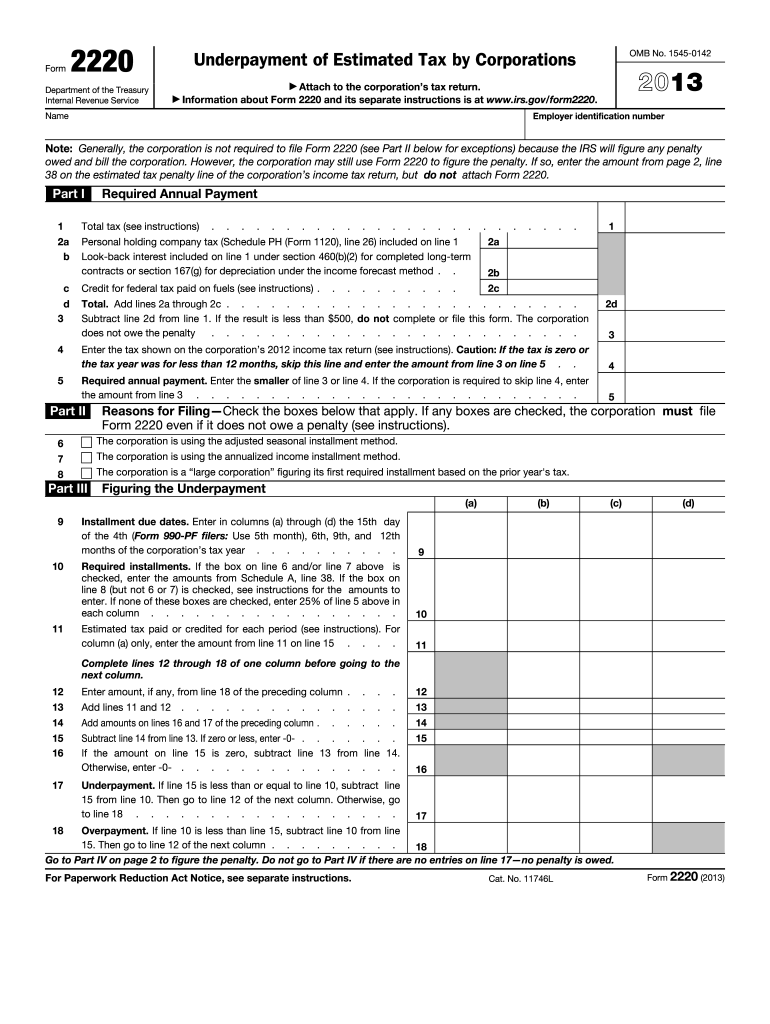

Definition and Meaning

The 2013 Form 2220, issued by the Internal Revenue Service (IRS), is a document primarily used by corporations to calculate if there has been an underpayment of estimated taxes. It assists businesses in determining any penalties that may be due from not meeting the required estimated tax payments. The form further aids in clarifying which past tax returns or seasonal income adjustments can be used to define the needed annual payments.

Purpose and Function

- Calculate Underpayments: Helps quantify any discrepancies in tax estimates.

- Penalty Determination: Guides on whether penalties apply and, if so, their amounts.

- Filing Exceptions: Clarifies situations where filing the form might not be necessary.

Steps to Complete the 2013 Form 2220

Completing the form involves several critical steps, intended to ensure accuracy in reporting and calculations.

- Identify the Corporation's Details: Enter essential information such as the corporation’s name and Employer Identification Number (EIN).

- Calculate Required Installments: Determine the required estimated tax payments based on prior tax returns or adjusted income criteria.

- Compute Underpayments: For each installment period, calculate any underpayment amounts.

- Determine Applicable Penalties: Use IRS tables to compute penalties for any underpayments detected.

- Review for Accuracy: Double-check all entries to ensure they adhere to IRS guidelines.

Subsections Involved

- Installment Calculations: Detailed breakdown of payment schedules.

- Penalty Assessments: Outline of how penalties are derived.

Required Documents

When preparing Form 2220, corporations need several documents to ensure accuracy in reporting and calculations.

- Previous Tax Returns: Used as a basis for determining estimated tax payments.

- Seasonal Income Statements: If applicable, these help determine adjusted payments.

- Payment Records: Documentation of all estimated tax payments made during the fiscal year.

Key Elements of Form 2220

Understanding the key sections of Form 2220 is crucial for correct completion and submission.

- Schedule for Installments: Details the estimated quarterly tax payment schedule.

- Calculation Worksheets: Provides a step-by-step guide to compute both underpayments and penalties.

- Filing Exceptions: Identifies situations where filing may not be necessary due to compliance with safe harbor rules.

Legal Use of the 2013 Form 2220

The legal framework governing Form 2220 ensures that corporations adhere to federal tax laws while calculating estimated payments.

Compliance With Federal Tax Laws

- ESIGN Act Adherence: Ensures that electronic signatures are legally binding on submitted forms.

- Guidelines for Correct Filing: Provides the legal requirements that must be met to avoid penalties.

IRS Guidelines

The IRS sets specific guidelines for the completion and submission of Form 2220, which corporations must follow.

Required Accuracy

- Ensure that all entries are meticulously verified against provided documentation to match IRS precision standards.

Submission Requisites

- Follow IRS-prescribed deadlines for both form completion and subsequent payments.

Penalties for Non-Compliance

Corporations failing to submit Form 2220 or misreporting may face penalties.

- Interest on Underpayments: Charged above the base rate for delayed tax payments.

- Additional Fees: Unless rectified, incorrect submissions can incur additional fees.

Avoidance Strategies

- Accurate Calculations: Ensure each calculation is exact, backed by documentation.

- Timely Submissions: Keep up with IRS deposit dates, especially for quarterly payments.

Examples of Using the 2013 Form 2220

Form 2220's practical uses can be seen across various business scenarios:

- Large Corporations: Regularly analyze cash flows to preemptively adjust estimated taxes.

- Seasonal Businesses: Utilize seasonal adjustment provisions to accurately forecast and pay estimated taxes.

Case Studies

- Manufacturing Firms: How their annual tax liability can be offset by applying previous years' overpayments.

- Retail Chains: Illustrates strategies to adjust payments based on fluctuating quarterly revenues.