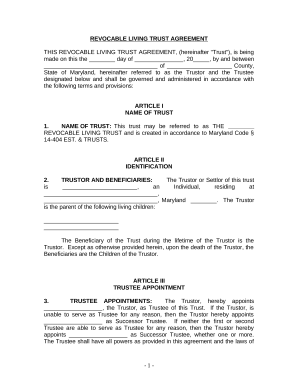

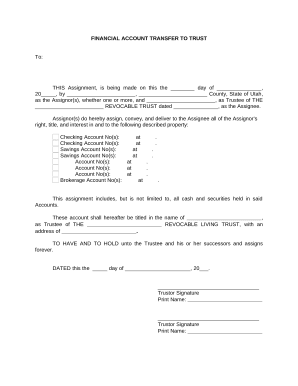

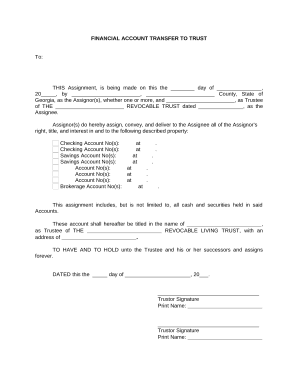

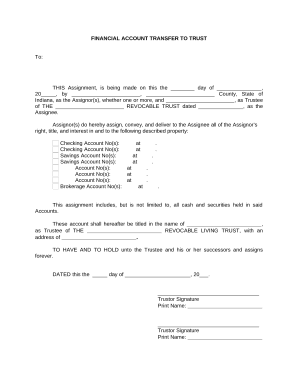

Boost your document operations with our Financial Trust Forms library with ready-made form templates that meet your requirements. Get the form template, alter it, complete it, and share it with your contributors without breaking a sweat. Begin working more efficiently together with your documents.

The best way to use our Financial Trust Forms:

Explore all of the opportunities for your online document administration with our Financial Trust Forms. Get a free free DocHub profile today!