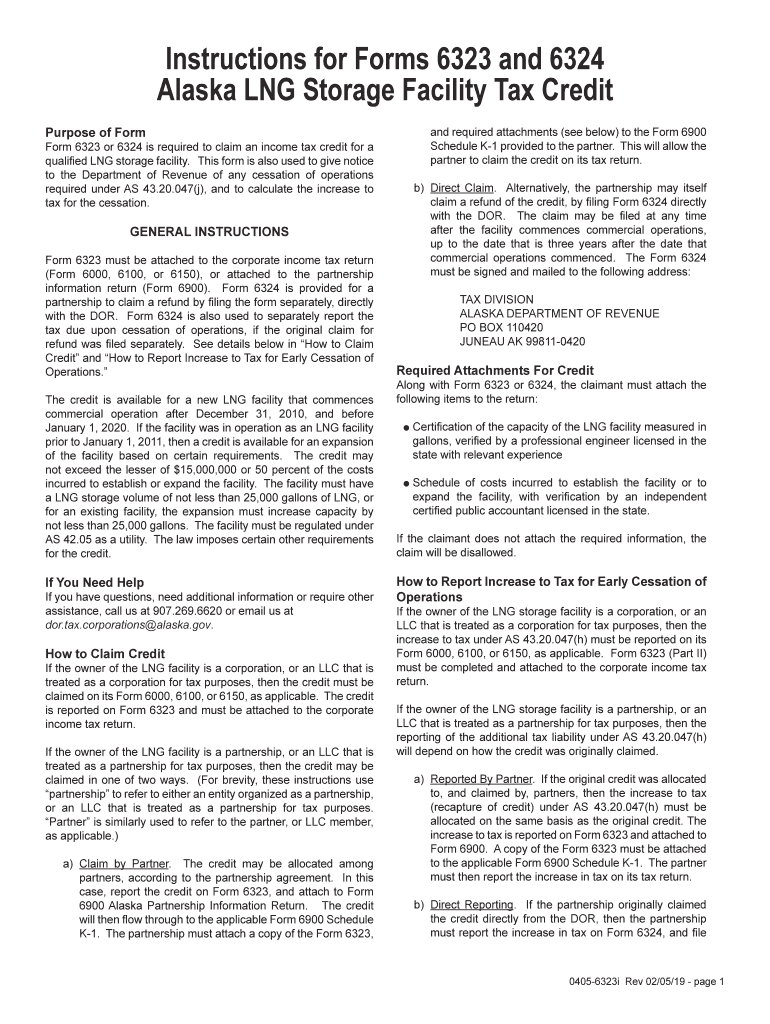

Definition and Purpose of the Alaska 6323 Form

The Alaska 6323 Form is a document used to claim an income tax credit specifically for qualified LNG (Liquefied Natural Gas) storage facilities in Alaska. This form is crucial for entities looking to reduce their tax liability through state incentives aimed at promoting LNG infrastructure. Businesses involved in LNG storage can utilize this form to both initiate and maintain tax credit processes for their facilities. Additionally, the form serves as a means to report any cessation of operations and to recalibrate any tax increases resulting from such cessations. It's essential for both corporations and partnerships intending to benefit from Alaska's tax credit program for LNG facilities.

Steps to Complete the Alaska 6323 Form

-

Gather Required Documentation:

- Collect details of LNG storage facilities, including operational status and expansion records.

- Prepare financial documents that demonstrate eligibility for the tax credit.

-

Complete Identification Information:

- Enter background information about the business entity.

- Provide facility-specific data, such as location and capacity details.

-

Calculate the Tax Credit:

- Utilize applicable financial records to calculate the potential tax credit.

- Include any appendices or calculations mandated by the form guidelines.

-

Report Cessation of Operations:

- If applicable, provide detailed information regarding any cessation or changes in operations.

- Calculate and report related tax adjustments.

-

Submit the Form:

- Complete all relevant sections, ensuring accuracy and compliance.

- Attach necessary supporting documents before submission.

Required Documents for the Alaska 6323 Form

-

Facility Documentation:

- Proof of operational status and documentation of any recent expansions.

- Records showing compliance with eligibility criteria for the tax credit.

-

Financial Statements:

- Recent financial reports that support the tax credit claim calculations.

- Documents detailing any previous tax credits claimed.

-

Operational Records:

- Details of any cessation of operations and subsequent financial impacts.

- Legal documents confirming the status of operational permits.

Eligibility Criteria for the Alaska 6323 Form

-

Qualified LNG Facility:

- Only facilities that meet specific operational and construction criteria are eligible.

- The facility must be either newly built or have undergone qualified expansion.

-

Business Structure:

- Both corporations and partnerships are eligible to use the form.

- Entities must be operating within the jurisdiction of Alaska.

-

Operational History:

- Businesses must maintain a transparent record of their operations and any changes therein.

- A history of compliance with state regulations is a prerequisite.

Legal Considerations of the Alaska 6323 Form

-

Tax Compliance:

- Properly completing the form ensures compliance with Alaska's tax regulations.

- Legal measures dictate accurate reporting of any cessation of operations.

-

Legally Binding Agreements:

- The form ties businesses to specific operational commitments to maintain eligibility.

- Misrepresentation of information can lead to legal consequences and loss of tax credits.

-

Policy Updates:

- Businesses must stay informed of any updates to the regulations affecting this form.

- Changes in state policies may impact the terms and conditions of tax credits.

Importance of the Alaska 6323 Form for Businesses

-

Financial Benefits:

- The tax credit can significantly reduce the business's annual tax liability.

- Incentivizes investment in LNG infrastructure, promoting sustainable energy solutions.

-

Regulatory Compliance:

- Keeping up with form submissions ensures compliance with state energy policies.

- Helps businesses avoid penalties associated with non-compliance or incorrect reporting.

-

Operational Planning:

- Offers insights into financial planning for infrastructure expansion.

- Assists in setting financial targets aligned with state tax credit incentives.

How to Obtain the Alaska 6323 Form

-

Online Download:

- Accessible through the official Alaska Department of Revenue website.

- Digital copies can be easily downloaded and printed for completion.

-

Local Tax Offices:

- Physical copies can be obtained from state tax offices for those preferring paper submissions.

- Assistance is often available from office staff to ensure proper acquisition.

-

Tax Preparation Software:

- The form is compatible with most tax preparation software options.

- Integration ensures seamless data entry and record-keeping.

Filing Deadlines and Important Dates for the Alaska 6323 Form

-

Annual Submission:

- The form should be submitted along with the annual tax return.

- Deadlines align with those set by the Alaska Department of Revenue for corporate and partnership tax returns.

-

Mid-Year Updates:

- Any changes in operation leading to cessation or expansion must be reported promptly.

- Specific dates apply to the submission of these updates, as detailed in the form guidelines.

-

Notification of Changes:

- Early reporting of operational changes can impact financial assessments and credit calculations.

- Timely updates ensure continued eligibility for the tax credit program.