Compatibility

Using tax preparation software can streamline the completion and submission of the RDC RDC application. Programs like TurboTax, QuickBooks, and other specialized software offer:

- Step-by-step Guidance: Ensures accuracy and compliance with complex tax credit calculations.

- Auto-population Features: Simplifies data entry by pulling relevant information from existing accounting records.

Business Entity Types

Different types of business entities can benefit from the RDC RDC application:

- Corporations: Can apply credits against federal tax obligations, reducing overall tax liability.

- LLCs and Partnerships: May pass credits to partners or members, optimizing individual tax positions.

- S-Corps: Typically focus on allocating credits to shareholders’ tax obligations.

Understanding the intricacies and legalities of each entity type can maximize credit utilization for specific business structures.