Definition & Meaning

The term "Income AGI Minus Deductions from Adjustments" refers to a specific financial calculation used to assess an individual's taxable income for tax return purposes in the United States. Adjusted Gross Income (AGI) is a figure calculated from your total income and is modified by certain adjustments to arrive at a final amount. This serves as the basis for determining the deductions you can apply, thereby impacting the taxable income and potentially reducing the amount of tax owed.

Examples of Applicable Deductions

- Educator Expenses: Teachers may deduct certain out-of-pocket expenses for classroom supplies.

- Student Loan Interest: Interest paid on student loans can be subtracted from your income if you meet eligibility criteria.

- Health Savings Account Contributions: Contributions to a Health Savings Account (HSA) are deductible.

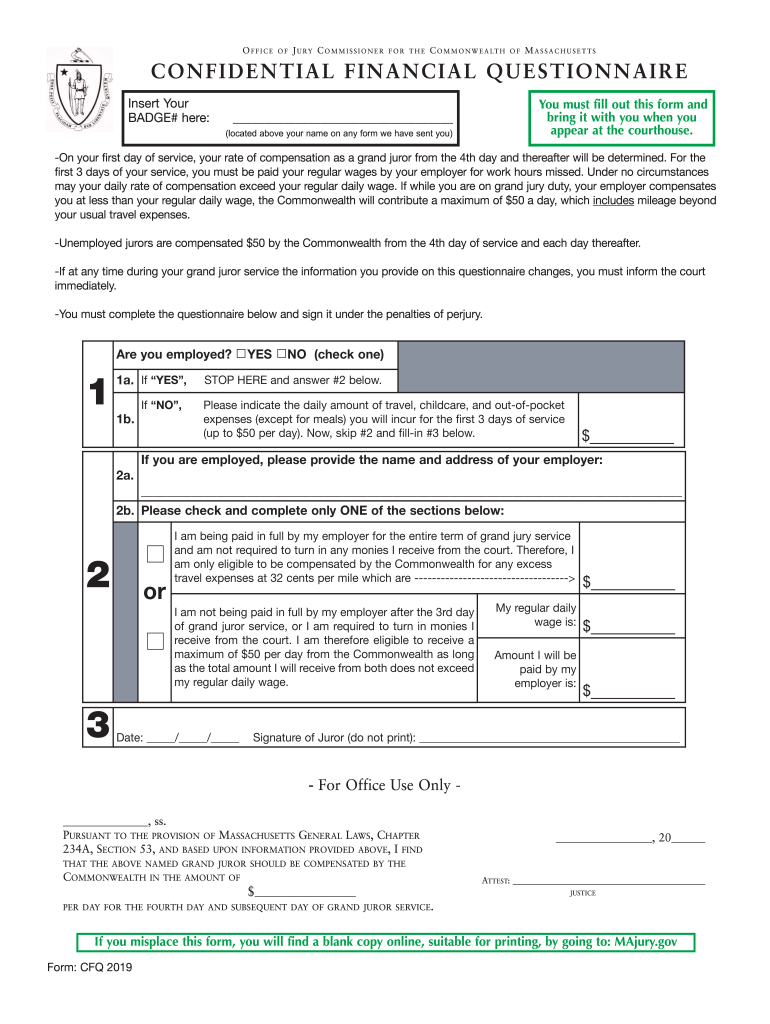

Steps to Complete the Income AGI Minus Deductions Form

Filing the Income AGI Minus Deductions form involves specific steps to ensure accuracy and compliance.

- Gather Required Documents: Collect your W-2s, 1099s, and any other documentation reflecting your annual income.

- Calculate Total Income: Sum all sources of income, including wages, dividends, and rental income.

- Identify Adjustments: Determine eligible adjustments like IRA contributions or moving expenses.

- Compute AGI: Subtract the adjustments from your total income to find your AGI.

- Apply Deductions: Further reduce AGI by applying either the standard deduction or itemized deductions.

- Verify and Submit: Double-check the form for accuracy before submitting it to the IRS.

Required Documents

Filing the Income AGI Minus Deductions form necessitates several documents to support your claims of income and deductions.

- W-2 Forms: Documents all employment income.

- 1099 Forms: Includes 1099-DIV for dividends, 1099-INT for interest, and others.

- Receipts for Deductions: Proof of eligible expenses like medical bills or charitable donations.

- Mortgage Interest Statements: Often provided by lenders for deduction eligibility.

Filing Deadlines / Important Dates

It's crucial to be aware of the deadlines associated with filing to avoid penalties.

- April 15: The primary deadline for submitting your tax return, unless this date falls on a weekend or holiday.

- October 15: Final deadline if you've filed for a six-month extension using Form 4868.

- Quarterly Estimates: For those who pay estimated taxes, these are due on April 15, June 15, September 15, and January 15 of the following year.

Legal Use of the Income AGI Minus Deductions Form

Proper completion and submission of this form ensure compliance with IRS regulations.

- The form is a fundamental part of your annual tax return submission.

- It dictates the amount of income eligible for taxation, influencing your total tax liability.

- Misreporting can lead to penalties, interest accrual on missed payments, and potential audits.

Who Typically Uses the Income AGI Minus Deductions Form

This form is commonly used by various groups for annual tax filings.

- Employees: Individuals receiving a regular salary or wages.

- Self-Employed Individuals: Those running their own business or freelancing.

- Retirees: People drawing on retirement funds or investments.

- Students: Individuals who may have part-time work or educational deductions.

Important Terms Related to the Income AGI Minus Deductions

Understanding key terminology enhances accurate form completion.

- Adjusted Gross Income (AGI): Total income minus specific adjustments.

- Standard Deduction: A flat deduction amount that reduces taxable income, varying by filing status.

- Itemized Deductions: Specific expenses like medical expenses or state taxes that may be deducted individually if they exceed the standard deduction.

Penalties for Non-Compliance

Failing to comply with filing requirements can lead to significant repercussions.

- Late Filing Penalty: 5% of the unpaid taxes each month, up to 25% of the total taxes owed.

- Late Payment Penalty: 0.5% per month on taxes not paid by the deadline.

- Interest on Unpaid Taxes: Accrues from the due date of the return until payment in full is made.

IRS Guidelines

The Internal Revenue Service provides guidelines to ensure proper filing.

- Eligibility for Adjustments: Determines which adjustments you qualify for based on income and life circumstances.

- Deduction Limits: Some deductions have caps or phase-outs depending on AGI.

- Record Keeping: Maintain all financial documents for a minimum of three years in case of an audit.