Definition and Meaning of a Trust Fund

A trust fund is a fiduciary arrangement that allows a third party, or trustee, to hold and manage assets on behalf of a beneficiary or beneficiaries. It's a legal entity designed to safeguard assets and ensure they are distributed according to the instructions of the trust's creator. Trusts can serve various purposes, such as minimizing estate taxes, protecting assets from creditors, or ensuring funds are handled responsibly for minors or individuals with special needs. Trusts can be revocable or irrevocable, with each type having distinct characteristics concerning control, flexibility, and tax implications.

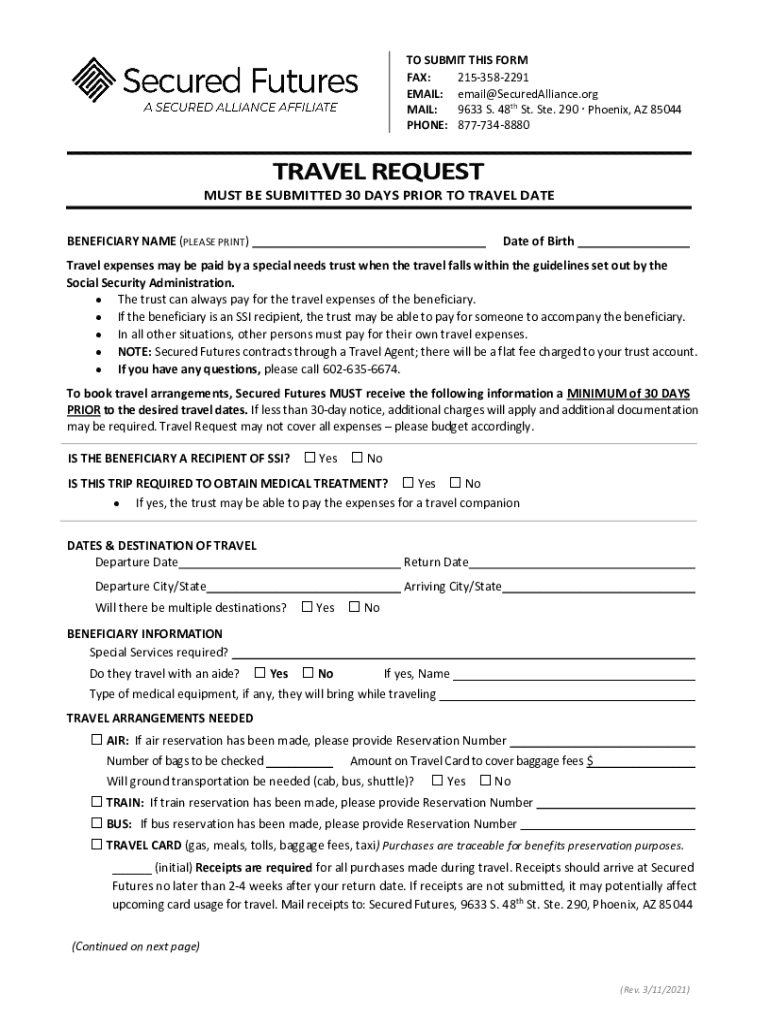

Steps to Complete the "Contact Secured Futures to Establish a Trust Fund"

-

Understand Your Goals: Determine the purpose of the trust fund—whether it's for asset protection, tax savings, charitable purposes, or to provide for beneficiaries.

-

Contact Secured Futures: Reach out to Secured Futures to initiate the process. They will provide guidance and information on the best type of trust to suit your needs.

-

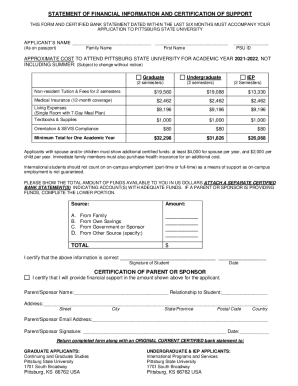

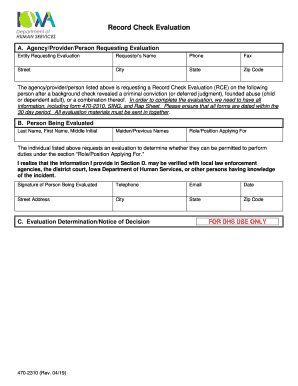

Gather Necessary Documents: Collect information such as the details of assets to be included in the trust, the names of beneficiaries, and any specific instructions for asset distribution.

