Understanding the Vermont Meals and Rooms Tax

The Vermont Meals and Rooms Tax refers to a specific tax imposed by the state of Vermont on meals and lodging services. This tax is designed to generate revenue for the state from businesses involved in providing food services and lodging. Understanding the intricacies of this tax is crucial for compliance and effective business management.

What is the Vermont Meals and Rooms Tax?

- A state-imposed tax applicable to meals served in restaurants, rented lodging, and alcoholic beverages sold.

- The tax rate is determined by the Vermont Department of Taxes and can vary annually.

- Both business owners and customers must be aware of the tax implications to ensure proper billing and reporting.

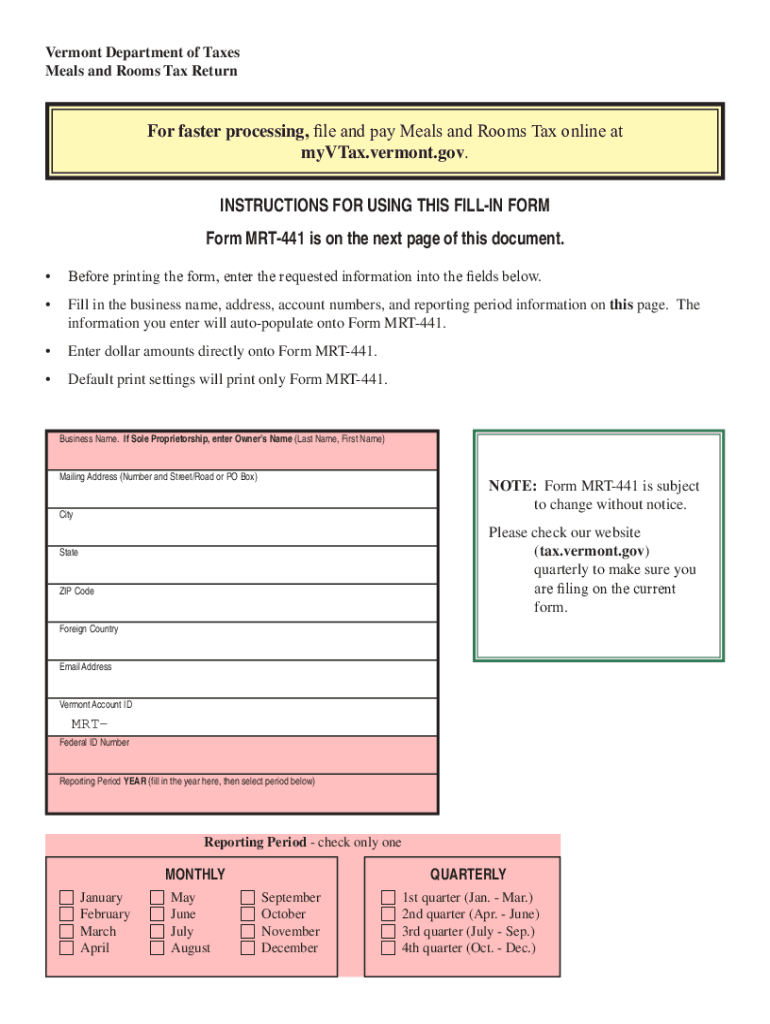

How to Use the Vermont Meals and Rooms Tax Form

Utilizing the Vermont Meals and Rooms Tax forms involves several steps that ensure accurate filing and compliance:

- Gather Necessary Information: Collect business details, including sales receipts for meals, rooms, and beverages.

- Access the Correct Form: Obtain the Form MRT-441 from the Vermont Department of Taxes website to report taxable sales accurately.

- Complete the Form: Enter total sales figures, deductions, and calculated tax amounts.

- Submit Electronically: File the form through the myVTax portal for efficiency and to meet electronic filing requirements.

Steps to Complete the Vermont Meals and Rooms Tax Form

Filing the Vermont Meals and Rooms Tax form requires precision and attention to detail. Here’s how to navigate this process:

- Log into myVTax: Access your account and select the appropriate option to file the Meals and Rooms Tax.

- Select Reporting Period: Ensure the correct period is chosen to avoid discrepancies in your tax return.

- Report Sales and Exemptions: List taxable sales and deduct any exemptions applicable, such as non-taxable sales.

- Calculate and Pay Due Taxes: Use the form to determine the correct tax liability and ensure payment is submitted before the deadline.

- Review and Submit: Double-check all entries for accuracy before submitting to avoid errors and potential penalties.

Business Entities That Must File and Payers’ Responsibilities

Several business types are required to file the Vermont Meals and Rooms Tax:

- Restaurants and Cafes: Any establishment serving food and beverages.

- Hotels and Inns: Those offering lodging services to the public.

- Catering Services: Businesses that provide on-site or off-site food services for events.

- Owners must maintain accurate financial records and routinely file the necessary tax forms to stay compliant.

Legal Use and Penalties for Non-Compliance

Compliance with the Vermont Meals and Rooms Tax requirements is mandatory, and non-compliance can lead to significant penalties:

- Legal Obligation: Businesses must file returns and pay taxes on a regular basis as prescribed by law.

- Penalties: Late filing or payment may result in fines, interest on overdue taxes, and potential legal action.

- Ensuring timely and correct filing helps avoid legal repercussions and maintain a good standing with state authorities.

Important Terms Related to Vermont Meals and Rooms Tax

Understanding key terms associated with Vermont’s tax can aid in proper filing:

- Taxable Sales: Sales on which the tax is applied, including meals, lodging, and certain beverages.

- Exemptions: Specific transactions that are not subject to tax, which must be documented.

- Filing Threshold: The minimum amount of taxable sales required before filing and payment are mandatory.

Examples of Transactions Involving the Meals and Rooms Tax

Practical examples illustrate when this tax is applied:

- A restaurant sells a meal for $50; the applicable tax needs to be calculated and added to the bill.

- A hotel rents a room for $150 per night, including applicable Meals and Rooms Tax in the total charge to the guest.

- Event organizers contract a catering service; the tax must be calculated on the total catering bill if it includes taxable items.

Filing Deadlines and Important Dates

Meeting deadlines is critical for compliance:

- Quarterly Filing: Businesses typically file returns quarterly unless they meet the threshold for more frequent filings.

- Annual Adjustments: Keep an eye out for rate changes or updated forms each fiscal year.

- Electronic Submission Deadlines: Ensure electronic filings are submitted by the specified due date to avoid penalties.

Required Documents for Filing

Gather these documents before filing:

- Sales Receipts: Documentation of all taxable transactions.

- Exemption Records: Proof of any exempt sales.

- Financial Statements: These provide a basis for accurate reporting for the tax period.

This comprehensive understanding of the Vermont Meals and Rooms Tax, along with diligent preparation and accurate filing, helps ensure compliance and smooth operation for businesses subject to this tax.