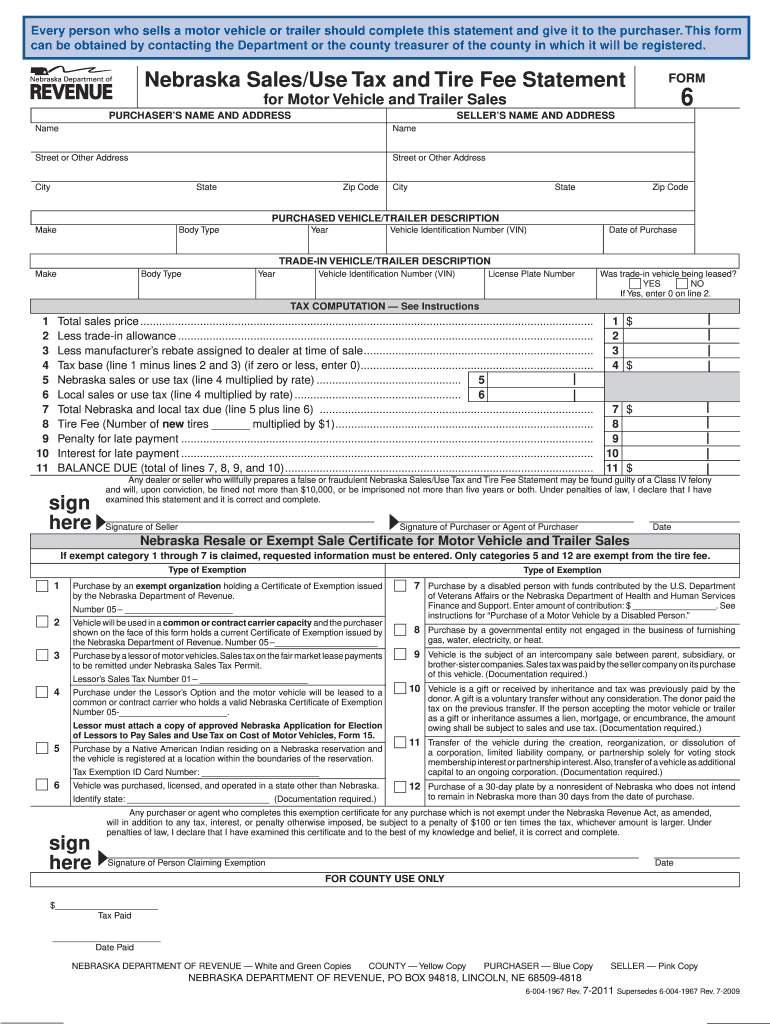

Definition and Purpose of the Form 6 Nebraska Sales Use Tax and Tire Fee Statement

The Form 6 Nebraska Sales Use Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales is an essential document used to report and remit sales and use tax, as well as tire fees, associated with motor vehicle and trailer sales in Nebraska. It serves as a formal record allowing sellers and purchasers to calculate any applicable taxes and fees accurately. This document ensures that the tax obligations are appropriately met and that exemptions or deductions are correctly applied.

Steps to Complete the Form 6

-

Gather Required Information: Before starting, collect all necessary details about the vehicle or trailer involved in the transaction. This includes the make, model, year, Vehicle Identification Number (VIN), and the sale amount.

-

Calculate Sales Tax: Compute the tax based on the sale price of the motor vehicle or trailer. Include any applicable exemptions that the purchaser or vehicle qualifies for, which must be documented.

-

Compute Tire Fee: If the sale involves new tires, calculate the tire fee, which is typically a flat rate per tire.

-

Fill in Purchaser Information: Provide the purchaser’s full legal name, address, and any tax identification numbers required by the state of Nebraska.

-

Complete Seller’s Section: The seller must provide their business details, including name, address, and seller’s permit number.

-

Sign and Date the Form: Ensure that both parties sign and date the form where indicated to validate the information provided.

Who Generally Uses Form 6

Form 6 is commonly used by:

-

Dealerships: Vehicle dealerships operating within Nebraska often utilize this form when completing sales to ensure all state tax requirements are fulfilled.

-

Private Sellers: Individuals selling vehicles or trailers privately use this form to document the sale and facilitate the accurate collection of applicable taxes.

-

Purchasers: Buyers of motor vehicles and trailers in Nebraska use this form to understand their tax liabilities and ensure compliance with state regulations.

State-Specific Rules on Sales and Use Tax

-

Rate Variations: The sales tax rate may vary depending on the location of the sale within Nebraska, reflecting local tax policies.

-

Exemptions: Certain sales might be exempt from sales tax, such as transfers between immediate family members or vehicles that qualify as farm machinery.

-

Payment Deadlines: Taxes must be reported and paid in a timely manner according to the state’s deadlines to avoid penalties.

Legal Implications of Using Form 6

Compliance with state tax codes is critical, and using Form 6 facilitates this compliance. Failure to accurately complete and file this form can result in significant legal penalties, including fines and potential interest on unpaid taxes. Accurate record-keeping and form submission help ensure transparency and adherence to Nebraska's tax laws.

Key Elements of Form 6

-

Taxpayer Identification: Ensures the proper identification of both the buyer and seller for tax reporting purposes.

-

Vehicle Information: Provides detailed specifications of the motor vehicle or trailer, aiding in precise tax calculation.

-

Tax Calculation Sections: Separated segments for computing sales/use taxes and tire fees to prevent errors.

-

Signatures: Legal assurance that the information presented is true and complete.

Penalties for Non-Compliance

Failing to file Form 6 or inaccurately reporting amounts can lead to:

-

Financial Penalties: Levying additional charges based on the outstanding tax amount.

-

Interest Accrual: Ongoing interest on late payments, increasing the liability over time.

-

Legal Consequences: Possible legal action for deliberate tax evasion or fraud.

Obtaining Form 6

-

Download from Official Websites: Nebraska Department of Revenue provides downloadable versions of the form on their site.

-

Request from Dealer: Dealerships often provide necessary forms during the vehicle purchasing process.

-

Contact Local DMV Offices: Obtain forms directly from state motor vehicle departments.

Importance of Form 6 Completion

Completing this form ensures compliance with Nebraska’s tax laws, enabling:

-

Accurate Tax Remittance: Properly calculated and remitted taxes prevent future legal troubles.

-

Transparency in Transactions: Provides a clear record of the financial dealings and obligations associated with vehicle sales.

-

Verification of Exemptions: Allows for documentation of any applicable exemptions, reducing potential tax liability.