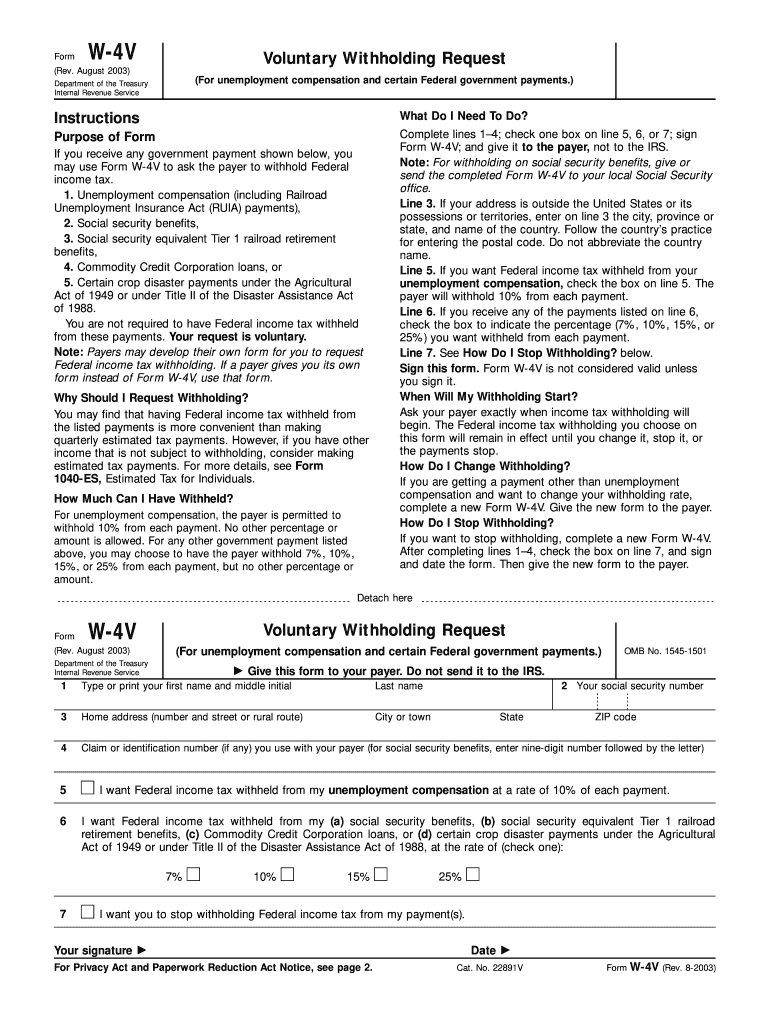

Definition & Purpose of Form W-4V

Form W-4V, known as the Voluntary Withholding Request, serves a key function in federal income tax withholdings. It provides a method for taxpayers to request federal income tax be withheld from certain government payments. This includes unemployment compensation and specific Social Security benefits. By doing so, taxpayers can help manage their overall tax liability and potentially avoid a large tax bill when filing their annual tax return.

Key Features

- Voluntary Nature: The form is not mandatory; it allows taxpayers to elect federal tax withholding based on their unique financial situations.

- Types of Payments Covered: Includes unemployment compensation and specific federal payments like Social Security.

Steps to Complete Form W-4V

The process to complete Form W-4V involves several specific steps, ensuring that the form is correctly filled out and submitted. Here’s a detailed guide:

- Provide Personal Information: Start by entering your name, Social Security number, and address.

- Indicate Type of Benefit: Specify which type of government payment you're receiving, such as Social Security.

- Select Withholding Rate: Choose an appropriate withholding rate. Options include 7%, 10%, 15%, or 25% for Social Security; 10% for unemployment compensation.

- Signature and Date: Sign and date the form as affirmation of your request and intentions.

Tips for Accurate Completion

- Double-check Numbers: Ensure your Social Security number and other details are correct to avoid processing delays.

- Office Contact: Contact your local office if you have questions about the applicable withholding rate.

How to Obtain Form W-4V

Form W-4V can be obtained through several methods, ensuring that taxpayers can access it conveniently.

- Online Access: Download the form from the IRS website, ensuring immediate access.

- Physical Locations: Visit a local Social Security office or unemployment office to obtain a physical copy.

Access Considerations

- Fill-in Capability: The form is designed to be fillable, meaning you can enter your information directly on the PDF before printing.

Why Use Form W-4V

Using Form W-4V offers several advantages. It facilitates efficient tax planning by aligning withholding practices with the taxpayer's overall financial strategy.

Key Benefits

- Avoid Surprises: Ensures that you withhold sufficient taxes to match your annual liability, potentially preventing a large tax bill.

- Financial Management: Helps evenly distribute tax payments throughout the year.

Who Typically Uses Form W-4V

Form W-4V is utilized by various demographics and financial situations. It is often used by those receiving unemployment or government benefits.

Common Users

- Retirees: Often use it to manage withholdings from Social Security benefits.

- Unemployed Individuals: Utilize it for withholding on unemployment compensation.

Important Terms Related to Form W-4V

Understanding the terms associated with Form W-4V can aid in its proper use and application.

Terms to Know

- Withholding Rate: The percentage of federal tax withheld from payments.

- Beneficiary: The individual receiving government payments.

Legal Use of Form W-4V

Form W-4V’s use is governed by federal laws, ensuring compliance and proper application.

Compliance Guidelines

- Submission: After completion, submit to the payer, like the Social Security Administration, not the IRS.

- Revocation and Changes: Changes or revocations can be made at any time by submitting a new form.

IRS Guidelines for Form W-4V

The IRS provides clear guidelines to assist taxpayers in using Form W-4V properly, ensuring compliance.

Key IRS References

- IRS Documentation: Refer to IRS Publication 505 for more detailed instructions on withholdings.

- Consultation Recommendations: Taxpayers are encouraged to consult tax professionals for personalized advice.