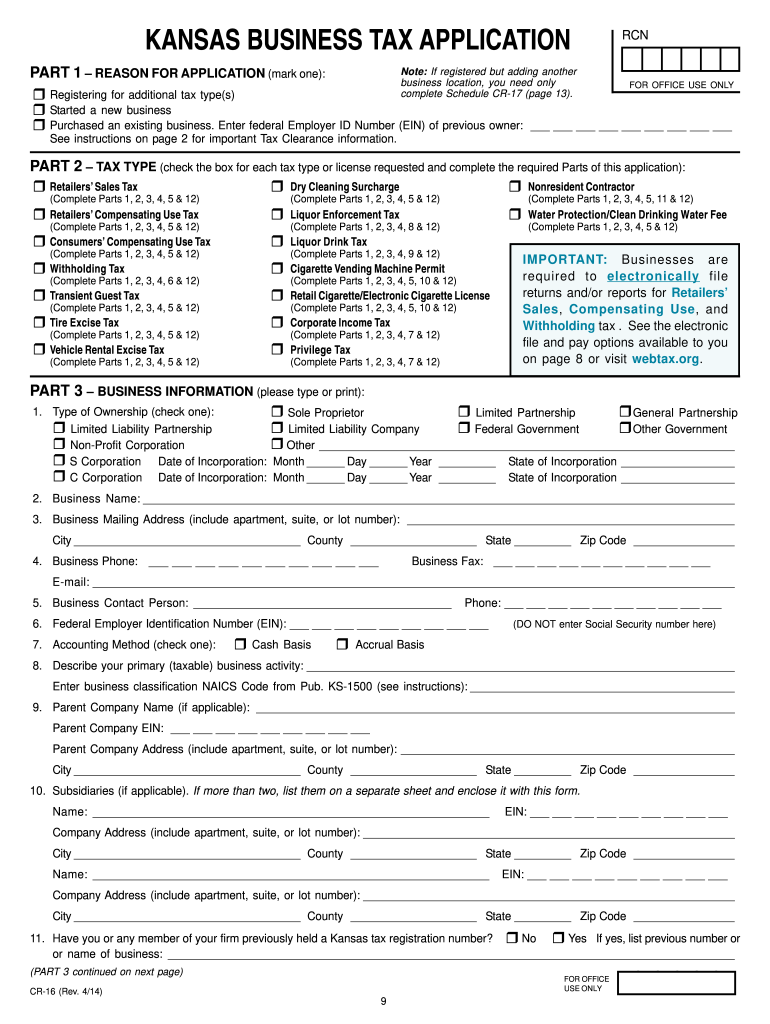

Definition & Purpose of the CR 16 2013 Form

The CR 16 2013 Form is a Kansas Business Tax Application necessary for businesses to register for multiple tax categories in the state of Kansas. It serves as a critical administrative document, enabling businesses to formalize their eligibility to comply with state tax obligations. The form's primary purpose is to gather essential business information and align businesses with appropriate tax types, ensuring statewide tax compliance.

Purpose and Application

- Retailers' Sales Tax: Facilitates businesses in reporting and remitting sales tax collected from customers.

- Withholding Tax: Ensures businesses comply with income tax withholding for employees.

- Liquor Enforcement Tax: Requires businesses involved in alcohol sales to register and remit taxes on alcoholic beverages.

- Other tax types: Offers sections for additional tax categories applicable to specific business operations.

How to Use the CR 16 2013 Form

This form is designed for easy use by businesses to register for necessary tax types in Kansas. Here’s a breakdown of how to properly utilize the form:

- Obtain the Form: Available through Kansas government websites or local tax offices.

- Understand Sections: Familiarize yourself with each section to ensure all information is properly reported.

- Complete Required Fields: Enter details such as business name, type of entity, and personal information of owners or officers.

- Select Tax Categories: Choose relevant tax types applicable to your business operations.

- Submit: Filing can often be completed electronically, encouraging quicker processing times.

Steps to Complete the CR 16 2013 Form

Filling out a CR 16 2013 Form requires attention to detail and following the structured sections designed specifically for state tax registration:

-

Preparation:

- Gather necessary business documents including taxpayer identification and corporate details.

-

Business Information Section:

- Provide the full legal name of the business, physical address, and mailing address if different.

- Define the legal structure (e.g., corporation, LLC, partnership).

-

Ownership Details:

- List full names, contact information, and Social Security or FEIN numbers for all owners or corporate officers.

-

Tax Category Selection:

- Mark applicable boxes for each type of tax your business is required to register for, such as Retailers’ Sales Tax or Withholding Tax.

-

Review and Error Correction:

- Double-check for errors or missing information to avoid complications in processing.

Who Typically Uses the CR 16 2013 Form

Businesses & Entities

- New Businesses: Entities newly established in Kansas need to register for tax purposes using this form.

- Expanding Businesses: Companies extending operations to Kansas or within Kansas often need to update tax registrations.

- Varied Business Types: Includes retailers, service providers, alcohol distributors, and employers.

Owners and Corporate Officers

- Individual proprietors and members of corporate governance use this form to link personal and business tax liabilities when necessary.

Key Elements of the CR 16 2013 Form

The form is divided strategically into sections that streamline the collection of necessary data. Here are the key elements involved:

- Business Information: Collects foundational data about the business.

- Ownership and Control: Gathers personal and ownership details.

- Tax Type Registration: Allows businesses to specify which state taxes they will be filing.

- Location Information: Essential for local tax jurisdiction and liability.

Legal Use and Compliance

Understanding the legal implications of the CR 16 2013 Form is crucial for maintaining compliance with Kansas state tax law:

- Mandatory Filing: Required by Kansas for businesses engaging in taxable activities.

- Record Keeping: Maintain copies of submission for audit and reference purposes.

Penalties for Non-Compliance

- Fines and Interest: Failure to submit can result in financial penalties and accrued interest.

- Audits: Non-compliance may trigger state audits, leading to potential legal action.

Eligibility Criteria for the CR 16 2013 Form

Businesses must meet certain eligibility criteria to use the CR 16 2013 Form:

- Registered Business: Must hold a valid business registration or charter within the state.

- Active Business Operations: Engaged in transactions that fall under Kansas tax jurisdiction.

- Proper Identification: Provide verification through tax identification numbers and documentation.

Examples of Using the CR 16 2013 Form

Case Study Scenarios

- Retail Expansion: A local Kansas retailer opens a new storefront, requiring registration for Retailers’ Sales Tax using this form.

- Multistate Company Opening Kansas Branch: A national corporation launching operations in Kansas must submit the form for Withholding Tax registration for new employees.

- New Liquor Distributor: A business enters the alcohol market, requiring Liquor Enforcement Tax registration through the CR 16 2013 Form.

These examples underscore the form's role in integrating business activities with state tax systems and ensuring compliance, thus enabling smooth operational commencement in Kansas.