Definition and Purpose of the In-School Deferment 2012 Form

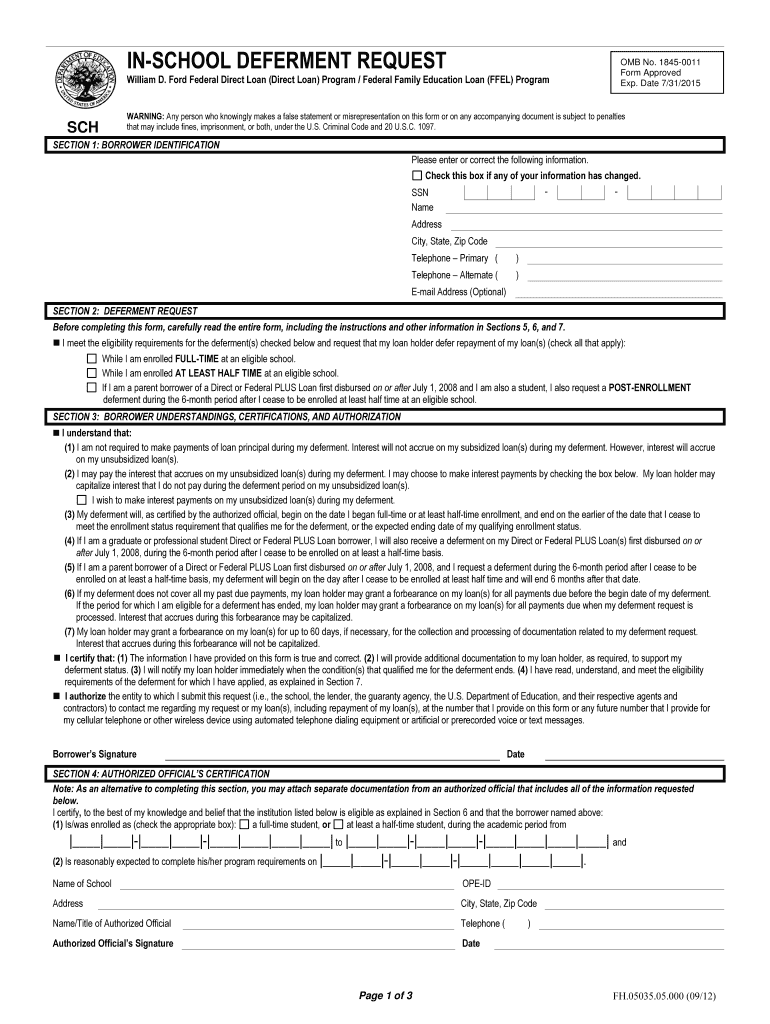

The In-School Deferment 2012 Form is used by borrowers who have taken loans under the William D. Ford Federal Direct Loan and Federal Family Education Loan programs. It allows eligible borrowers to request a deferment of their loan repayments while they are enrolled at least half-time at an eligible institution. This form provides a way for students to manage their educational debt effectively by postponing repayments during their study period.

- Eligible Loans: Applicable to the William D. Ford Federal Direct Loan and Federal Family Education Loan programs.

- Period of Deferment: While enrolled at least half-time in an approved educational institution.

- Purpose: To ease financial burdens during academic pursuits by delaying loan repayments.

How to Obtain the In-School Deferment 2012 Form

Securing the In-School Deferment 2012 Form involves contacting your loan servicer or accessing the form via official educational loan websites. Availability of the form is designed to be straightforward to ensure borrowers can easily get the paperwork needed to apply for deferment.

- Contact Your Loan Servicer: Reach out directly to the organization managing your loan.

- Download from Official Websites: Often available on the Federal Student Aid or your loan servicer's site.

- Request via Email or Phone: Some servicers may allow you to request the form through these channels.

Steps to Complete the In-School Deferment 2012 Form

Completion of the In-School Deferment 2012 Form requires attention to specific details to prevent processing delays. Borrowers should ensure all sections are accurately filled out, including personal identification and certification parts.

- Personal Information: Complete borrower identification details.

- Deferment Request: Specify the eligible institution and enrollment status.

- Borrower Certifications: Sign indicating all information is accurate.

- Authorized Official's Certification: Obtain verification from an official at the educational institution.

- Submit Completed Form: Follow instructions for sending the form to your loan servicer.

Key Elements of the In-School Deferment 2012 Form

The form is divided into several vital sections, each crucial to the deferment request process. Understanding each element ensures comprehensive completion.

- Borrower Information: Includes name, Social Security number, and contact information.

- Enrollment Certification: Must be confirmed by the registrar or an authorized school official.

- Deferment Terms: Outlines conditions under which interest may accrue on certain loans.

- Submission Instructions: Detailed steps on how and where to submit the form.

Eligibility Criteria for the In-School Deferment 2012 Form

Eligibility for deferment under this form requires that the borrower meets specific conditions related to their enrollment and loan status.

- Enrollment Status: Must be enrolled at least half-time in an approved institution.

- Loan Status: Must not be in default.

- School’s Eligibility: Institution must be recognized and approved for deferment arrangements.

- Documentary Proof: Sufficient documentation proving enrollment status is necessary.

Legal Use of the In-School Deferment 2012 Form

The form is used within a legal framework defined by federal guidelines, ensuring that borrowers’ deferment requests comply with regulations.

- Federal Compliance: Adheres to regulations under the Higher Education Act.

- Binding Agreement: Borrower’s signature certifies understanding and intention to defer repayment.

Important Terms Related to the In-School Deferment 2012 Form

Several terms are critical to understanding the deferment process. Familiarity with these will aid in accurate form completion.

- Deferment: Temporary postponement of loan payments.

- Interest Accrual: Refers to interest that may continue to accumulate on certain types of loans during deferment.

- Eligibility Certification: Verification by educational institution of borrower’s enrollment status.

Form Submission Methods

Submitting the In-School Deferment 2012 Form can be done through multiple channels, ensuring accessibility for all borrowers.

- Online Submission: Some servicers provide a digital submission feature.

- Mail: Printable forms can be mailed directly to the loan servicer.

- In-Person Delivery: Some institutions allow forms to be delivered directly to an office for processing.

Examples of Using the In-School Deferment 2012 Form

Consider a student pursuing a master’s degree who wishes to temporarily suspend loan payments while studying. By utilizing this form, they can legally defer repayments and focus on their education.

- Graduate Students: Those continuing education beyond undergraduate levels.

- Part-Time Students: Eligible if enrolled at least half-time.

Application Process and Approval Time

Utilizing the form involves a defined application process with corresponding timelines for approval.

- Processing Time: Typically takes a few weeks, depending on lender and accuracy of submitted data.

- Application Verification: Forms are subject to a verification process by both educational institutions and loan servicers.

Versions or Alternatives to the In-School Deferment 2012 Form

While the 2012 form remains a primary tool, other versions may cater to different deferment needs or be updated over time.

- Alternative Forms: Might be available for varied deferment scenarios, like economic hardship.

- Newer Versions: Institutions may update deferment forms to reflect current regulations and stipulations.

Each section on the In-School Deferment 2012 Form is integral to ensuring borrowers can manage their loan repayments efficiently while continuing their education. Accurate fulfillment and submission of this form help maintain financial stability and focus during academic pursuits.