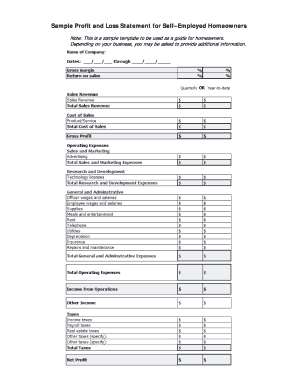

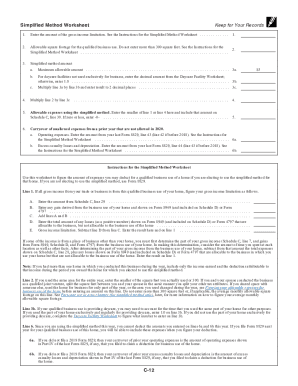

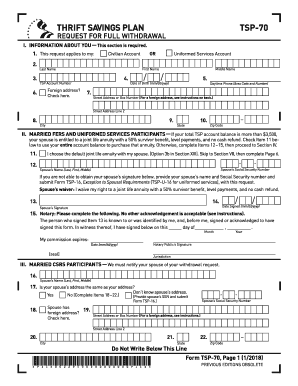

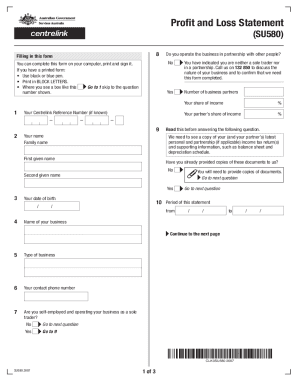

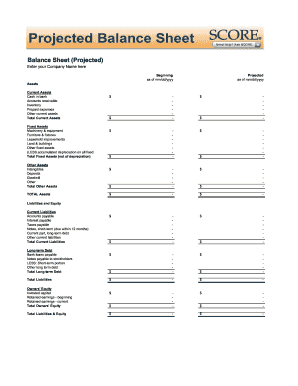

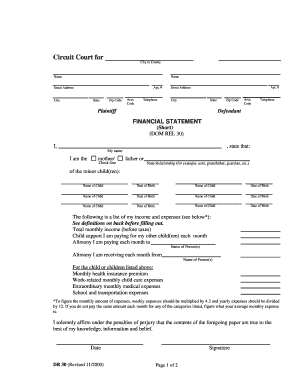

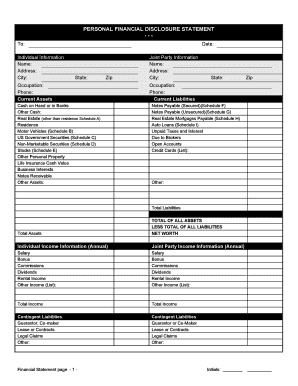

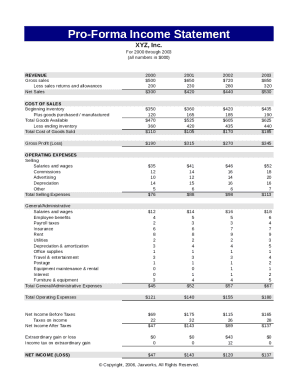

Obtain access to Sole proprietor Balance Sheet Templates and ensure that your financial statements are transparent, compliant, and accurate. Modify, complete, or work together with your team on the document before sending it.

Papers management consumes to half of your office hours. With DocHub, it is simple to reclaim your office time and boost your team's productivity. Access Sole proprietor Balance Sheet Templates online library and explore all form templates relevant to your daily workflows.

Easily use Sole proprietor Balance Sheet Templates:

Speed up your daily file management with our Sole proprietor Balance Sheet Templates. Get your free DocHub profile right now to explore all templates.