Definition & Meaning of the NYS Tax Exempt Form

The New York State (NYS) tax exempt form, commonly known as Form ST-125, is an exemption certificate that enables eligible taxpayers, particularly government employees, to avoid paying sales tax on certain purchases. The form serves as a declaration that the items being bought are for official use rather than personal consumption. This exemption is particularly relevant for expenses incurred during business travel, such as hotel accommodations.

Key Details of the Tax Exempt Form:

- Eligibility: Generally, only government agencies, certain tax-exempt organizations, and specific types of entities can utilize Form ST-125 for tax-exempt purchases.

- Types of Purchases: The form is typically used for transactions involving tangible personal property or certain services that are directly related to the official duties of the employee.

- Legal Basis: The authority for this exemption comes from specific New York state laws and regulations aimed at easing the financial burden on public employees while performing their job duties.

Understanding the definition and purpose of this form is essential for both employees and employers to navigate the nuances of sales tax exemptions properly.

How to Use the NYS Tax Exempt Form

Using the NYS tax exempt form effectively requires adherence to specific guidelines that ensure compliance with state laws. The form functions as a formal declaration that allows qualified individuals to make purchases without incurring sales tax.

Step-by-Step Guide to Using the Form:

-

Identify Eligible Transactions:

- Determine the nature of your purchase to ensure it qualifies for tax exemption.

- Common examples include hotel bills and travel-related expenses incurred by government officials.

-

Complete the Form:

- Fill out all required sections of the Form ST-125, including your name, agency, and purpose for the purchase.

- Ensure the accuracy of all information to facilitate acceptance by the vendor.

-

Present the Form to Vendors:

- Deliver the completed form to the seller at the time of purchase.

- Ensure the vendor retains a copy for their records, as they may be required to provide proof of sales tax exemption during audits.

-

Retain Copies for Personal Records:

- Keep a completed copy for your records in case of future inquiries regarding the validity of the tax-exempt purchase.

Implementing these steps guarantees that purchases are tax-exempt, reducing unnecessary expenses incurred while fulfilling governmental duties.

How to Obtain the NYS Tax Exempt Form

Acquiring the NYS tax exempt form is straightforward and can be done through several channels. Individuals seeking to utilize this exemption should know where to find the form and the requirements necessary for its completion.

Steps to Secure Form ST-125:

-

Download Online:

- The New York State Department of Taxation and Finance provides downloadable versions of the form on their official website. Access the site to find and download Form ST-125.

-

Request from Agency:

- Many state and local government agencies maintain stocks of tax exempt forms. Employees may request copies through their agency's accounting or finance department.

-

Direct Contact:

- If there are difficulties in obtaining the form, individuals can directly contact the New York State Department of Taxation and Finance for assistance.

By ensuring access to the necessary form, employees can make tax-exempt purchases without delay or confusion.

Steps to Complete the NYS Tax Exempt Form

Completing the NYS tax exempt form accurately is crucial to avoid complications or rejection during transactions. This process involves several specific steps to ensure compliance with tax regulations.

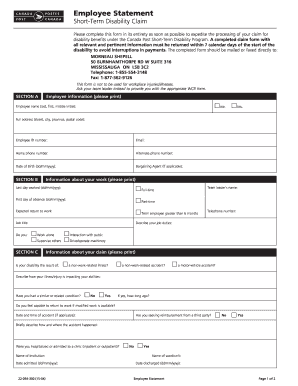

Detailed Completion Instructions:

-

Header Information:

- Start by entering the name and address of the agency using the form. This establishes the identity of the entity claiming tax exemption.

-

Fill in Employee Details:

- Include the name, title, and employee identification number of the person making the purchase.

-

Specify the Reason for Exemption:

- Clearly state the purpose of the purchase, linking it directly to official duties associated with the government agency.

-

Sign and Date:

- The employee must sign and date the form, certifying that the information is accurate and pertains to tax-exempt transactions.

-

Vendor Information:

- Provide the name and address of the vendor to whom the form is presented, ensuring that all necessary entities are documented.

Following these meticulous steps aids in minimizing errors and ensuring a smooth transaction process.

Important Terms Related to the NYS Tax Exempt Form

Understanding the essential terminology related to the NYS tax exempt form can enhance clarity on its use and application. Familiarizing oneself with these terms can simplify the process for both taxpayers and vendors.

Key Terms to Know:

- Exempt Use: The specific purpose for which the form may be utilized, indicating that purchases are for business use rather than personal consumption.

- Sales Tax: A tax imposed on the sale of goods and services, which the form seeks to exempt eligible purchases from.

- Vendor: The entity selling goods or services; this term encompasses businesses and individuals that transact with government employees.

- Certification: The process of formally attesting to the accuracy and legitimacy of the information provided on the form.

These terms create a foundational understanding necessary for navigating the processes surrounding tax exemptions.

Examples of Using the NYS Tax Exempt Form

Practical examples can offer insights into the scenarios where the NYS tax exempt form is beneficial, clarifying its application in real-world contexts.

Common Use Cases:

-

Hotel Stays for Conferences:

- Government employees attending official conferences or training sessions may present the form at check-in to avoid sales tax on their accommodations.

-

Travel-Related Supplies:

- Purchasing materials needed for official travel, such as office supplies or equipment, can also qualify for tax exemption when accompanied by the form.

-

Vehicle Rentals:

- When renting vehicles for state business, employees must use Form ST-125 to ensure that rental companies do not charge sales tax.

By illustrating these situations, individuals can better grasp the practical utility of the NYS tax exempt form.

IRS Guidelines

While the NYS tax exempt form primarily relates to state regulations, it may also intersect with federal guidelines issued by the IRS. Awareness of these guidelines can be essential for compliance and accurate reporting.

Relevant IRS Considerations:

- Recognition of Tax-Exempt Status: Per IRS regulations, certain government entities may have specific guidelines for how tax-exempt purchases are documented and reported.

- Record Keeping Requirements: Agencies and employees must maintain thorough records of tax-exempt transactions to provide proof during audits.

- Tax Reporting by Vendors: Vendors accepting the NYS tax exempt form must adhere to IRS regulations regarding the reporting of income derived from non-taxable sales.

Considering these guidelines allows for thorough preparation and compliance for those navigating both state and federal tax regulations.