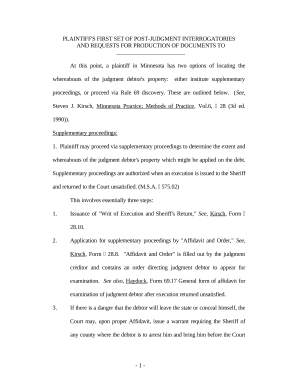

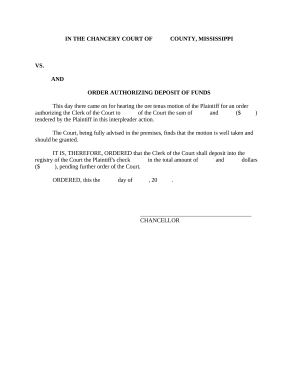

Boost your form management using our Legal Collection Forms online library with ready-made form templates that meet your requirements. Access the form, edit it, fill it, and share it with your contributors without breaking a sweat. Start working more effectively with the documents.

How to use our Legal Collection Forms:

Discover all of the opportunities for your online file administration using our Legal Collection Forms. Get a free free DocHub account today!