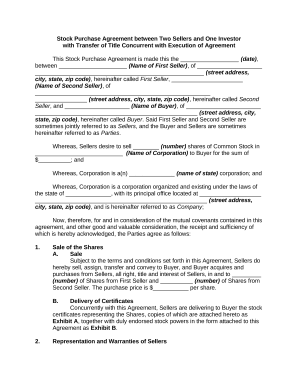

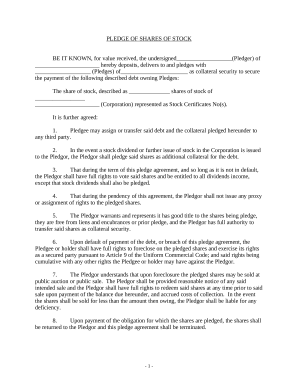

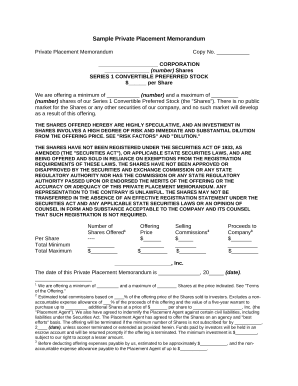

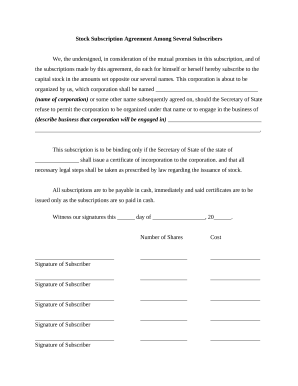

Speed up your document managing with our Investor Agreement Forms online library with ready-made document templates that suit your requirements. Get your form, edit it, complete it, and share it with your contributors without breaking a sweat. Begin working more efficiently with your forms.

The best way to manage our Investor Agreement Forms:

Examine all of the opportunities for your online document management with our Investor Agreement Forms. Get a totally free DocHub profile right now!