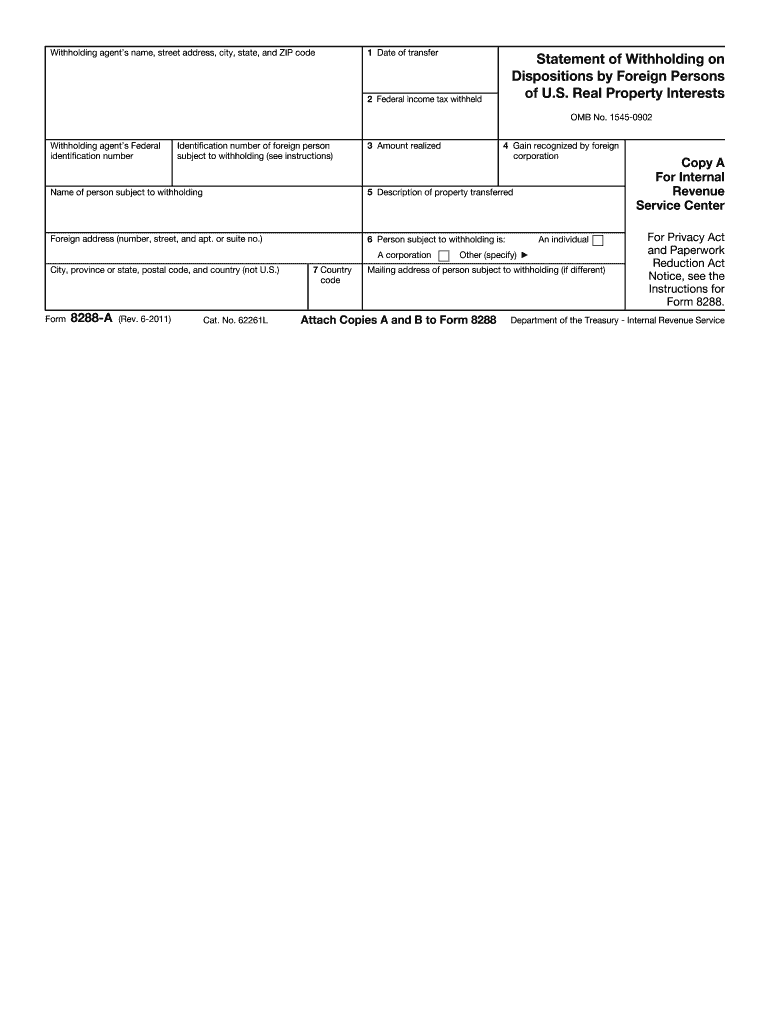

Definition and Meaning of 2011 Form Withholding

The "2011 form withholding" relates to the processes and regulations in place to manage the withholding of taxes for specific situations, primarily involving the transaction of U.S. real property interests by foreign persons. This involves understanding who is responsible for withholding taxes (the withholding agent) and which foreign persons are subject to these regulations. The form captures crucial data such as the federal income tax withheld, the financial outcomes of the transaction, and detailed descriptions of the property involved. This form serves as a compliance tool to ensure proper reporting and payment of taxes in these transactions.

How to Use the 2011 Form Withholding

To use the 2011 form withholding effectively, one must first identify whether the transaction at hand qualifies under the criteria that necessitate completing this form. Primarily, it is used in real estate dealings involving foreign sellers. Follow these steps:

- Determine Withholding Obligation: Confirm if you (as the buyer or withholding agent) are required to withhold taxes under FIRPTA (Foreign Investment in Real Property Tax Act).

- Collect Necessary Information: Obtain complete details about the seller, property transfer dates, and financial specifics.

- Calculate the Withhold Amount: Following IRS guidelines, typically, 15% of the sales price must be withheld.

- Complete the Form: Accurately fill out all sections, referencing the IRS guidelines for specifics.

- Submit with Payment: Ensure submission along with the withholding amount via IRS-approved methods.

Steps to Complete the 2011 Form Withholding

Filling out the form requires detailed attention to IRS guidelines to avoid errors or penalties. Here’s a step-by-step process:

- Gather Required Information: Collect details regarding the property, the transaction, and the involved parties.

- Enter Dates and Financial Data: Include the date of transfer and figures related to the amount realized.

- Identify the Withholding Agent: This is often the buyer or an intermediary party responsible for the tax withholding.

- Report Withholding Amounts: Indicate the calculated withholding amounts in compliance with any special rates or exemptions.

- Check for Accuracy: Review all entered information to ensure it matches the transaction records.

- File the Form: Submit the form to the IRS promptly to meet any deadlines associated with the transaction.

Important Terms Related to 2011 Form Withholding

Understanding key terms enhances comprehension and compliance:

- Withholding Agent: The individual or entity responsible for withholding tax on the transaction.

- Amount Realized: The total consideration received from the property transfer, including cash, fair market value of other property, and any liabilities assumed.

- IRS: The U.S. Internal Revenue Service, the governing body for tax-related matters.

- FIRPTA: Foreign Investment in Real Property Tax Act, which outlines tax requirements for foreign individuals selling U.S. property.

Legal Use of the 2011 Form Withholding

The 2011 form withholding is legally mandated for transactions involving U.S. real properties held by foreign individuals. Compliance with FIRPTA is critical to avoid penalties and ensure legal transaction processing. This also aligns with legal obligations under U.S. tax law to accurately report and remit withheld taxes.

IRS Guidelines for the 2011 Form Withholding

The IRS sets forth detailed guidelines that dictate how the form should be completed and filed. These include specifications for what constitutes the withholding requirement, special cases for exemption or reduced rates, and compliance deadlines. Familiarizing oneself with these guidelines is crucial for correct filing.

Filing Deadlines and Important Dates

Timeliness in filing this form is paramount. The IRS typically mandates filing within 20 days following the withholding date (transaction completion). Missing these deadlines can result in penalties or interest charges. Mark important dates related to the transaction to ensure all IRS requirements are met without delay.

Penalties for Non-Compliance

Failure to adhere to withholding requirements can lead to substantial penalties. These include fines, interest on the withheld amount, or potential legal action against the withholding agent or involved parties. Understanding the gravity of these consequences underscores the importance of complying with IRS instructions.