-

Draft the Trust Agreement: Work with Secured Futures to draft a comprehensive trust document that outlines the terms, the role of the trustee, and the rights of the beneficiaries.

-

Sign and Notarize: Once the trust document is finalized, execute it by signing in front of a notary to ensure its legality.

-

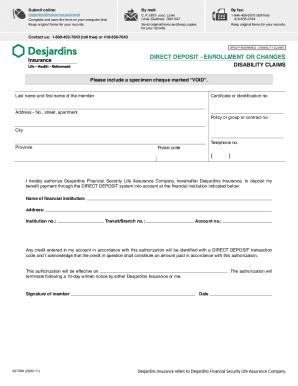

Fund the Trust: Transfer the assets you wish to include into the trust. This step is crucial for the trust to operate as intended.

-

Review and Update: Regularly review the trust with Secured Futures to ensure it continues to meet your objectives and make updates as necessary.

Why Contact Secured Futures to Establish a Trust Fund

Secured Futures offers expertise and personalized service in setting up trust funds. They ensure compliance with all legal requirements and work with you to tailor a trust that aligns with your financial and personal goals. Trusts managed with the help of Secured Futures can provide peace of mind by ensuring assets are administered according to your wishes and can protect beneficiaries from financial mismanagement.

Key Elements of the Contact Secured Futures to Establish a Trust Fund

- Trustee Selection: Choosing a reliable person or institution to manage and distribute the trust's assets.

- Beneficiary Designation: Identifying the individuals or entities who will benefit from the trust.

- Asset Inclusion: Deciding which assets—such as property, investments, or cash—will be held in the trust.

- Distribution Instructions: Outlining how and when beneficiaries will receive trust assets, which can include age controls or stipulations for certain achievements.

- Trustee Powers: Defining the authority of the trustee, such as investment decisions and the ability to modify the trust terms in specific circumstances.

Important Terms Related to Trust Funds

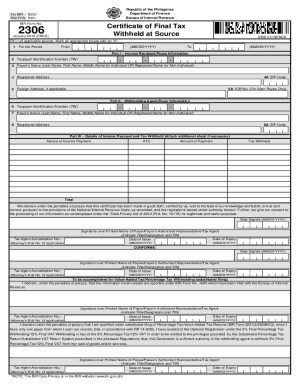

- Grantor/Settlor: The individual who creates the trust fund and transfers assets into it.

- Trustee: The person or institution responsible for managing the trust in accordance with its terms.

- Beneficiary: The individual or entity that receives benefits or assets from the trust.

- Corpus/Principal: The assets that make up the trust property.

- Irrevocable Trust: A trust that cannot be changed or terminated without the beneficiary's consent once it has been created.

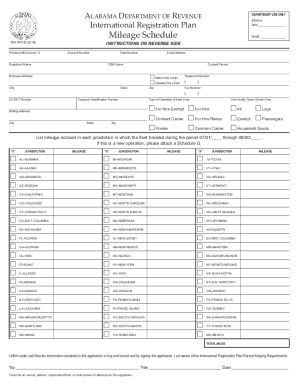

State-Specific Rules for Establishing a Trust Fund

Trust fund regulations can vary significantly by state, impacting tax implications, privacy levels, and administrative requirements. For instance, some states might offer more favorable tax treatments for certain types of trusts or mandate specific registrations or fees. Consulting with Secured Futures offers expert insights into these regional differences, ensuring compliance with local laws and maximizing the benefits of your trust fund.

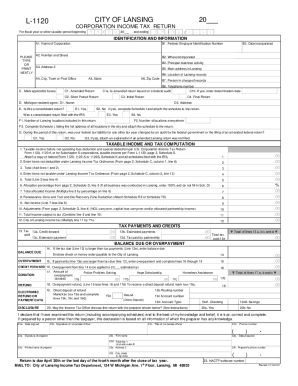

Form Submission Methods

Trust forms and agreements can be prepared and submitted via different methods:

- Online: Digitally sign and manage documents through platforms like DocHub for a seamless, paperless process.

- Mail: Send physical documents via postal service, suitable for those who prefer a traditional approach.

- In-Person: Visit Secured Futures' offices to hand-deliver forms, allowing for direct communication and clarification of any queries.

Legal Use of the Trust Fund

Trusts must comply with legal standards to be valid and enforceable. They should be created with clear intent, against a backdrop of existing legal frameworks, such as state trust laws and federal regulations like the ESIGN Act for electronic signatures. It's essential to ensure that the trust fund does not contravene any laws, such as those related to fraud or tax evasion, which helps maintain its integrity and protect beneficiaries' interests.