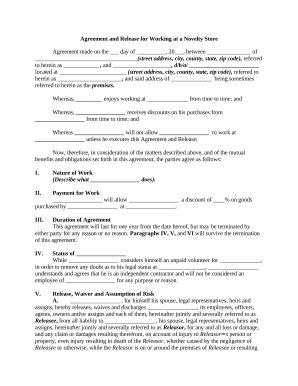

Boost your file operations with the Self-Employment Agreements category with ready-made document templates that suit your requirements. Access your form, edit it, complete it, and share it with your contributors without breaking a sweat. Begin working more efficiently with the forms.

The best way to manage our Self-Employment Agreements:

Explore all of the possibilities for your online file administration with our Self-Employment Agreements. Get your totally free DocHub profile right now!