Definition & Meaning

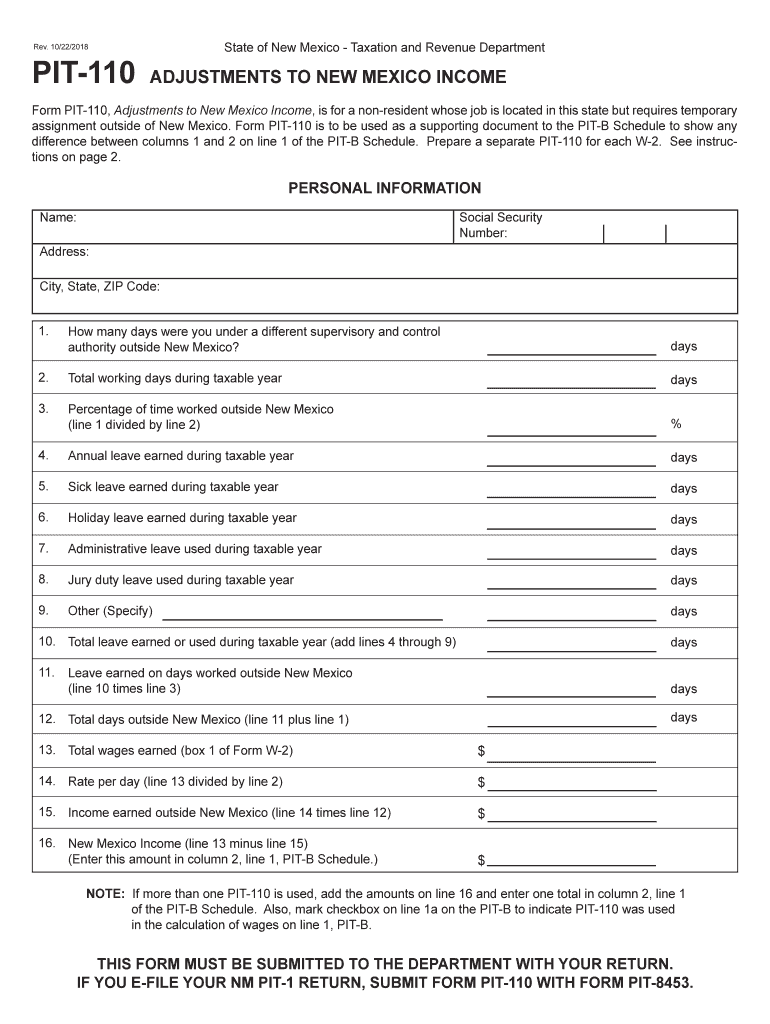

The PIT-110 New Mexico Form is a crucial document for non-resident taxpayers to report income adjustments when working temporarily outside the state. This form supports accurate income detailing under the PIT-B Schedule, ensuring compliance with New Mexico's tax regulations.

Importance of the Form

- Adjusts taxable income: Ensures correct calculation of taxes owed to New Mexico.

- Supports tax submissions: Must accompany the tax return for formal acceptance.

- Documents work days: Tracks days worked out-of-state and types of leave.

Context and Purpose

Designed specifically for non-residents, this form facilitates transparency and accountability in income reporting. It ensures New Mexico captures all taxable income despite out-of-state employment.

Steps to Complete the PIT-110 New Mexico Form

Completing the PIT-110 involves several detailed steps, requiring accuracy to ensure compliance and the avoidance of potential penalties.

-

Gather Required Information

- Employer details and income records.

- Days worked outside New Mexico.

- Any applicable leave types and corresponding days.

-

Documentation of Work Days

- Enter the number of days worked outside the state.

- Specify types of leave with corresponding days off.

-

Calculate Adjustments

- Total days of leave.

- Adjust taxable income based on out-of-state workdays.

-

Review and Submit

- Double-check for accuracy.

- Ensure all required sections are completed.

- Submit the form with your state tax return.

How to Obtain the PIT-110 New Mexico Form

Acquiring the PIT-110 form is a vital first step for processing non-resident income adjustments.

Available Methods

- Online Access: Accessible through New Mexico's official tax website.

- Tax Preparers: Obtain directly from tax professionals.

- Contact the Tax Authority: Request a physical copy via mail or in-person visits to the New Mexico tax office.

Key Elements of the PIT-110 New Mexico Form

The composition of the PIT-110 form is designed to gather comprehensive income and work activity details.

Essential Sections

- Personal Information: Includes taxpayer name, address, and Social Security Number.

- Work Activity Details: Specifically for tracking days worked outside New Mexico.

- Leave Types and Days: Establishes grounds for income adjustments.

- Income Adjustment Calculations: Documents income subject to New Mexico tax laws.

Who Typically Uses the PIT-110 New Mexico Form

Understanding the typical users of the PIT-110 form helps identify if it's applicable to your situation.

Relevant Users

- Non-resident Employees: Working temporarily outside New Mexico.

- Employers with Out-of-State Assignments: Needing to report employee workdays accurately.

- Tax Professionals: Assisting in ensuring compliance with state taxes.

Legal Use of the PIT-110 New Mexico Form

Compliance and Verification

- Fulfils State Requirements: Adheres to New Mexico's tax laws for non-residents.

- Acts as Legal Proof: Documents adjustments and out-of-state workdays.

- Serves as Official Record: Supports tax returns and subsequent audits.

Potential Penalties for Non-Compliance

Failure to properly file the PIT-110 form when required can lead to significant consequences such as late fees, additional taxes, or potential audits.

Filing Deadlines / Important Dates

Timeliness is critical in tax submission to avoid penalties.

-

Annual Tax Deadline

- Aligns with New Mexico's individual tax return deadline, usually April 15.

-

Filing Extensions

- Possible upon request, extending the deadline for individuals unable to meet the original date.

-

Penalties for Late Submission

- Financial penalties and interest fees can apply for late or incomplete filings.

State-Specific Rules for the PIT-110 New Mexico Form

Filing tax forms accurately includes adhering to New Mexico’s state-specific guidelines.

Unique Regulations

- Exclusive to Non-Residents: The form caters specifically to individuals working outside the state but taxed by New Mexico.

- Strict Reporting Requirements: Requires full disclosure of all out-of-state workdays.

- Customized Adjustments: Reflects New Mexico’s criteria for income tax adjustments based on residency status.

Examples of Using the PIT-110 New Mexico Form

Case Studies

- Non-Resident Engineer: An engineer contracted for a six-month project in Texas files Form PIT-110 to adjust his New Mexico taxable income accordingly.

- Consultant with Multiple Projects: A consultant working in various states files the form to reflect out-of-state workdays and modify taxable income.