Definition and Meaning

The "HI Form Notice" refers to a formal document typically used within specific jurisdictions to notify involved parties about legal or official proceedings. It generally acts as a communication tool to ensure that all relevant entities are informed about the initiation or progress of a particular situation, such as a lawsuit, medical claim, or any administrative process. Understanding its definition and purpose is crucial because it determines how the notice is used and the legal implications of its execution. This document is associated typically with legal and government processes, and its significance lies in its ability to uphold due process by ensuring transparency and communication.

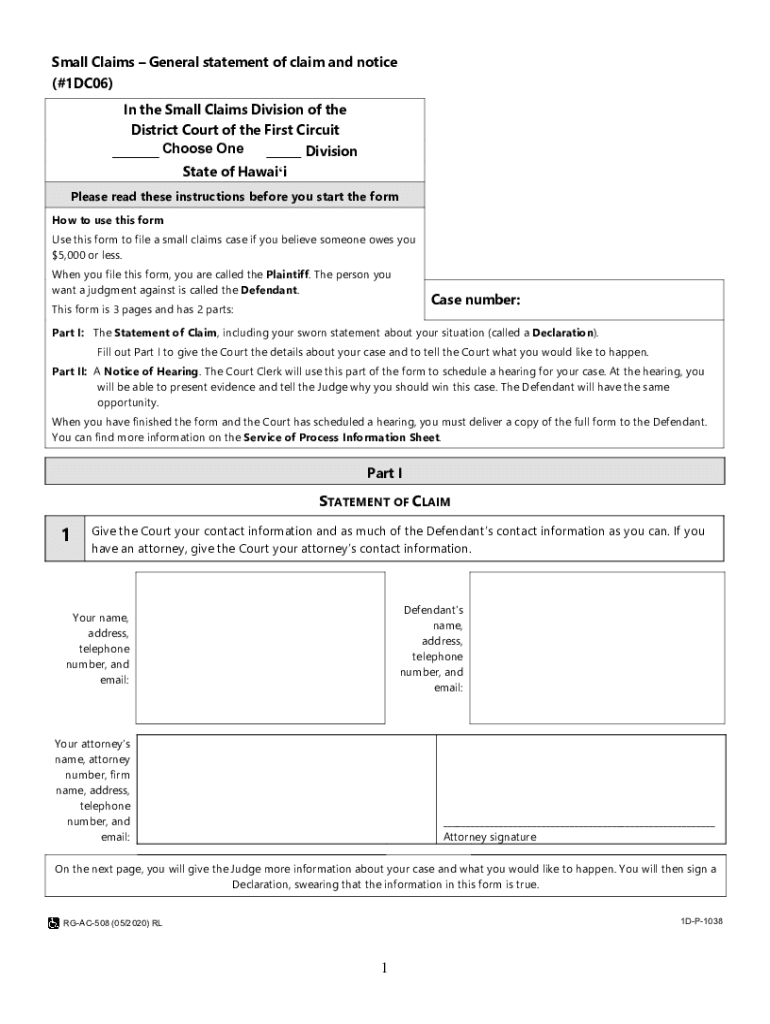

Key Elements of the HI Form Notice

Key elements of the HI Form Notice include the name and description of the involved parties, specific details about the proceedings or matter being addressed, and deadlines for responses or required actions. It often contains a case number or identifier that links it to a particular legal or administrative matter. Additionally, the form will detail specific instructions on actions required by the recipient, potential ramifications for non-compliance, and the issuing authority's contact details. These elements collectively work to provide clear guidance on what the recipients need to understand and act upon.

How to Use the HI Form Notice

Using the HI Form Notice correctly involves several steps to ensure compliance and the effective management of the indicated processes. Initially, recipients should thoroughly read the notice to comprehend all its requirements. It is critical to note deadlines specified in the form and adhere to them strictly to avoid any penalties or negative outcomes. If the form necessitates a response or documentation, prepare and submit this within the given timeframe. In situations requiring clarification, contacting the issuing authority via the contact details provided is advisable. Providing thorough compliance might involve consulting a legal advisor, especially if the form is related to judicial proceedings.

Steps to Complete the HI Form Notice

-

Review the Form: Begin by carefully reading all sections of the form. It is essential to understand what is requested and any instructions provided.

-

Gather Information: Collect necessary personal or business information that is required for completion. This might include identification numbers, addresses, or specific details related to the matter at hand.

-

Fill in the Form: Use clear and legible handwriting or a digital format if available. Ensure all mandatory fields are accurately completed.

-

Double-Check Details: Re-evaluate the form to confirm that all information is correct and complete. Mistakes or omissions could result in delays or legal consequences.

-

Submit the Form: Choose the submission method indicated, whether online, by mail, or in person. Comply with the specified procedures to ensure the form is officially received by the correct department or authority.

Legal Use of the HI Form Notice

The legal use of the HI Form Notice involves adhering to specific guidelines and regulations set forth by the jurisdiction in which it is issued. This might include its use in court proceedings, informing individuals or organizations of certain rights or obligations, and establishing formal communication in legal processes. It is crucial to recognize that misuse or non-compliance with the procedures related to this form could result in legal penalties or a negative impact on legal proceedings. Each jurisdiction might have particular laws governing the issuance and processing of such notices, emphasizing the need for awareness and compliance.

Entries and Documentation for the HI Form Notice

Required documentation accompanying the HI Form Notice can vary based on the type of proceeding or its legal context. Common required documents might include identification proof, previous legal or administrative correspondences, and any relevant contracts or agreements. In some cases, you might need affidavits or certified translations if the documents are in a different language. Assembling the proper documentation ensures that the notice process is smooth, effective, and free from unnecessary delays. The completeness and accuracy of submissions will significantly influence the notice's success and validity.

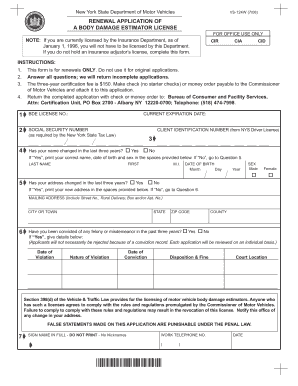

State-Specific Rules for the HI Form Notice

State-specific rules can significantly influence how the HI Form Notice operates and is processed. These rules can dictate how the notice is served, the timeline for responses, and any specialty rules that apply to certain jurisdictions or types of proceedings. For instance, some states may have stricter penalties for non-compliance, while others might offer more flexible guidelines on submission methods or supporting documentation required. Consulting with local legal experts or suitable state departments can provide important insights into these state-specific requirements, ensuring alignment with local laws and regulations.

Examples of Using the HI Form Notice

Examples of using the HI Form Notice include notifying parties of a small claims case in Hawaii, where the form might play a role in both informing and gathering responses from defendants and other pertinent entities. These examples can vary widely based on the form's particular application, such as medical claims, service disputes, or administrative communications. By exploring different scenarios, such as employment disputes or landlord-tenant matters, the utility of the form in providing structured communication and facilitating the resolution process can be better comprehended. These cases illustrate the adaptability and importance of the HI Form Notice within diverse legal frameworks and processes.