Definition & Meaning

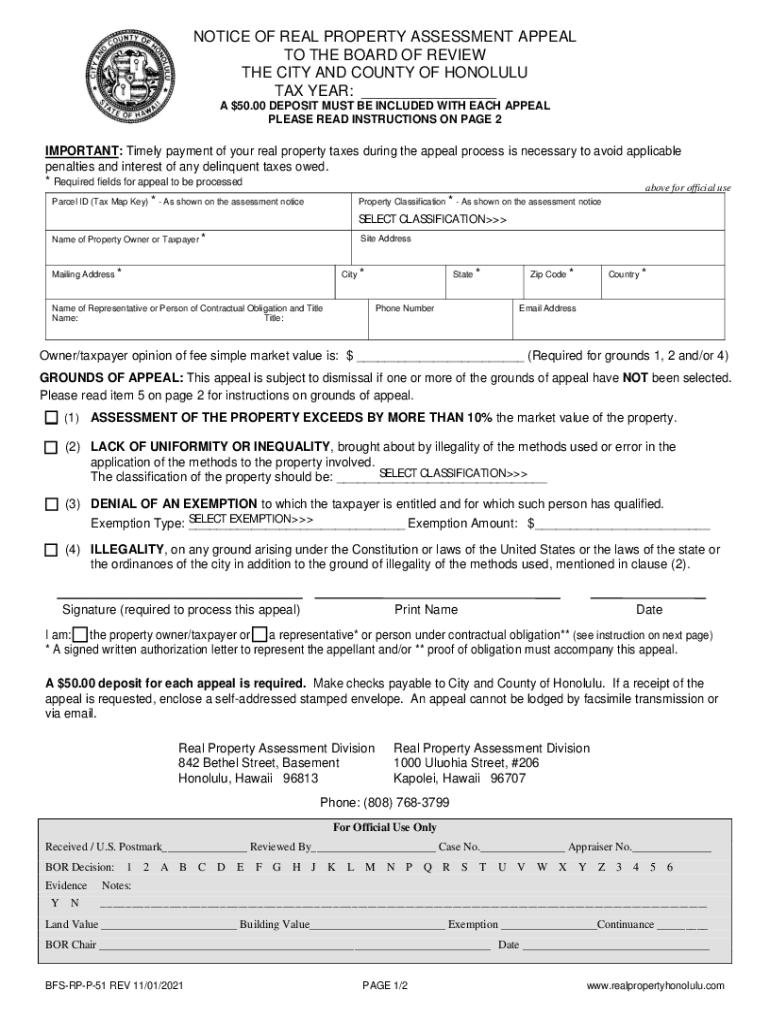

The "Hawaii RP Real Board Form" refers to a procedural document used primarily for appealing real property tax assessments in the City and County of Honolulu, Hawaii. This form is central to the appeals process, providing property owners with an official means to contest the assessed value of their property if they believe it has been overvalued. By submitting this form, individuals can initiate a formal review by the Real Property Assessment Board, which may result in an adjustment to their tax obligations.

How to Use the Hawaii RP Real Board Form

To effectively use the Hawaii RP Real Board Form, individuals must follow a systematic process beginning with gathering necessary documentation, such as the property’s current assessment, evidence of its market value, and supporting documents that justify the appeal. Once the form is filled out completely, it must be submitted to the appropriate local government office. It's crucial to ensure all required sections are accurately completed to avoid delays. Individuals should include any additional information or documentation that strengthens their case and adhere to specific guidelines on the submission format.

Steps to Complete the Hawaii RP Real Board Form

- Collect Required Documents: Gather all pertinent property assessment documents, evidence of market value, and any supporting data.

- Fill Out Personal Information: Enter personal details and property identification numbers at the top of the form.

- Explain Grounds for Appeal: Clearly state the reasons for the appeal, supported by evidence and market comparisons.

- Attach Supporting Documents: Include appraisals, photographs, and market analysis that substantiate your appeal.

- Sign and Date the Form: Ensure that the form is signed and dated, declaring the truthfulness of the provided information.

- Submit the Form: Deliver the completed form and documents to the appropriate government office either online, by mail, or in person.

Who Typically Uses the Hawaii RP Real Board Form

This form is primarily used by property owners in Honolulu who believe their property tax assessment is incorrect. This includes residential as well as commercial property owners who seek a reassessment due to a perceived overvaluation that leads to higher tax liability. Real estate professionals and tax advisors may also use the form on behalf of their clients, providing insights and expertise to strengthen the appeal case.

Key Elements of the Hawaii RP Real Board Form

- Property Details: Information such as property identification numbers, location, and current assessed value.

- Owner Information: Name, contact information, and legal interest in the property.

- Assessment Year: The specific year for which valuation is being contested.

- Grounds for Appeal: A detailed explanation of why the current assessment is deemed incorrect.

- Supporting Evidence: Appraisals, market analysis, photos, and any documents that support the claim.

- Applicant’s Signature: Acknowledgement of the information provided and its accuracy.

Legal Use of the Hawaii RP Real Board Form

The form must be used in compliance with local regulations governing property tax appeals. It serves as a legally binding document that initiates the appeal process, requiring the applicant to provide accurate and truthful information. This document is integral to the protection of property owners’ rights, ensuring they are taxed fairly according to accurate property valuations.

State-Specific Rules for the Hawaii RP Real Board Form

Hawaii has specific guidelines for appealing property tax assessments, including deadlines and the format for submission. Appeals often must be filed by a set date, typically within a few months after the annual assessment notice is received. Failure to comply with these timelines or procedural requirements can result in the dismissal of the appeal. It is vital for applicants to thoroughly understand these regional variations to successfully navigate the appeals process.

Form Submission Methods (Online / Mail / In-Person)

Applicants can submit the Hawaii RP Real Board Form through various channels:

- Online Submission: Some jurisdictions may offer an online portal for digital submissions, streamlining the process.

- Mail Submission: Forms and accompanying documents can be sent via postal service to the designated local authority.

- In-Person Submission: Direct submission to the property tax office, which may provide immediate feedback or receipt confirmation.

Required Documents

To support the appeal, several documents are necessary:

- Current Assessment Notification: The official notice indicating the assessed value being contested.

- Property Appraisals: Professional appraisals that provide an alternative valuation.

- Market Analysis Data: Comparable sales data and analyses to demonstrate discrepancies in valuation.

- Supportive Photographs: Visual evidence that might affect property value, such as structural damage or changes in the neighborhood.

Penalties for Non-Compliance

Failure to comply with the submission deadlines or to provide complete and accurate information can lead to the rejection of the appeal. Additionally, dishonesty in the provided information could result in legal action or penalties. It's imperative that all applicants adhere strictly to the guidelines to avoid such consequences.