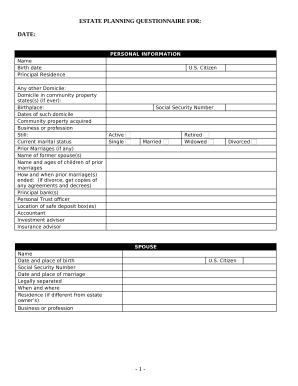

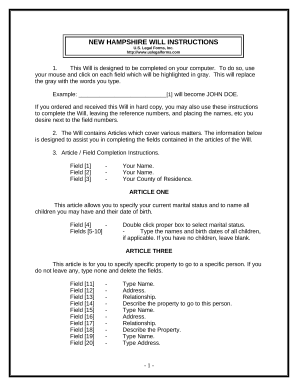

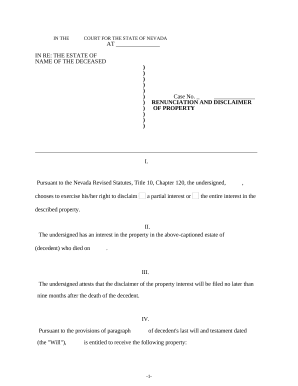

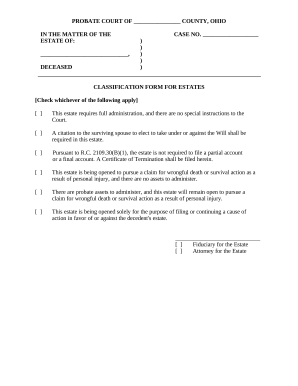

Boost your document managing with our Probate and Estate Planning collection with ready-made templates that meet your needs. Access your form, change it, complete it, and share it with your contributors without breaking a sweat. Start working more effectively with the forms.

The best way to use our Probate and Estate Planning:

Examine all of the possibilities for your online file administration using our Probate and Estate Planning. Get a free free DocHub account right now!