Definition and Purpose of FORM 104CR (09/28/16)

FORM 104CR, the Colorado Individual Income Tax Credit Schedule, is designed for taxpayers in Colorado to determine their eligibility and claim various income tax credits. This form assists individuals in reporting and taking advantage of both refundable and nonrefundable tax credits to reduce their overall tax liability.

Primary purposes of the form include:

- Eligibility Assessment: It outlines the criteria taxpayers must meet to apply for specific credits, ensuring that only those eligible benefit from such provisions.

- Credit Calculation: The form provides a structured way for taxpayers to calculate their credits, ensuring accuracy in reporting and compliance with state tax laws.

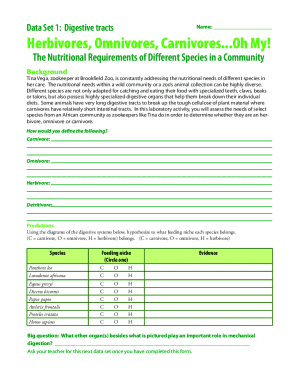

Tax credits available through FORM 104CR include the Earned Income Tax Credit and Child Care Expenses Credit, among others. Each credit has specific eligibility criteria and requires taxpayers to provide necessary supporting documentation.

Steps to Complete FORM 104CR (09/28/16)

Completing FORM 104CR requires careful attention to detail. Here are the steps involved:

- Gather Documentation: Before filling out the form, obtain all necessary documents, including W-2s, 1099s, and any other income statements. This will support your eligibility claims.

- Determine Eligibility: Review the eligibility criteria for each credit to know which ones you may qualify for. This can include income limits and specific conditions related to dependents.

- Fill Out the Form: Begin filling out the form with your personal information, including your name, address, and Social Security number. Follow the instructions for claiming each credit you are eligible for.

- Calculate Your Credits: Use the provided sections of the form to calculate your available credits accurately. Each credit type will have specific instructions on how to complete this section correctly.

- Attach Supporting Documents: If required, attach the necessary documentation to validate your claims, such as forms related to child care expenses or proof of income adjustments.

- Review for Errors: Check your completed form for any mistakes or omissions to reduce the likelihood of delays or audits.

- Submit the Form: Decide if you will file online or through physical mail and ensure you send the completed form to the correct address by the tax filing deadline.

These steps ensure you maximize your available credits while maintaining compliance with state tax laws.

Important Terms Related to FORM 104CR (09/28/16)

Understanding key terms associated with FORM 104CR is crucial for accurate completion and filing. Here are several important definitions:

- Refundable Credits: These allow taxpayers to receive a refund even if they do not owe taxes. For example, a taxpayer earning under a specific threshold may receive a refund through the Earned Income Tax Credit despite no tax liability.

- Nonrefundable Credits: These can only reduce a taxpayer’s liability up to zero and do not result in a refund. An example is the Child Care Expense Credit, which can lower taxes owed but cannot create a refund if the taxpayer's liability is less than the credit amount.

- Eligibility Requirements: Criteria set by the state that define who qualifies for certain credits. For instance, credits may vary based on income levels or family size.

- Supporting Documentation: Documents required by the IRS or state tax authorities to substantiate claims for credits, such as income proof or dependent status verification.

Familiarity with these terms helps taxpayers accurately understand their rights and responsibilities regarding available credits.

Filing Deadlines and Important Dates for FORM 104CR (09/28/16)

Timely filing is critical when it comes to tax forms such as 104CR. Here are the key deadlines and dates associated with this form:

- Tax Return Filing Deadline: For the 2016 tax year, the standard deadline to file your individual income tax return, including FORM 104CR, is April 18, 2017.

- Extensions: If filing an extension, the new deadline typically falls around October 16, 2017. However, any taxes owed must still be paid by the original due date to avoid penalties.

- Amendments: Should you discover an error after submitting your 104CR, you must file an amended return using FORM 104. The deadline for amending returns usually follows the same rules concerning the original filing deadline, with an allowance of up to three years to claim a refund.

Staying aware of these dates ensures compliance with tax regulations and minimizes the risk of penalties.

Who Typically Uses FORM 104CR (09/28/16)

FORM 104CR is primarily used by Colorado residents who file their state income taxes and are looking to claim specific tax credits. The following groups are likely to benefit from completing this form:

- Low to Moderate-Income Families: Taxpayers eligible for refundable credits, such as the Earned Income Tax Credit, can significantly reduce their tax liability or receive refunds.

- Parents and Guardians: Individuals claiming child care expenses are likely to use FORM 104CR to benefit from associated tax credits that can aid in offsetting costs related to dependents.

- Tax Professionals and Accountants: These individuals assist clients in the accurate completion of tax documents, ensuring that all eligible credits are claimed for maximum benefits.

Understanding the typical users of FORM 104CR helps to communicate its relevance and importance in the tax filing process.