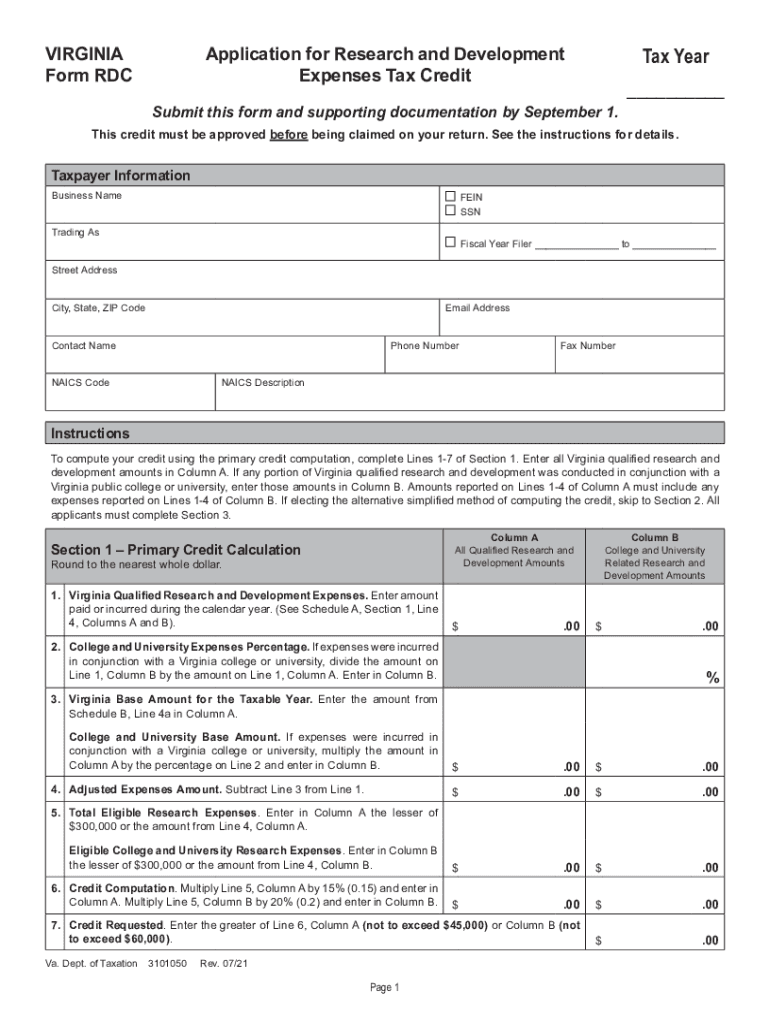

Definition and Purpose of Virginia Form RDC 2021

The Virginia Form RDC 2021 is crucial for businesses seeking to apply for the Virginia Research and Development Expenses Tax Credit. This tax credit is designed to incentivize businesses conducting qualified research and development activities within the state. Eligible businesses can use this form to calculate and claim credit on expenses incurred from research initiatives, thereby reducing their overall tax liability.

Key Components of the Form

- Eligibility Criteria: The credit primarily targets businesses engaged in research activities in collaboration with Virginia colleges or universities.

- Qualified Expenses: Includes wages for research staff, costs of supplies used in research, and expenses related to testing and prototyping.

- Base Amount Calculation: Establishes a benchmark for determining the additional credit amount.

Example Scenarios

- A tech startup developing a new software application should use this form to offset expenses incurred during the research phase.

- A pharmaceutical company partnering with Virginia universities for drug development qualifies to use this form for R&D expenses.

How to Obtain the Virginia Form RDC 2021

Downloading the Form

The form is available on the Virginia Department of Taxation’s website. You can download and print it for filing purposes.

- Digital Access: Look for the “Forms” section on the taxation website, where forms are categorized by tax type.

- Paper Requests: Physical copies can be requested by contacting the Virginia Department of Taxation directly if needed.

Software Compatibility

Various tax software, including TurboTax and QuickBooks, support the importation and completion of Virginia Form RDC 2021. This compatibility simplifies the filing process, especially for businesses managing large volumes of financial data.

Steps to Complete the Virginia Form RDC 2021

Step-by-Step Breakdown

- Identify Qualified Activities: Determine which of your business's R&D activities qualify under Virginia’s guidelines.

- Compile Expense Data: Gather detailed records of all expenses related to R&D activities.

- Calculate the Base Amount: Use available worksheet tools to establish your business’s base amount for R&D spending.

- Complete the Form: Enter your calculated figures into the appropriate sections. Ensure accuracy in every field to avoid discrepancies.

Important Considerations

- Consultation: Businesses are advised to consult with a tax professional to ensure the thorough completion of the form.

- Verification: Cross-check all figures to match supporting documentation before final submission.

Eligibility Criteria for Virginia Form RDC 2021

Business Requirements

- Eligible businesses must conduct research within Virginia and derive taxable income in the state. Common sectors include technology, pharmaceuticals, and engineering.

Research Activity Alignment

- Activities should have a qualified purpose, such as product innovation, or process improvement.

Collaboration Benefit

- Businesses involved in collaborative projects with Virginia’s higher education institutions may claim additional incentives.

Important Dates for Virginia Form RDC 2021 Submission

Key Deadlines

- Filing Period: Generally aligns with Virginia’s corporate income tax deadlines, typically due by the 15th day of the fourth month following your business’s tax year-end.

Extension Requests

- Filing Extensions: Should be requested through the Virginia Department of Taxation if you need additional time to gather necessary documentation.

Example Timeline

- For businesses with a December 31 year-end, the form is due by April 15 of the following year.

Submission Methods for Virginia Form RDC 2021

Available Submission Choices

- Online Submission: Through the Virginia Tax website, offering a secure and efficient method.

- Mail Submission: Completed forms can be sent to the specified address provided in the instructions section.

Benefits of Online Submission

- Immediate confirmation of receipt.

- Reduced processing times compared to mail submissions.

Legal Use and Compliance for Virginia Form RDC 2021

Compliance Requirements

- Adherence to Virginia state laws governing tax credits and R&D activities is mandatory when claiming the tax credit.

- Records pertaining to claimed expenses should be retained for future audits or verification by the state.

Consequences of Non-Compliance

- Incorrect submissions or fraudulent claims may result in penalties, including the repayment of credit amounts plus interest. Businesses are advised to maintain transparency when completing the form.

Examples and Scenarios Utilizing Virginia Form RDC 2021

Real-World Examples

- A manufacturing company developing new production techniques can claim the credit for experimental and trial runs conducted within their Virginia facility.

- An agriculture business improving crop yields through scientific research collaborates with local universities and claims eligible expenses under this tax credit.

Application in Business Strategy

- The Virginia Form RDC 2021 allows businesses to strategically lower tax liabilities while fostering innovation through research partnerships and internal R&D projects.

By understanding and appropriately utilizing the Virginia Form RDC 2021, businesses can effectively leverage tax credits to support and expand their research endeavors in Virginia, contributing to both their growth and the state's economic development.