Definition & Meaning

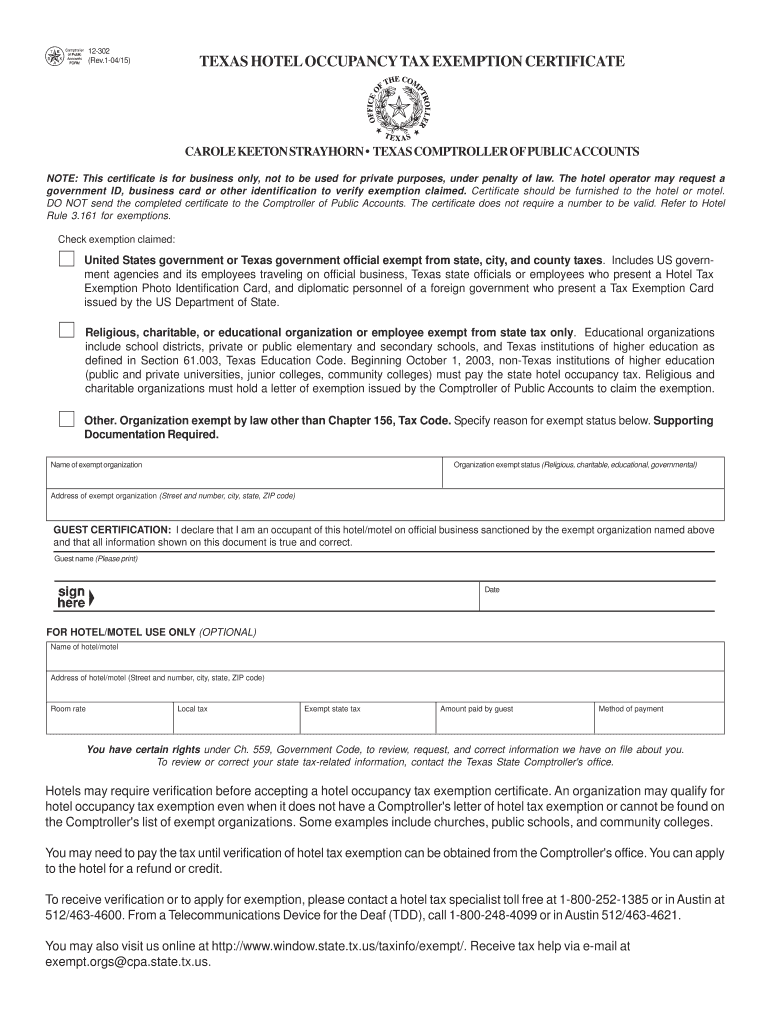

The Texas Hotel Occupancy Tax Exemption Certificate, commonly referred to as the "texas hotel tax exempt form," is a formal document used by specific individuals and organizations to claim exemption from hotel occupancy taxes within the state of Texas. This form is primarily intended for use by government officials and qualifying non-profit organizations, such as those with religious, charitable, or educational missions. The 2004 version of this form outlines the necessary steps and information required to validate the tax exemption status during hotel stays.

Key Elements of the Texas Hotel Tax Exempt Form 2004

The form includes several crucial components that must be accurately completed to ensure valid exemption from hotel taxes:

- General Information: Includes name, address, and contact information of the guest or organization.

- Certification of Exemption: A statement wherein the individual or organization certifies their eligibility for tax exemption.

- Hotel Use Section: Requires details from the hotel, for validation and processing of the exemption.

- Verification Requirements: Some hotels may require additional verification to accept the exemption, such as verification of government identification or proof of non-profit status.

How to Use the Texas Hotel Tax Exempt Form 2004

Proper utilization of the form involves several steps to ensure compliance and acceptance:

- Prior to Check-In: Identify whether you or your organization qualifies for tax exemption under the specified categories outlined in the form.

- Presentation at Check-In: Provide the completed form to the hotel staff at the time of check-in along with any other required documentation, such as proof of government employment or non-profit status.

- Hotel's Confirmation: Ensure the hotel acknowledges and processes the exemption duly, reducing the final bill by the corresponding tax amount.

Steps to Complete the Texas Hotel Tax Exempt Form 2004

Completing the form requires careful attention to detail:

- Fill Out Personal or Organization Details: Enter information such as name, address, and tax identification number if applicable.

- Specify Exemption Qualification: Clearly specify under which category your exemption falls - U.S. government, Texas state government, or qualifying non-profit organization.

- Attach Supporting Documentation: Attach any required documentation that supports the exemption claim, such as a government ID or 501(c)(3) status certificate.

- Submit to Hotel: Present the filled form to the hotel’s front desk or designated representative.

Who Typically Uses the Texas Hotel Tax Exempt Form 2004

This form is predominantly utilized by:

- Government Officials: Federal or Texas state government employees traveling for official duties.

- Non-Profit Organizations: Entities recognized under specific tax codes that serve religious, charitable, or educational purposes.

- Educational Institutions: Professors and staff on institution-sponsored travel that meets exemption criteria.

Legal Use of the Texas Hotel Tax Exempt Form 2004

To legally use this form, users must adhere to the following:

- Eligibility Compliance: Only those who meet the eligibility requirements should use the form; misuse can result in penalties.

- Accurate Completion: All sections of the form must be completed truthfully and accurately.

- Document Retention: Retain a copy of the form and accompanying documentation for personal records, as falsification may lead to audits.

Why You Should Use the Texas Hotel Tax Exempt Form 2004

Using this form offers significant benefits:

- Cost Savings: It allows qualified individuals and organizations to save on hotel-related expenses by not paying occupancy taxes.

- Efficient Travel Budgeting: For organizations, exempting from taxes aids in maintaining allocated travel budgets.

- Financial Compliance: Ensures compliance with state and federal tax laws, avoiding potential legal issues.

State-Specific Rules for the Texas Hotel Tax Exempt Form 2004

While the form is standardized, consider these points:

- Local Compliance: Ensure compliance with any additional local regulations that may further define qualifying criteria.

- Periodic Revisions: Stay updated with any amendments to the laws that may affect the use of this form and its acceptance criteria.

- Cross-State Validity: This exemption applies strictly within Texas, so verify requirements when traveling outside this jurisdiction.

Examples of Using the Texas Hotel Tax Exempt Form 2004

Real-world scenarios include:

- Federal Agencies: An FBI agent staying overnight for official business.

- Non-Profit Retreats: A charity organizing a staff retreat at a Texas hotel.

- Educational Conferences: A university professor attending a conference with university sponsorship.

This well-structured approach provides nuanced, expansive coverage for anyone seeking to understand or apply the Texas Hotel Tax Exempt Form 2004.