Record managing occupies to half of your office hours. With DocHub, you can easily reclaim your time and enhance your team's efficiency. Get Legal Forms for Property Deed Transfer online library and investigate all document templates related to your day-to-day workflows.

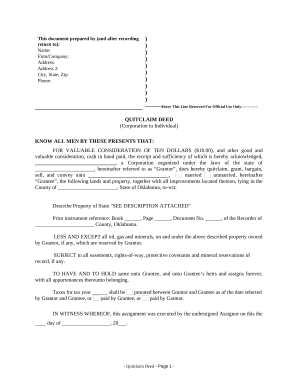

The best way to use Legal Forms for Property Deed Transfer:

Improve your day-to-day document managing using our Legal Forms for Property Deed Transfer. Get your free DocHub profile today to discover all templates.