Definition & Meaning of TC 569A

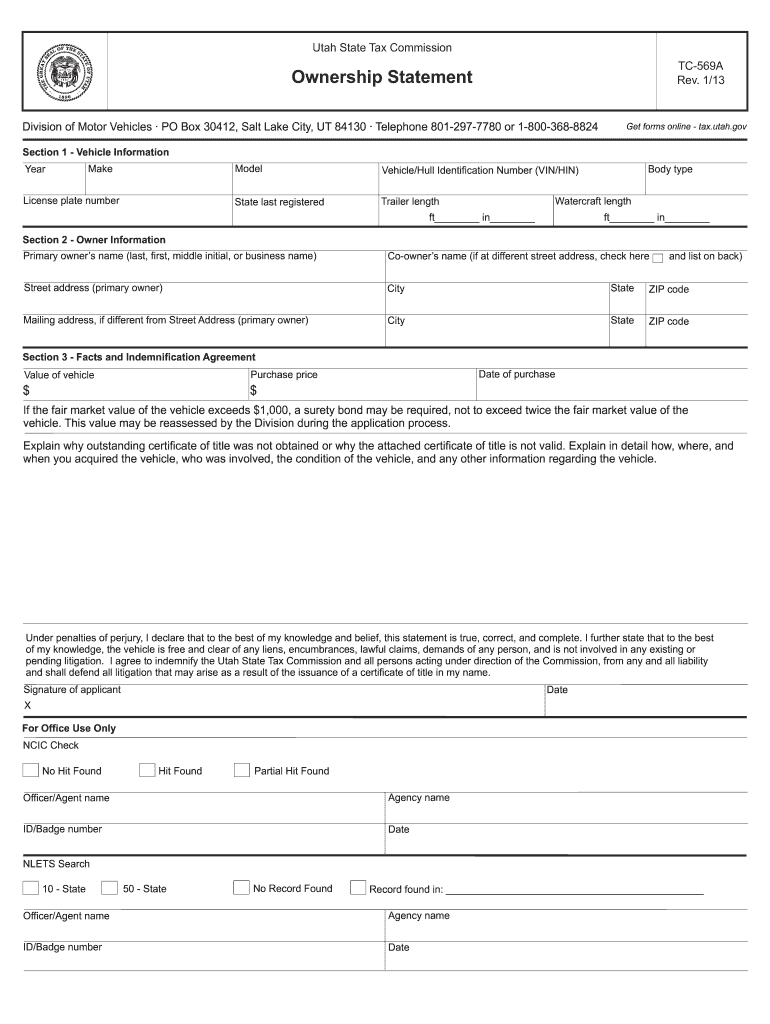

The TC 569A form, also known as the Vehicle Ownership Declaration form, is a document used by the Utah State Tax Commission. It serves primarily to declare ownership of a vehicle when the title is not available. This form is essential in situations where a vehicle may be abandoned or where the owner cannot produce a valid title. The TC 569A helps facilitate the proper transfer of vehicle ownership in compliance with Utah law, ensuring that all necessary legal and ownership details are appropriately documented.

The form includes critical sections that require information about the vehicle, such as make, model, year, Vehicle Identification Number (VIN), and other identifying details. Additionally, it necessitates the inclusion of the owner's information, such as name, address, and the relationship to the vehicle. The form also contains an indemnification agreement in which the signer attests to the truthfulness of the information provided under penalty of perjury. By completing the TC 569A, vehicle owners can initiate the process for obtaining a title or solidifying their ownership claim legally.

How to Use the TC 569A

Using the TC 569A involves several key steps to ensure proper completion and submission. The process typically includes the following:

- Obtain the Form: The TC 569A can be downloaded from the Utah State Tax Commission’s website or obtained at local DMV offices.

- Complete Vehicle Information: Fill in essential details about the vehicle. This includes the VIN, make, model, year, and any odometer reading if applicable.

- Owner Information: Provide the necessary owner information, including full name, address, and contact details.

- Indemnification Agreement: Review and complete the indemnification section, assuring that the information is accurate and truthful. This agreement is a legal affirmation that you are responsible for the information provided.

- Sign and Date the Form: The form must be signed and dated to be considered valid.

- Submission: Submit the completed TC 569A to the appropriate DMV location or the Utah State Tax Commission via mail or in person.

By following these steps, individuals can facilitate the process of declaring vehicle ownership, especially in cases where the title is absent.

