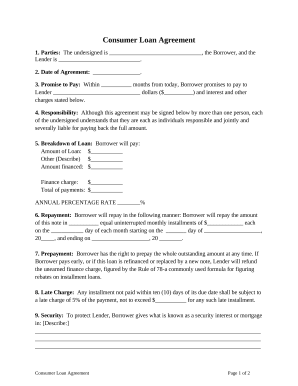

Your workflows always benefit when you can locate all the forms and documents you will need at your fingertips. DocHub gives a huge selection of forms to alleviate your daily pains. Get hold of Loan Agreement Forms category and easily discover your document.

Begin working with Loan Agreement Forms in several clicks:

Enjoy seamless record managing with DocHub. Discover our Loan Agreement Forms category and look for your form right now!