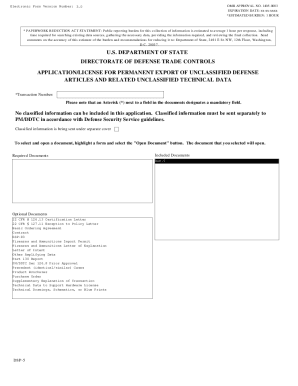

Definition and Meaning of INPS-RESIDENTI ALL'ESTERO - Dichiarazione redditi

The "INPS-RESIDENTI ALL'ESTERO - Dichiarazione redditi" form is specifically designed for pensioners residing outside Italy. This document is used to declare income to the Italian National Social Security Institute (INPS) to receive certain income-related benefits. It is essential for foreign-resident pensioners who draw pensions from Italian sources, ensuring their income is accurately reported and benefits are not suspended.

Importance of Accurate Reporting

- Ensures eligibility for benefits tied to income.

- Prevents suspension or delay of pension payments.

- Reflects a comprehensive financial status, including income from both Italian and foreign sources.

How to Use the INPS-RESIDENTI ALL'ESTERO - Dichiarazione redditi

Completing this form involves several detailed steps to ensure accurate submission. Users must gather all relevant financial documents and follow the form's instructions carefully to avoid errors.

Steps in Completing the Form

- Personal Information: Input your personal data accurately, including full name, fiscal code, and address.

- Income Declaration: Report income from Italian and foreign pensions, as well as any additional earnings.

- Review: Double-check all entered information to prevent errors that could lead to benefit suspension.

Common Mistakes to Avoid

- Misreporting income amounts.

- Incorrect personal details which can cause submission delays.

Steps to Obtain the INPS-RESIDENTI ALL'ESTERO - Dichiarazione redditi

Obtaining the form can be done through several methods, depending on your residence and access to Italian government resources.

Form Acquisition Methods

- Online Download: Visit the INPS website for a downloadable version of the form.

- Mail Request: Request the form to be sent to your foreign address.

- Local Italian Consulate: Obtain the form directly from an Italian consulate office.

Why Complete the INPS-RESIDENTI ALL'ESTERO - Dichiarazione redditi

Submitting this form is critical for maintaining your eligibility for income-based benefits as a foreign-resident pensioner from Italy.

Benefits of Form Submission

- Secures Benefits: Ensures continuous access to pension benefits.

- Compliance: Keeps you in legal compliance with Italian tax regulations.

- Financial Planning: Assists in planning and managing cross-border finances effectively.

Who Typically Uses the INPS-RESIDENTI ALL'ESTERO - Dichiarazione redditi

This form is primarily used by Italian nationals and eligible residents receiving pensions from Italy while living abroad.

Key User Groups

- Retired Individuals: Those who receive an Italian pension while residing in another country.

- Cross-border Pensioners: Individuals drawing pensions from multiple international sources.

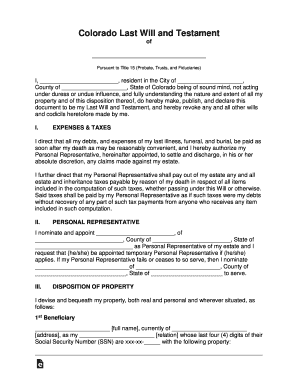

Required Documents for INPS-RESIDENTI ALL'ESTERO - Dichiarazione redditi

Certain documents are needed to complete the form accurately. Collecting these in advance ensures a smoother submission process.

Essential Documents

- Proof of Income: Statements and certificates detailing income from pensions and other sources.

- Personal Identification: Copies of identification documents such as a passport or Italian fiscal code.

- Previous Submissions: Prior tax return submissions and documents related to the previous year's income.

Legal Use and Compliance of INPS-RESIDENTI ALL'ESTERO - Dichiarazione redditi

Adhering to the legal requirements of this form is crucial to avoid penalties and ensure proper reporting.

Legal Obligations

- Timely Submission: Must be submitted by the specified deadlines to remain compliant.

- Accurate Information: All data must be truthful and reflect actual income details.

Compliance Penalties

- Benefits Suspension: Non-submission can lead to a halt in benefits.

- Legal Repercussions: Potential fines and legal action for fraudulent information.

Filing Deadlines and Important Dates

Knowing the deadlines for when to submit the INPS-RESIDENTI ALL'ESTERO - Dichiarazione redditi is essential for compliance.

Critical Dates to Remember

- Annual Deadline: Typically set early in the year, but confirm exact dates on the INPS website.

- Submission Period: Several months are usually provided to complete and submit the form, allowing ample preparation time.

Understanding these sections and thoroughly completing the INPS-RESIDENTI ALL'ESTERO - Dichiarazione redditi form ensures the accurate declaration of your income as a pensioner residing outside Italy and helps maintain eligibility for associated benefits.