Steps to Complete the TC 569A

Completing the TC 569A accurately is essential for successfully declaring ownership of a vehicle. Here are detailed steps to guide you through the process:

-

Gather Required Information:

- Collect all necessary details about the vehicle, including the VIN, purchase date, and purchase price.

- Ensure you have your identification and any supporting documents related to the vehicle ownership.

-

Fill Out the Form:

- Begin by entering the vehicle’s details in the corresponding fields.

- Include all applicable owner information, paying special attention to spelling and accuracy.

-

Detail Claims for Indemnification:

- Read through the indemnification agreement carefully. This section asserts that you understand the law and are claiming rightful ownership.

- Fill in any required acknowledgment or signature lines.

-

Review Your Entries:

- Double-check all sections for accuracy and completeness. Ensure that no field is left blank unless specified.

- Confirm that your signature is included and that you’ve dated the form correctly.

-

Submit the Completed Form:

- Determine the submission method: you can send it by mail or deliver it in person.

- Keep copies of your form for personal records and any correspondence related to its submission.

-

Follow Up:

- If submitted by mail, consider following up with the tax commission or DMV after a few weeks to confirm the processing status.

Completing these steps will help ensure that your TC 569A form is processed smoothly.

Important Terms Related to the TC 569A

Understanding the key terms associated with the TC 569A form is crucial for grasping the responsibilities and requirements involved in the vehicle ownership declaration process. Here are some important terms:

- Indemnification: A legal agreement where one party agrees to protect another from legal liability for actions or claims. In the context of TC 569A, it indicates the signer is taking legal responsibility for the truthfulness of the information provided.

- Vehicle Identification Number (VIN): A unique code used to identify individual motor vehicles. It is essential for establishing the vehicle’s identity and history.

- Abandoned Vehicle: A vehicle left unattended on public or private property without consent, often leading to legal ownership claims.

- Ownership Declaration: A formal statement asserting one’s ownership rights to a vehicle, necessary when traditional ownership documents (like a title) are unavailable.

- Authority to Sign: The legal right of an individual to assert ownership or make declarations on behalf of another party, relevant in scenarios involving joint ownership or business-related vehicles.

Familiarizing yourself with these terms will enhance your understanding of the entire process surrounding the TC 569A form.

Legal Use of the TC 569A

The TC 569A's legal use hinges significantly on compliance with Utah laws governing vehicle ownership and transfers. This form is specifically crafted to assist individuals in reclaiming ownership of vehicles for which they possess insufficient documentation. The following points illustrate its legal significance:

- Establishing Vehicle Ownership: The TC 569A acts as an official means to declare vehicle ownership when legal titles are lost or unavailable. It essentially serves as a substitute for the title in light of appropriate evidence.

- Compliance with State Law: By using the TC 569A, vehicle owners align themselves with the Utah Abandoned Vehicle Law, demonstrating a commitment to following legal protocol in claim ownership of vehicles.

- Indemnity Clause Enforcement: The indemnification agreement included in the form functions as a safeguard for both the declarant and the state against potential fraudulent claims of vehicle ownership.

- Reference for Future Transactions: Should any disputes arise regarding ownership, a properly filled TC 569A serves as a legal document referencing the claimant's position at the time.

By understanding these legal implications, users can effectively navigate the vehicle ownership declaration process with confidence and adherence to local laws.

Examples of Using the TC 569A

Utilizing the TC 569A in real-world scenarios provides clarity on its practical application. Here are several examples illustrating its use:

- Claiming an Abandoned Vehicle: An individual discovers a vehicle on their property that has been left unattended. They can complete the TC 569A to declare ownership, supporting their claim of right to the vehicle by providing evidence of its location and condition.

- Lost Title Scenario: A vehicle owner misplaces their title and intends to sell the vehicle. By completing the TC 569A, they can legally assert ownership and proceed with the sale, creating a smooth transaction process.

- Inheritance Situation: If a vehicle is inherited but the title is not readily available, the heir can file the TC 569A as part of the estate settlement process to formalize the ownership transfer.

- Title Transfer for Business Vehicles: A business may need to declare ownership of a vehicle after acquiring it without a title transfer document. The TC 569A can serve as a means for the business to legally affirm its ownership of the vehicle for tax and registration purposes.

These examples demonstrate the TC 569A's versatility and necessity in various ownership-related scenarios, highlighting its role in facilitating legal vehicle ownership in Utah.