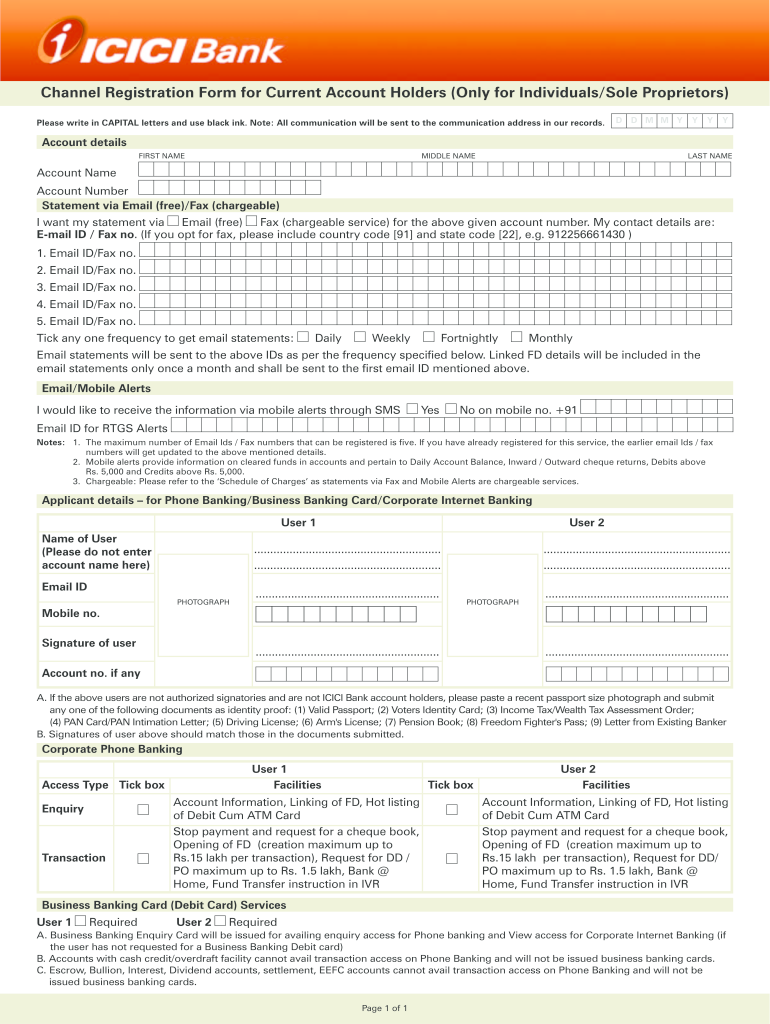

Overview of ICICI RTGS Form

The ICICI RTGS form is essential for conducting Real-Time Gross Settlement (RTGS) transactions, allowing individuals to transfer large sums of money electronically within the banking system. This form facilitates interbank transfers that are processed on a real-time basis, ensuring immediate availability of funds for the recipient. Understanding the form's components and the necessary procedure to complete it is vital for anyone looking to utilize this banking service efficiently.

Key Elements of the ICICI RTGS Form

The ICICI RTGS form includes several critical sections that need to be completed accurately. Key elements often featured are:

- Payer's Details: The form captures the name, account number, and associated branch details of the sender. This information confirms the legitimacy of the transaction.

- Beneficiary's Information: It requires the name, account number, and IFSC code of the recipient's bank. This ensures funds are directed to the correct account.

- Transaction Amount: A clear declaration of the amount to be transferred must be included, specified in both numerals and words to prevent discrepancies.

- Purpose of Transfer: An optional section allows the sender to specify the purpose, which aids in maintaining clear transaction records.

Each section must be filled out meticulously to avoid rejection of the transaction, and failure to provide complete information can lead to delays.

How to Fill Out the ICICI RTGS Form

Filling out the ICICI RTGS form requires attention to detail to ensure that all information is accurate. The process can be outlined in the following steps:

-

Download the Form: Obtain the ICICI RTGS form from the bank's official website or in physical form at your nearest ICICI Bank branch. Ensure that you are using the most current version, which may also be available in PDF format for immediate printing.

-

Personal Information: Provide your details, including your full name as it appears on the bank records, your account number, and the branch code of your account.

-

Beneficiary Details: Enter the complete information of the recipient. Double-check the IFSC code against official sources or the recipient's bank details to ensure accuracy.

-

Amount and Purpose: Fill in the amount being transferred, and if necessary, specify the transaction's purpose. Be clear and specific to avoid confusion.

-

Signature and Submission: Sign the form where required and submit it either online through the bank’s digital services or in person at the bank branch.

Submission Methods for the ICICI RTGS Form

The ICICI RTGS form can be submitted through various channels, providing flexibility based on user preference:

-

In-Person: Customers can bring the completed form to any ICICI Bank branch. Staff will review the form for accuracy and process the transaction directly.

-

Online Submission: For those using Internet banking, ICICI Bank offers a seamless online submission. Users can log into their accounts, navigate to the RTGS section, and complete the transaction without needing to visit a branch.

-

Mobile Banking: Users of the ICICI Bank mobile app can also initiate RTGS transfers. The app typically guides user input, making it easy to submit the necessary forms electronically.

Legal and Compliance Considerations

Understanding the legal implications of using the ICICI RTGS form is crucial to ensure compliance with banking regulations. The key aspects include:

-

Verification of Identity: Banks are required to follow Know Your Customer (KYC) guidelines. Ensure that your identity is verified, as all details in the RTGS form must correspond with your bank records.

-

Transaction Limits: Be aware that RTGS transactions may have limits based on bank policies or legal frameworks to prevent money laundering and fraud.

-

Record Keeping: Retain a copy of the submitted form and any confirmation receipts as part of your financial records, which may be needed for future reference or audits.

Frequently Asked Questions about the ICICI RTGS Form

Several common inquiries may arise when completing the ICICI RTGS form:

-

Can I modify a submitted RTGS transaction? Specific changes are not allowed once submitted. A new form must be filled out for updates or corrections.

-

Is there a transaction fee? Typically, ICICI Bank charges a fee for processing RTGS transactions. Clarify the fee structure before submitting your form to avoid surprises.

-

What happens if the transfer fails? In the event of a failed transaction, the bank will usually notify you, and the funds will remain in your account. Checking with customer service for resolution steps is advisable.

Examples of ICICI RTGS Transactions

To enhance understanding, here are practical scenarios showcasing the use of the ICICI RTGS form:

-

Corporate Transactions: A business needing to pay a supplier can utilize the RTGS form to transfer a significant sum directly between accounts, ensuring timely payment for goods received.

-

Real Estate Purchases: When finalizing a property transaction, the buyer may opt for an RTGS to facilitate the down payment, ensuring immediate receipt of funds by the seller’s bank.

-

Educational Payments: Students paying tuition fees directly to their educational institution can also benefit from the RTGS process for large payments that require immediacy.

These examples illustrate how the ICICI RTGS form serves various needs across different sectors, highlighting its versatility in managing financial transactions efficiently.