Definition and Meaning of UC-1 Delaware

The UC-1 Delaware form is a crucial document used by the Delaware Department of Labor's Division of Unemployment Insurance. It helps employers determine their liability under the state's unemployment compensation laws. The form captures essential details about an employer's business activities, ownership, payroll information, and employment status in Delaware. This report form is key to assessing the organization's responsibility for unemployment insurance contributions, ensuring compliance with state regulations.

How to Use the UC-1 Delaware Form

Employers need to understand the components of the UC-1 Delaware form to ensure accurate completion. The form collects comprehensive data about the business, which is essential for calculating unemployment tax liabilities. Process involves:

- Filling out sections pertaining to business ownership and legal structure.

- Reporting employee payroll data accurately.

- Providing information about the nature of business operations within Delaware.

This data helps the state identify which employers are required to contribute to unemployment funds and ensures benefits are available to eligible workers.

How to Obtain the UC-1 Delaware Form

The UC-1 Delaware form can be procured through several methods to accommodate different preferences:

- Online: Visit the Delaware Department of Labor's website to download the form directly. This is often the quickest method, offering instant access.

- Mail: Request a copy by contacting the Department of Labor. It requires more time, but is suitable for those who prefer physical documents.

- In-Person: Visit a local DOL office to pick up the form. This option provides the opportunity to ask questions about the form during retrieval.

Each method ensures accessibility, accommodating various workplace and technological constraints.

Steps to Complete the UC-1 Delaware Form

Completing the UC-1 Delaware form involves several critical steps to guarantee accuracy and compliance:

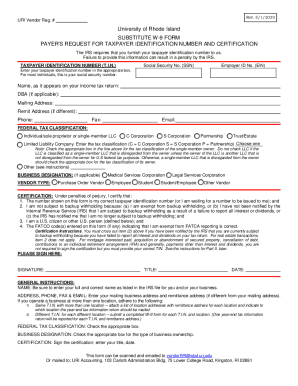

- Gather Required Information: Collect business details including Employer Identification Number (EIN), business name, and contact information.

- Provide Employment Data: Record employee count, payroll amounts, and employment status.

- Detail Business Activities: Describe the nature of business operations in Delaware to assess relevant tax obligations.

- Review and Double-Check: Carefully check for errors or omissions before finalizing the form.

- Submission: Submit the completed form within 10 days of receipt either online, by mail, or in-person, based on your preference and urgency.

Accurate completion ensures that you remain compliant with state unemployment regulations.

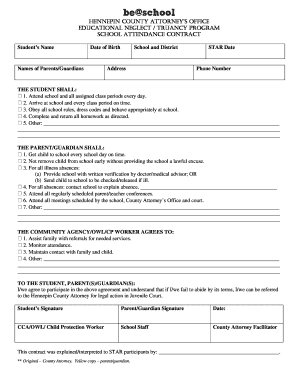

Who Typically Uses the UC-1 Delaware Form

The UC-1 Delaware form primarily serves businesses operating in Delaware. It is used by:

- Employers of all sizes: From small businesses to large corporations, any organization with employees in Delaware needs this form to determine unemployment insurance liability.

- New business owners: As they initiate operations, they need to establish their tax responsibilities from the outset.

- Human Resources Departments: These teams often handle the logistics of completing and submitting the form to the Department of Labor.

Understanding its role and the demographic of its users helps ensure timely and accurate filing.

Key Elements of the UC-1 Delaware Form

This form comprises several vital elements necessary for assessing unemployment tax liabilities:

- Employer Identification and Business Structure: Captures fundamental details about the business and its operational model.

- Payroll Information: Requires detailed reporting on employee wages and payroll figures.

- Employment Status: Collects data on employee statuses, essential for calculating accurate unemployment contribution requirements.

- Operational Activities: Requires detailed descriptions of business activities, influencing tax bracket and liability.

Each section plays an integral role in establishing employer responsibilities under Delaware's unemployment laws.

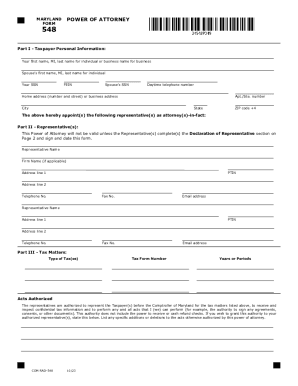

Penalties for Non-Compliance

Failure to submit the UC-1 Delaware form or providing inaccurate information can result in significant repercussions:

- Fines and Penalties: Failing to file or incorrect submissions may lead to monetary fines. These impact the business's financial standing and operational capacity.

- Legal Action: Chronic non-compliance could result in legal proceedings, adding layers of complexity and potential business disruption.

- Loss of Benefits: Incorrect liability determination affects your employees' ability to access unemployment benefits, potentially leading to disputes.

Maintaining compliance with submission timelines and accuracy is crucial to avoiding these negative impacts.

Filing Deadlines and Important Dates

The UC-1 Delaware form has strict deadlines:

- Initial Submission: Must be completed and returned within 10 days of receipt. This ensures employer activities are assessed promptly for unemployment insurance liability.

- Regular Updates: Employers must stay aware of any required annual updates or changes in company information that necessitate re-filing.

Timely filing is not just about meeting legal obligations; it also supports the smooth operation of your business regarding workforce management.

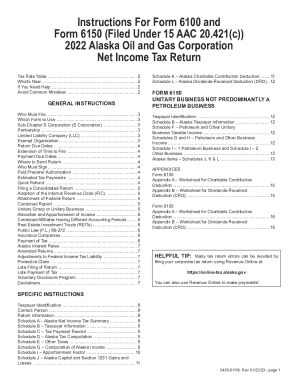

State-Specific Rules for the UC-1 Delaware

Delaware has distinct regulations guiding the use and submission of UC-1:

- Unique Taxation Structure: The state's unemployment insurance setup primarily impacts employers and necessitates rigorous detail on the form.

- Local Guidelines: Specifics of Delaware's laws may differ from federal unemployment regulations or those in other states, emphasizing the necessity of understanding and adhering to local nuances.

These state-specific rules ensure that the unemployment system functions effectively, supporting both businesses and employees sustainably.