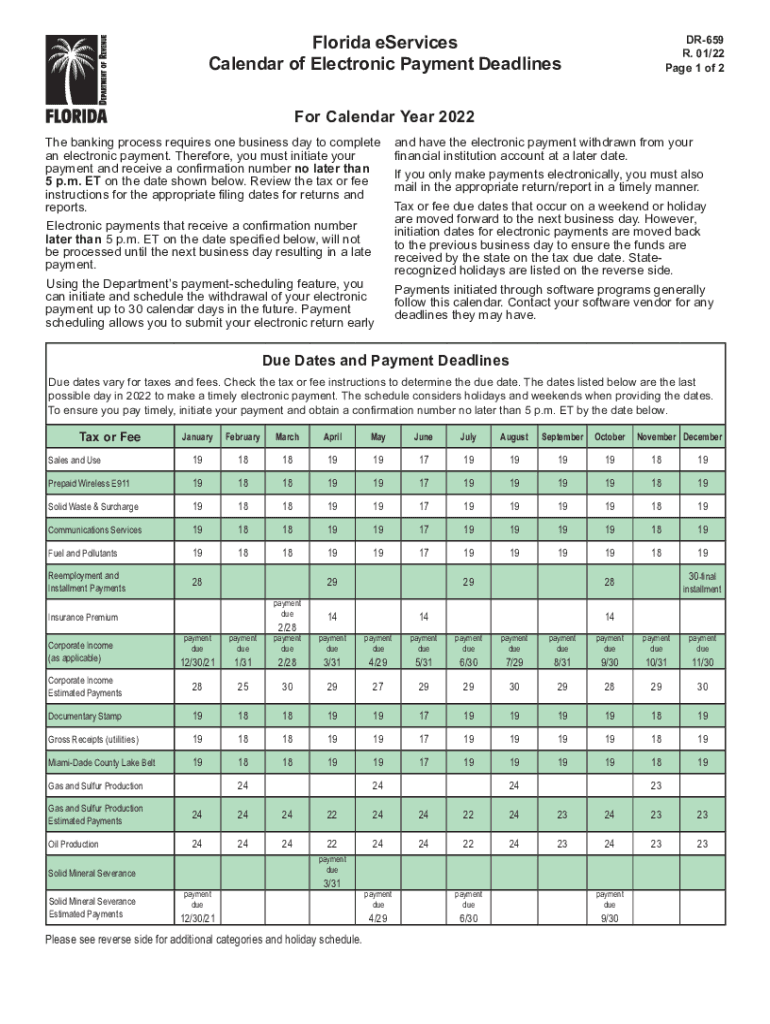

Definition and Importance of Florida Due Dates

Florida due dates refer to the specific deadlines set by state authorities for various tax filings, payments, and documentation, essential for maintaining compliance. These due dates are particularly critical for sales tax, corporate income tax, and other state-related financial obligations. Missing these deadlines can result in penalties, interest charges, and potential legal complications.

Key Elements of Florida Due Dates

- Sales Tax: Florida businesses are required to file sales tax returns based on their reporting frequency—monthly, quarterly, or annually.

- Corporate Income Tax: Businesses must adhere to filing schedules for corporate income tax returns.

- Personal Income Tax: While Florida does not impose a state income tax, federal deadlines must also be considered for residents.

Understanding these due dates helps individuals and businesses avoid unnecessary penalties, enhance financial planning, and maintain good standing with the Florida Department of Revenue.

How to Use Florida Due Dates Effectively

Effectively utilizing Florida due dates requires familiarity with tax obligations and filing requirements. Here are several strategies to ensure compliance:

- Calendar Integration: Mark due dates on a calendar to ensure timely filings. Utilize digital reminders for ease.

- Document Preparation: Collect all necessary documentation well in advance of the due dates to facilitate smooth submissions.

- Standard Operating Procedures: Establish internal processes within a business for tracking and managing tax obligations. This includes designating personnel responsible for monitoring due dates.

- Regular Updates: Stay informed about changes in tax laws and due dates by subscribing to updates from the Florida Department of Revenue.

