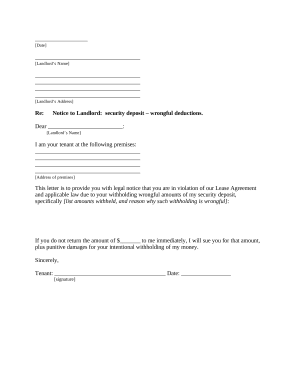

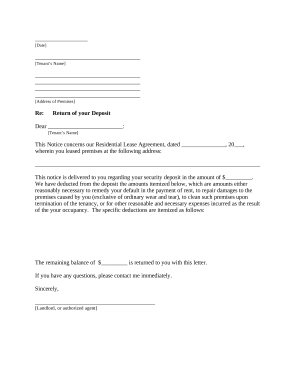

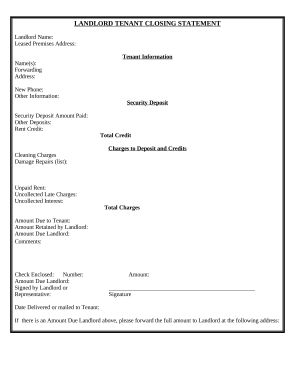

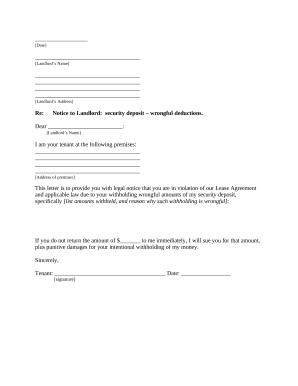

Accelerate your form management with our Security Deposit Deductions online library with ready-made form templates that meet your requirements. Access your document template, alter it, fill it, and share it with your contributors without breaking a sweat. Begin working more efficiently together with your documents.

The best way to manage our Security Deposit Deductions:

Discover all the opportunities for your online document management using our Security Deposit Deductions. Get your free free DocHub profile right now!