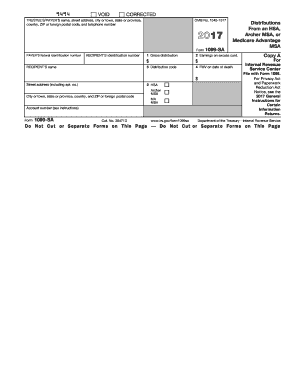

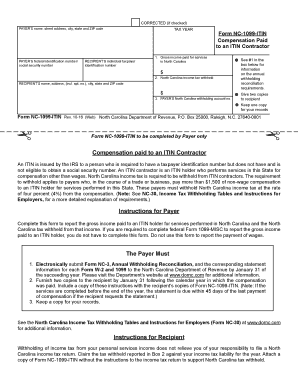

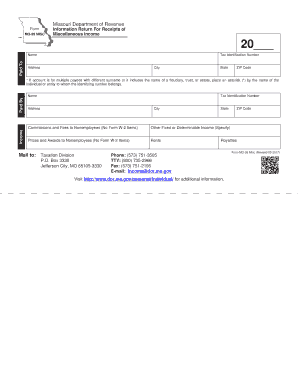

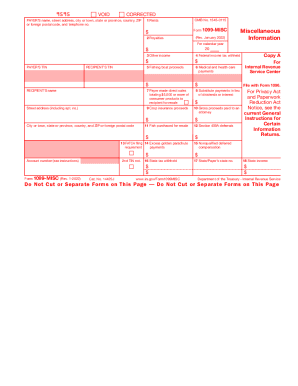

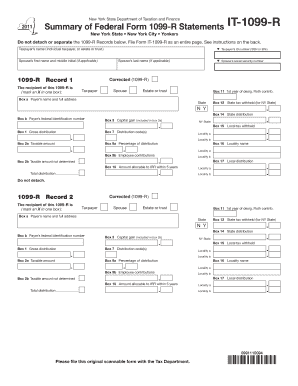

Handle your order documents and discover 1099 misc irs Order Forms. Keep confidential data secure with DocHub's data encryption and access controls.

Improve your form managing using our 1099 misc irs Order Forms category with ready-made document templates that suit your requirements. Access your document template, change it, fill it, and share it with your contributors without breaking a sweat. Begin working more effectively with the forms.

The best way to manage our 1099 misc irs Order Forms:

Examine all the possibilities for your online file administration with the 1099 misc irs Order Forms. Get your totally free DocHub profile right now!