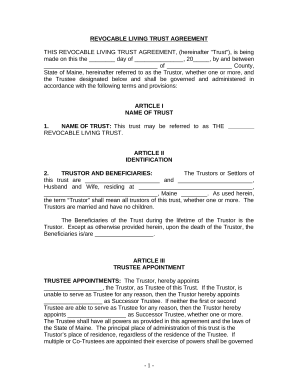

Your workflows always benefit when you can locate all of the forms and files you may need on hand. DocHub offers a wide array of form templates to relieve your day-to-day pains. Get hold of No Children Living Trusts category and quickly browse for your document.

Begin working with No Children Living Trusts in a few clicks:

Enjoy fast and easy file administration with DocHub. Explore our No Children Living Trusts collection and find your form today!