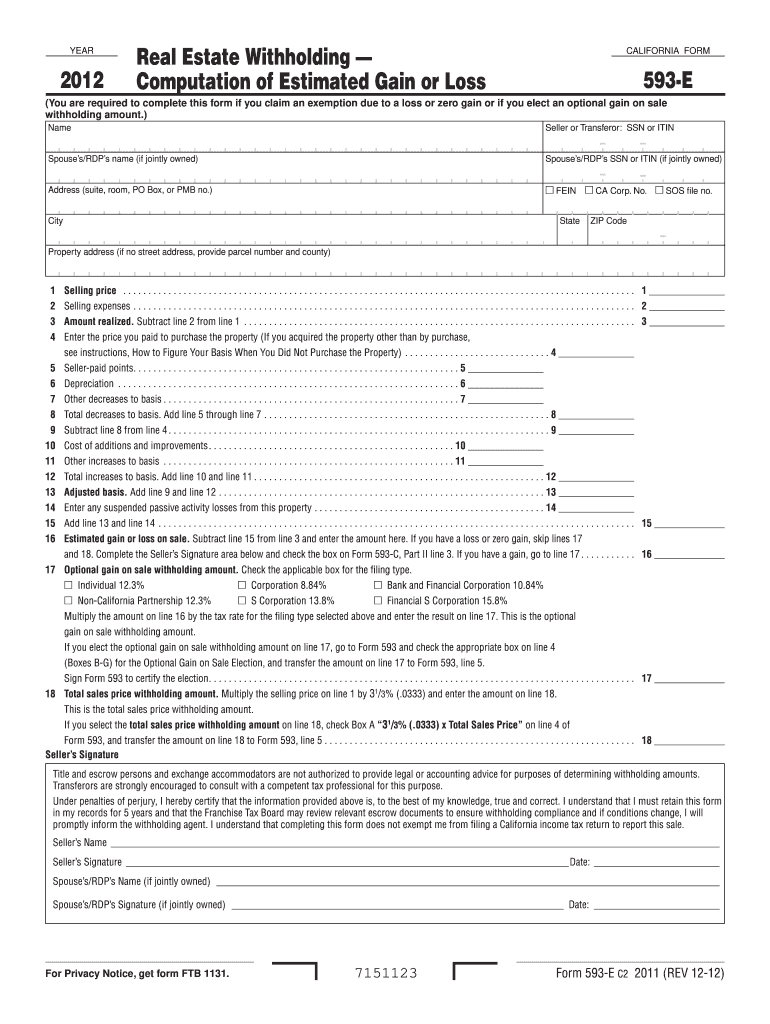

Definition and Purpose of California Form 593-E

California Form 593-E is used specifically for real estate withholding at the time of selling or transferring property. This form is required to calculate and document the estimated gain or loss from the sale, helping ensure compliance with California's tax regulations. The form aids sellers or transferors in declaring the necessary details, which include the selling price, various expenses, and any adjustments made to the basis of the property. It plays a critical role in protecting both the state's interest in tax revenue and the seller's right to exemptions.

How to Obtain the Form

Acquiring California Form 593-E can be done through multiple channels. The form is readily available for download from the Franchise Tax Board’s official website. Additionally, tax professionals often have access to this form and can provide a copy to their clients. Sometimes, real estate brokers or attorneys involved in a property transaction can supply the form as part of the closing paperwork. It is essential to ensure the form version is up-to-date, reflecting any recent tax law changes.

Steps to Complete California Form 593-E

-

Gather Necessary Information:

- Start with basic details such as names, addresses, and taxpayer identification numbers of both the seller and the buyer.

- Document the selling price and any associated expenses.

-

Calculate Adjustments and Gains:

- List and compute any adjustments to the property’s basis.

- Deduce permitted exemptions and calculate the estimated gain or loss from the sale.

-

Fill in the Form:

- Complete the form fields carefully, inserting calculated figures where required.

- Be sure to double-check entries for accuracy to prevent submission errors.

-

Review and Attachments:

- Attach any required documents that substantiate the figures and calculations.

- Review the whole form for completeness and accuracy.

-

Submission:

- Submit the completed form as per the outlined method — either electronically or via mail.

- Retain a copy for personal records.

Who Typically Uses California Form 593-E

Primarily, California Form 593-E is utilized by individuals or entities involved in the sale or transfer of real estate property within California. This includes homeowners, corporations, LLCs, and partnerships selling property that witnesses a gain or loss. Real estate agents and brokers may also use this form to assist clients in complying with state tax requirements. Additionally, tax professionals engage with this form regularly to provide services to their clients during property transactions.

Key Elements of the Form

- Personal and Transactional Details: Identifying information about the seller, buyer, and property.

- Computation of Estimated Gain or Loss: Important calculations summarizing financial aspects of the transaction.

- Exemption Clauses: Sections allowing for potential exemption claims based on certain criteria.

- Declaration and Signatures: Concluding parts of the form where parties involved affirm the accuracy of the details provided.

Important Terms Related to California Form 593-E

- Withholding: The portion of the selling price retained to cover potential tax liabilities.

- Exemption Threshold: Specific conditions under which sellers may avoid withholding.

- Basis Adjustment: Changes made to the original price or value of the property that affects gain calculations.

Legal Use and Compliance

The correct completion and submission of California Form 593-E are critical to staying in compliance with state laws. Real estate withholding ensures that taxes on gains from property sales are managed appropriately. Non-compliance can lead to penalties or additional scrutiny from tax authorities. It's advisable for sellers to consult with a qualified tax professional to navigate any complexities and ensure that all legal obligations are met during a property sale.

State-Specific Rules for Real Estate Transactions

California imposes specific rules for real estate transactions, particularly those involving nonresident sellers. These rules mandate withholding to make sure taxes on capital gains are accurately reported and paid. Sellers should be aware that even if they qualify for exceptions, proper documentation and Form 593-E filing is critical. Differences in regulations compared to other states underline the necessity for state-focused financial advice and diligent form documentation.