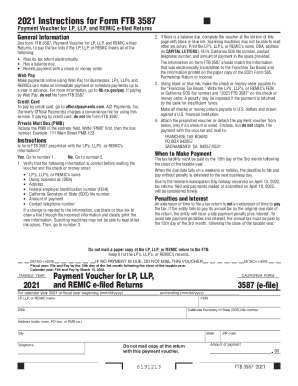

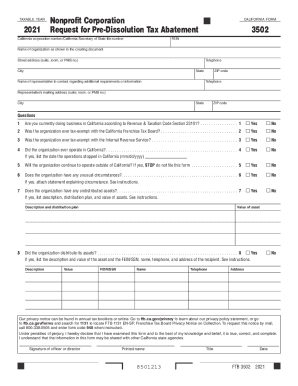

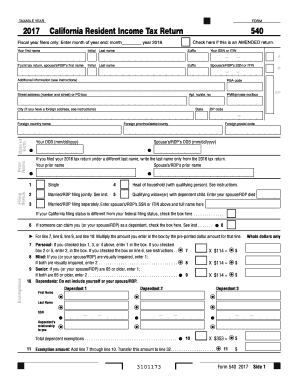

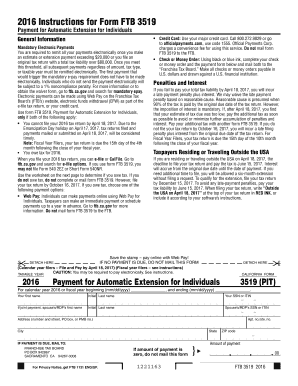

Maintain your records organized and up-to-date with our comprehensive Ftb tax Order Forms selection. Effortlessly personalize and modify forms to ensure data accuracy.

Your workflows always benefit when you are able to find all of the forms and documents you will need at your fingertips. DocHub provides a a huge library of forms to ease your day-to-day pains. Get hold of Ftb tax Order Forms category and quickly find your form.

Begin working with Ftb tax Order Forms in several clicks:

Enjoy fast and easy record management with DocHub. Discover our Ftb tax Order Forms category and look for your form right now!