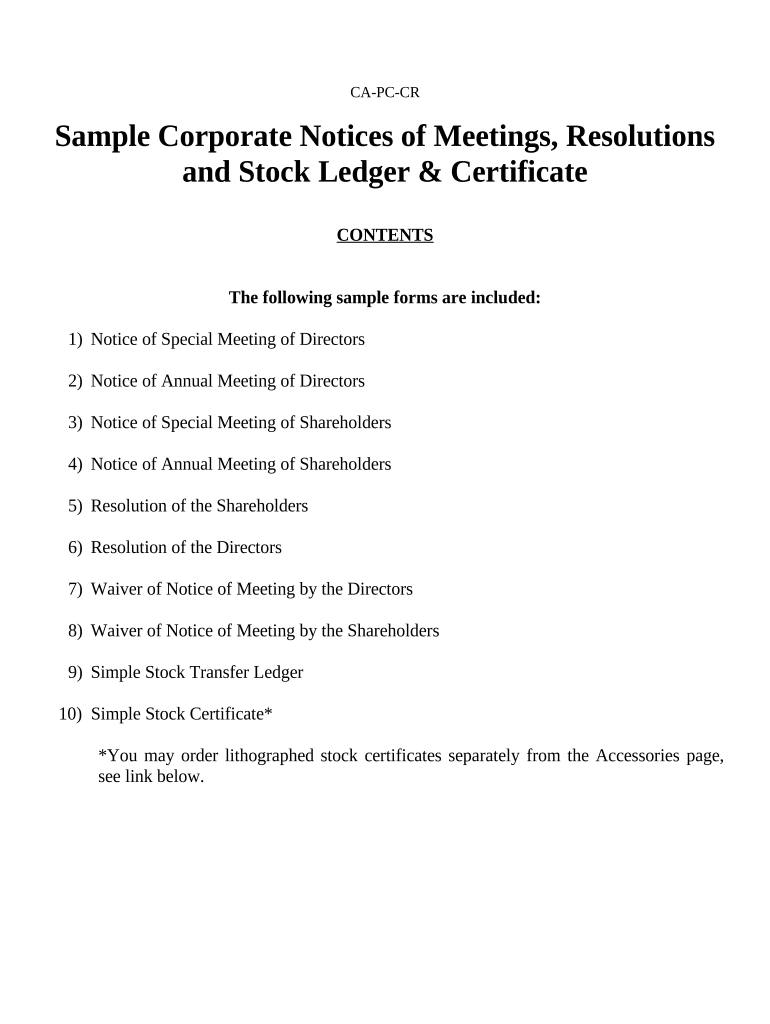

Definition and Meaning

The "California Sample Corporate" document, often denoted as CA-PC-CR, is a comprehensive template package used for guiding corporate governance within professional corporations in California. Primarily, it includes samples of corporate notices, resolutions, and stock ledger forms. These samples are vital for meetings involving directors and shareholders. The templates typically cover essential elements such as special and annual meeting notices, resolutions for various corporate decisions, waivers of notice, and stock certificates, ensuring that corporations comply with organizational governance standards.

How to Use the California Sample Corporate

To effectively utilize the California Sample Corporate document, corporations should follow these steps:

-

Identify Needs: Determine which corporate activities require formal documentation, such as shareholder meetings or stock transfers.

-

Select Appropriate Templates: Choose specific forms from the CA-PC-CR package that correspond to the corporate activity at hand.

-

Customize the Forms: Modify the templated content to reflect your corporation’s specific details, such as names, dates, and decisions made.

-

Validate with Stakeholders: Share the documents with relevant parties for review, ensuring that all necessary information is included, and they adhere to corporate policies.

-

File and Store: Once completed and approved, file the documents properly for future reference, adhering to legal requirements for document retention.

How to Obtain the California Sample Corporate

Corporations can acquire the California Sample Corporate document package through various means:

- Direct Purchase: Available from legal template providers specializing in corporate governance documents.

- Legal Counsel: Corporate attorneys may provide access to these documents as part of their service offerings.

- Online Platforms: Some online legal form services offer downloadable versions of the CA-PC-CR package for a fee.

Ensure that the source is reliable and that the documents are the most current version to comply with any recent changes in corporate law.

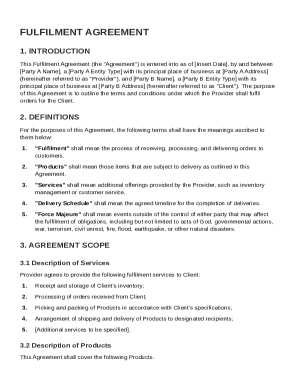

Steps to Complete the California Sample Corporate

Completing the CA-PC-CR forms requires careful attention to detail:

-

Fill in Basic Details: Enter the corporation’s name, address, and other identifying information.

-

Document Specifics: Clearly outline the meeting agendas, decisions, and resolutions passed.

-

Approval Process: Obtain signatures from designated corporate officers and stakeholders to verify and legitimize the documents.

-

Review for Compliance: Check that all filled sections adhere to California corporate law and corporate bylaws.

-

Finalize and Distribute: Once finalized, distribute copies to relevant stakeholders and store the originals securely.

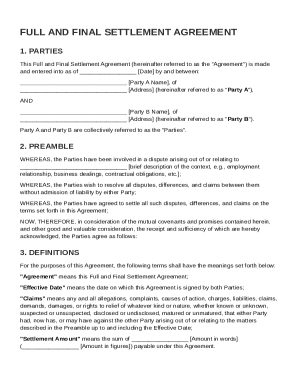

Why Should You Use the California Sample Corporate

Employing the CA-PC-CR forms ensures that:

- Standardization: Provides a consistent format across all corporate documentation, promoting clarity and coherence.

- Legal Compliance: Assists in meeting legal requirements for corporate governance in California.

- Operational Efficiency: Saves time by offering ready-to-use templates, reducing the need for drafting documents from scratch.

- Risk Mitigation: Helps avoid potential legal disputes by maintaining clear and proper records of corporate actions and resolutions.

Key Elements of the California Sample Corporate

The CA-PC-CR document includes several key components:

- Meeting Notices: Templates for notifying participants about shareholder and director meetings.

- Resolutions: Formats for documenting decisions made during corporate meetings.

- Waivers of Notice: Forms for waiving the requirement to notify stakeholders of meetings when agreed upon.

- Stock Certificates and Ledgers: Tools for tracking stock ownership and transfers.

These elements are designed to support various facets of corporate governance and ensure comprehensive documentation of corporate activities.

State-Specific Rules for the California Sample Corporate

Corporations using the CA-PC-CR package must adhere to California-specific regulations, including:

- Corporate Notices: Must comply with California Corporations Code concerning the timing and method of distributing meeting notices.

- Resolution Requirements: Need to follow state-mandated inclusions for resolutions, ensuring they reflect legally binding decisions.

- Waiver Conditions: Waivers must be voluntary and agreed upon in written form by the involved parties to be valid.

Understanding these state-specific rules is critical for ensuring that corporate documents are both legally compliant and effective in achieving their governance purposes.

Who Typically Uses the California Sample Corporate

The CA-PC-CR document is predominantly utilized by:

- Professional Corporations: Businesses formed for specific professions such as law, medicine, or accounting, requiring structured governance processes.

- Corporate Legal Departments: In-house legal teams that manage corporate documentation and ensure compliance with governance laws.

- Business Consultants: Professionals advising on corporate structuring and governance, facilitating the use of standardized documentation.

These users rely on the California Sample Corporate to streamline corporate governance and maintain accurate records that align with legal requirements.