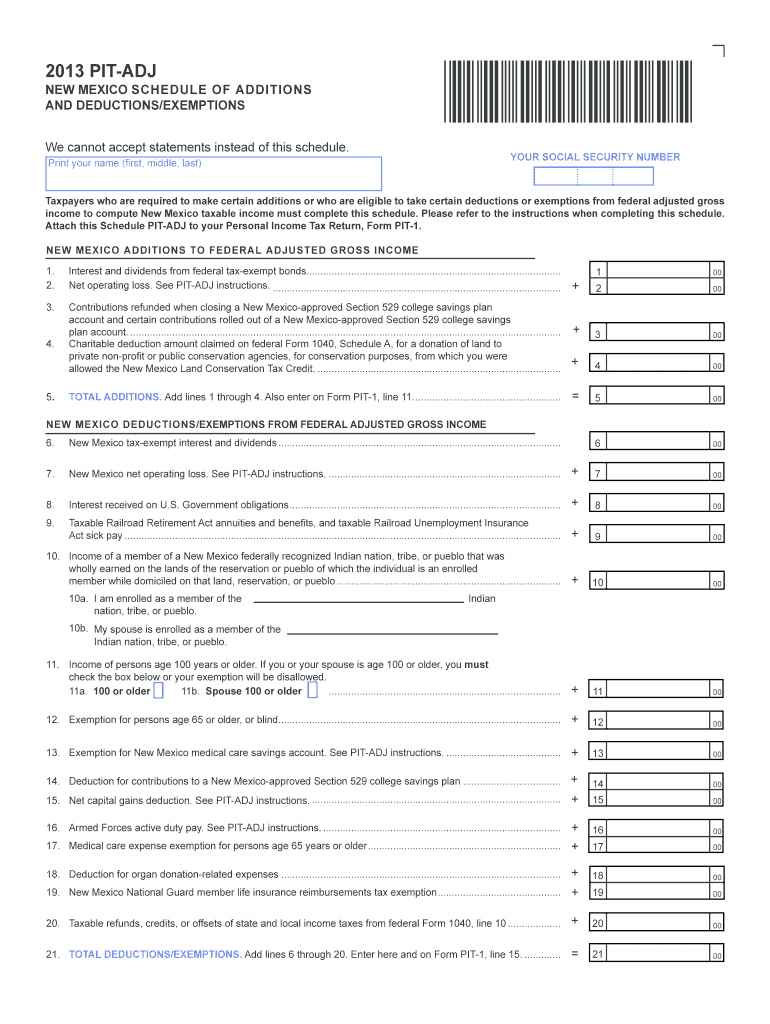

Definition and Purpose of the PIT-ADJ 2 Form

The PIT-ADJ, also known as the New Mexico Schedule of Additions and Deductions/Exemptions form, serves as a crucial component for taxpayers in New Mexico between 2013 and 2019. This form is specifically designed to capture various additions and deductions to a taxpayer's federal adjusted gross income. By adjusting the income, the form assists taxpayers in accurately determining their New Mexico taxable income. The precise calculation of taxable income ensures compliance with state tax laws and assists in determining the amount owed or the refund due.

How to Use the PIT-ADJ 2 Form

To effectively use the PIT-ADJ form, follow these steps to ensure that all relevant additions and deductions are accurately reported:

-

Gather Financial Information: Collect all pertinent financial documents, including federal tax returns and income statements, to ensure accurate data input.

-

Identify Additions: Fill in any income that was not included in your federal adjusted gross income but is taxable in New Mexico. Examples include certain retirement distributions or out-of-state income.

-

Identify Deductions: Report any deductions allowed by New Mexico that were not on the federal return, such as unreimbursed employee expenses or contributions to 529 college savings plans.

-

Complete and Attach: Ensure all sections are filled, and attach the PIT-ADJ form to your Personal Income Tax Return (Form PIT-1) before submission.

Steps to Complete the PIT-ADJ 2 Form

-

Familiarize with Instructions: Before filling out the form, carefully read the instructions provided for each year, as rules and allowances may vary.

-

Calculate Additions: Detailed calculations may be needed for specific items such as bonus depreciation or certain retirement income. Keep clear records of calculations.

-

Calculate Deductions: Use the form’s deduction list to ensure nothing is missed, including health insurance premiums or student loan interest deductible at the state level.

-

Verify Total Adjustments: Ensure that the sum of your additions and deductions is accurate, and enter it in the appropriate line for adjusting your state taxable income.

-

Review for Accuracy: Double-check all entries for consistency with your other tax documents before final submission to avoid errors.

Importance of the PIT-ADJ 2 Form

Using the PIT-ADJ form ensures that taxpayers account for all differences between federal and state taxable income, which can impact the overall tax liability or refund amount for the individual filer. The form's accurate completion helps maintain compliance with New Mexico state tax laws and can prevent potential audits or penalties associated with incorrect filings.

Who Typically Uses the PIT-ADJ 2 Form

The PIT-ADJ form is predominantly used by New Mexico residents who have income sources that require additional state-specific adjustments. This includes individuals with retirement income, those who have incurred state-specific deductible expenses, or taxpayers with out-of-state income that needs adjustment for New Mexico tax purposes.

Key Elements of the PIT-ADJ 2 Form

- Additions Section: Items like bonus depreciation or out-of-state municipal bond interest.

- Deductions Section: Includes items like 529 plan contributions or military pension deductions.

- Legal Instructions: Detailed legal guidelines helping taxpayers understand which specific additions and deductions apply.

Filing Deadlines and Important Dates

Filing deadlines for the PIT-ADJ form coincide with state tax deadlines, generally April 15th unless extended due to weekends or public holidays. Taxpayers should ensure timely submission to avoid penalties.

Form Submission Methods

Taxpayers can submit the PIT-ADJ form either electronically via New Mexico’s online tax filing system or by mail alongside their PIT-1 form. It is crucial to retain copies of all submitted documents for personal records and future reference.

Penalties for Non-Compliance

Failure to accurately complete or timely file the PIT-ADJ form can result in penalties, including fines or increased tax assessments from the New Mexico Taxation and Revenue Department. Maintaining organized records and adhering to deadlines is essential to avoid these potential issues.