Defining Eaglemark Savings Bank

Eaglemark Savings Bank is primarily known for providing financing solutions for individuals purchasing Harley-Davidson vehicles. This institution is renowned for its tailored approach to lending, focused on automotive loans. Understanding its role and function is essential for those seeking to apply for financing through this avenue. The bank serves as a pivotal bridge between consumers aiming to acquire vehicles and the financing required to do so. As part of Harley-Davidson Financial Services, Eaglemark Savings Bank provides competitive rates and specialized loan products designed specifically for motorcycle enthusiasts.

How to Use Eaglemark Savings Bank

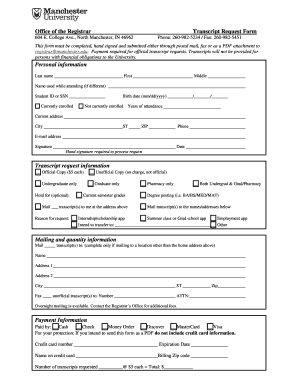

Using the services of Eaglemark Savings Bank involves a straightforward application process for financing. Prospective applicants must prepare necessary personal and financial documentation. The application itself requires detailed disclosures, including employment verification, income statements, and personal identification. Interested parties can apply directly through Harley-Davidson dealerships, ensuring a seamless integration between loan approval and bike acquisition. This process allows applicants to engage directly with the financing options suited explicitly to their purchase needs.

Application Process & Approval Time

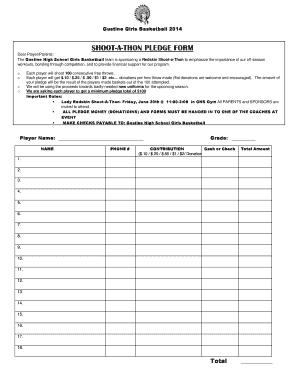

The application process at Eaglemark Savings Bank entails a systematic approach. Applicants begin by filling out a credit application form, which captures all vital personal and financial information necessary for credit assessment. Once submitted, the bank typically processes applications swiftly, often providing responses within a few business days. Approval times can vary based on applicant creditworthiness and the completeness of the application. Ensuring that all information is accurate and complete can aid in a faster approval process, potentially expediting vehicle acquisition.

Key Elements of the Eaglemark Savings Bank Credit Application

The Eaglemark Savings Bank credit application focuses on capturing comprehensive personal and financial data. Key elements of this form include:

- Personal Information: Full name, address, and contact details.

- Employment Information: Current job status, employer details, and length of employment.

- Financial Information: Monthly income, outstanding debts, and other liabilities.

- Vehicle Information: Details of the Harley-Davidson product you intend to purchase.

- Co-Applicant Details: Information on any additional parties involved in the loan application.

These sections are critical for assessing the applicant's financial health and loan eligibility. Accuracy and completeness in these areas are vital to avoid processing delays.

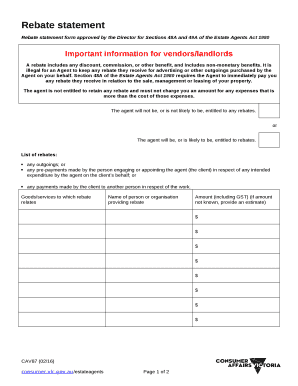

Legal Use of the Eaglemark Savings Bank Form

The Eaglemark Savings Bank form complies with U.S. financial regulations and consumer protection laws, ensuring transparency and security for applicants. The form is designed to adhere to the Truth in Lending Act, which mandates clear disclosure of loan terms, interest rates, and any associated fees. Applicants should carefully review all terms and conditions, ensuring a full understanding of financial obligations upon loan approval. This due diligence helps safeguard against misunderstandings and potential legal issues.

State-Specific Rules for Eaglemark Savings Bank

State-specific regulations can influence the credit application process with Eaglemark Savings Bank. Certain states might have distinct requirements regarding credit reporting, interest rate caps, or disclosure obligations. Applicants are encouraged to be aware of the nuances in their particular state to ensure compliance and a smoother application process. Legal notices within the form inform state residents of specific rights and obligations, providing a tailored application experience that respects local laws.

Required Documents for the Application

To complete the Eaglemark Savings Bank credit application, certain documents are typically required:

- Government-issued identification (e.g., driver's license).

- Recent pay stubs or income verification.

- Proof of residency, such as a utility bill.

- Detailed information about the Harley-Davidson product intended for purchase.

Ensuring all necessary documentation is prepared and attached with the application can significantly enhance the efficiency and speed of the approval process. These documents establish the applicant’s identity and financial capability, essential elements for credit assessment.

Digital vs. Paper Version of the Application

Eaglemark Savings Bank offers both digital and paper versions of their credit application. The digital application provides a user-friendly interface that guides applicants through each section with integrated checks for completeness. This version facilitates quicker submission and processing. Conversely, the paper application remains an option for those who prefer traditional methods or face digital access barriers. Either method ultimately aims to provide a comprehensive and accessible means to obtain financing for Harley-Davidson vehicles.

Examples of Using Eaglemark Savings Bank

Consider the scenario of a client named Alex, who wishes to purchase a Harley-Davidson motorcycle. Alex visits a local dealership and discusses financing options with an adviser, who suggests Eaglemark Savings Bank for specialized loan products. Alex fills out the credit application, attaching relevant documentation. Within days, Eaglemark Savings Bank approves the loan, enabling Alex to purchase the motorcycle hassle-free. This example underscores the practical application of the bank’s services, facilitating a seamless purchasing experience catered to Harley-Davidson enthusiasts.