By managing your calendar proactively, you can mitigate the risks associated with late submissions.

Filing Deadlines and Important Dates in Florida

Florida has specific deadlines for various taxes that individuals and businesses must meet. Below is an outline of the most critical dates typically encountered:

Sales Tax Due Dates

- Monthly Filing: Due on the first day of the month following the reporting period.

- Quarterly Filing: Typically due on the 1st of the month following the end of each quarter (e.g., January 1, April 1, July 1, October 1).

- Annual Filing: Due on January 31, for businesses that qualify under annual reporting.

Corporate Income Tax Due Dates

- Fiscal Year: Due on the first day of the fourth month following the close of the fiscal year.

- Extension Requests: Applicants must file for an extension before the original due date.

Ensuring adherence to these timelines is crucial for avoiding late fees and maintaining compliance.

Steps to Complete the Florida Due Dates

Completing obligations associated with Florida due dates follows a structured process. Here are detailed steps for effective management:

-

Identify Obligations: Determine all applicable taxes based on your business structure and transactions.

- Examples: Sales tax, corporate income tax, and local business taxes.

-

Gather Required Documents: Assemble financial records, receipts, and previous filings to ensure accuracy in reporting.

- Consider keeping electronic copies for ease of access.

-

Calculate Tax Liabilities: Use accurate data to compute any tax dues to avoid underpayment penalties. Utilize software tools for assistance.

-

Prepare and File Returns:

- Use the Florida Department of Revenue’s e-filing system for sales tax returns.

- Submit corporate taxes according to the designated method (e-file or paper filing).

-

Monitor Confirmation: After submission, ensure you receive confirmation of filing, whether electronically or via postal mail.

Following these structured steps minimizes errors and simplifies compliance with Floridian regulations.

Who Typically Uses Florida Due Dates?

The audience for Florida due dates encompasses a diverse group of individuals and entities. Key users include:

- Small Business Owners: Required to file sales tax and corporate taxes consistently.

- Self-Employed Individuals: Must manage their own tax responsibilities, often including quarterly estimated tax payments.

- Corporate Entities: Large businesses with complex tax structures must adhere to multiple filing deadlines.

- Accountants and Tax Professionals: These individuals rely on due dates to manage client finances effectively.

Awareness of these parties highlights the broad scope of impact that Florida due dates have on the state's economic landscape.

Penalties for Non-Compliance with Florida Due Dates

Comprehension of potential penalties for missing Florida due dates is essential for effective financial governance. Here are common repercussions:

- Late Fees: A percentage of taxes owed can be assessed as a penalty for late filings.

- Interest Charges: Interest accrues on unpaid taxes daily until settled.

- Legal Consequences: Continuous non-compliance may result in audits or further legal actions by the Florida Department of Revenue.

- Loss of Good Standing: Businesses may face administrative complications, affecting their ability to operate within the state.

Preventing these penalties demands diligent adherence to all filing requirements and due dates.

Important Terms Related to Florida Due Dates

Understanding essential terminology associated with Florida due dates can greatly enhance compliance efforts. Below are key terms to familiarize yourself with:

- Filing Frequency: The schedule (monthly, quarterly, annual) on which businesses must report their taxes.

- E-filing: Electronic submission of tax returns, which is often mandatory for certain businesses.

- Estimated Tax Payments: Payments made throughout the year to cover anticipated tax liability, particularly for self-employed individuals.

Clear knowledge of these terms facilitates smoother compliance and reduces confusion during the filing process.

Examples of Using Florida Due Dates

Practical examples can illustrate how Florida due dates impact various scenarios:

-

Scenario for a Small Retail Store: A local retail shop collects sales tax from customers and must file monthly returns. If January sales amount to $10,000, they owe $600 in sales tax and must submit their return by February 1.

-

Corporate Examples: A corporation with a fiscal year ending December 31 will need to file its corporate tax return by April 1. If they fail to file by the due date, they incur penalties and interest on taxes owed.

These examples exemplify the practical applications and implications of adhering to Florida's tax deadlines.