Definition & Purpose of the Sports Qualifying Physical Examination Clearance Form

The Sports Qualifying Physical Examination Clearance Form is a critical document used by students participating in interscholastic sports under the Minnesota State High School League. This form is designed to assess whether a student is medically fit to engage in sports activities. The form includes sections that capture student information, results from a medical evaluation, immunization status, and emergency contact details. It serves as an official certification, indicating whether a student is cleared to participate in sports, requires further evaluation, or cannot participate due to health concerns.

How to Obtain the Form

To obtain the Sports Qualifying Physical Examination Clearance Form, students or their guardians can access it through a few channels. Many schools provide the form during registration periods or sports meetings. Alternatively, it can be downloaded from the official website of the Minnesota State High School League. Students are required to complete their personal information before visiting a healthcare provider for a physical examination to substantiate the form.

Key Elements of the Form

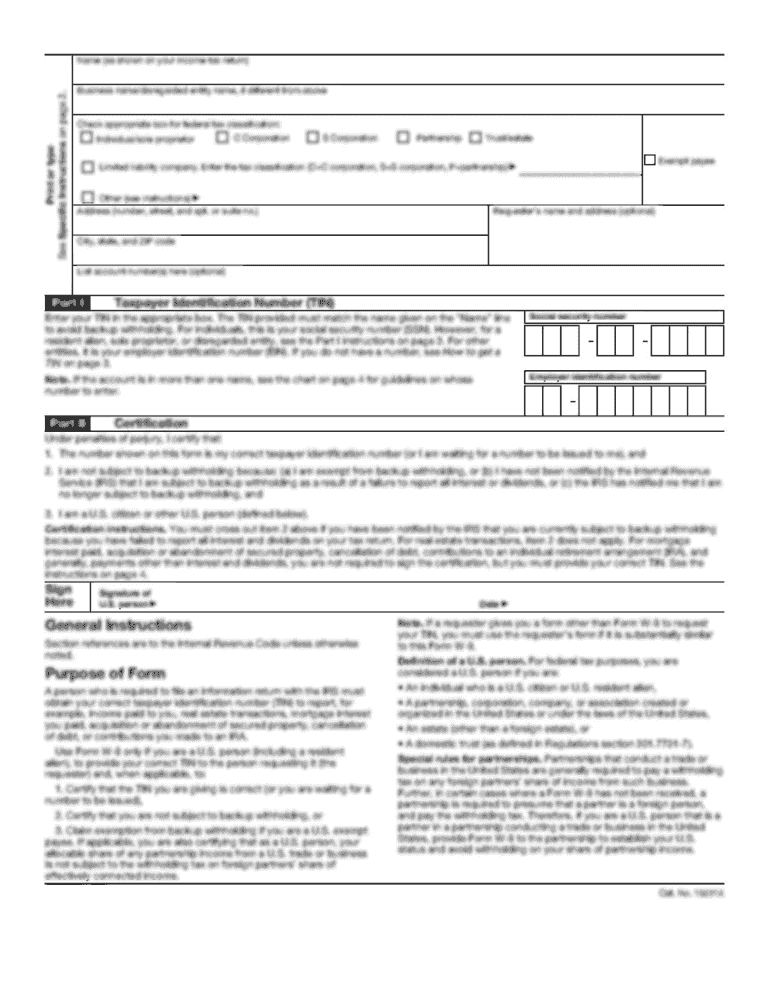

The form consists of several essential components that need to be filled out accurately:

- Student Information: Includes the student’s full name, date of birth, and school.

- Medical Evaluation Results: A section for healthcare providers to document the outcomes of the physical examination.

- Immunization Status: A checklist verifying the student’s immunization records.

- Emergency Contact Details: Provides information on immediate contacts in case of emergencies.

- Medical History Questionnaire: Encompasses questions regarding general health, heart health, bone and joint health, and other medical conditions.

Steps to Complete the Form

- Fill Out Student Information: Complete the sections detailing personal and educational information.

- Visit a Healthcare Provider: Schedule an appointment with a licensed healthcare provider to conduct the physical examination.

- Complete Medical Evaluation: The healthcare provider should complete the Medical Evaluation Results portion.

- Update Immunization Status: Include updated immunization records, if necessary.

- Provide Emergency Contacts: Fill out contact information for emergencies.

- Answer the Medical History Questionnaire: The questionnaire should be completed by the student and guardian before the examination.

- Submit the Form: Once completed and signed, return the form to the appropriate school authorities for approval.

Importance of Completing the Form

Completing the Sports Qualifying Physical Examination Clearance Form is crucial for ensuring the safety and well-being of student-athletes. It helps to identify any potential health risks before participation in sports. The form is a compulsory requirement, and failing to submit a completed version can prevent students from being eligible to participate in school sports. It provides a standardized assessment ensuring that all student-athletes meet the health standards set by the Minnesota State High School League.

Who Typically Uses the Form

This form is primarily used by:

- Students in grades 7-12 who wish to participate in interscholastic sports.

- Parents or Guardians who are responsible for ensuring their children complete the medical requirements.

- Healthcare Providers who assess the students' health and complete the examination section of the form.

- School Administrators who keep a record of the students' clearance to participate in sporting activities.

Legal Use and Compliance

Using the Sports Qualifying Physical Examination Clearance Form adheres to the guidelines outlined by the Minnesota State High School League, ensuring that the student's health is thoroughly assessed. The submission of a completed form is a legal requirement for participating in school sports. All information must be accurate and truthful to avoid any legal consequences and ensure the student's safety.

State-Specific Protocols

Under Minnesota regulations, the Sports Qualifying Physical Examination Clearance Form needs to be renewed every three years or if significant health changes occur sooner. This ensures that the information reflects the student's current health and fitness level. Schools may have specific submission deadlines in line with the start of sports seasons, necessitating prompt completion to maintain eligibility for participation.

Software Compatibility for Form Use

DocHub offers compatibility with various file formats, including PDF, DOC, and more, to streamline the completion and digital submission of the form. Users can import the form from cloud storage, edit it directly in DocHub with text and annotation tools, and ensure data is securely transferred with encryption. The platform supports electronic signatures, allowing for legally binding completion before submission to the school.

Digital vs. Paper Version

While the paper version of the form is traditionally used, a digital version is increasingly advantageous. The digital copy allows for easier distribution, secure storage, and efficient processing. Through platforms like DocHub, the digital form can be signed and shared quickly without the need for physical copies, reducing the overall administrative burden.