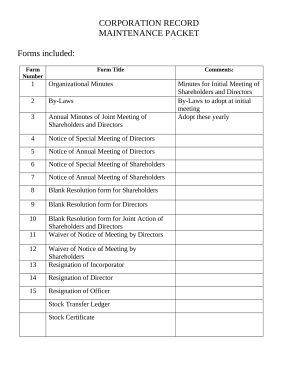

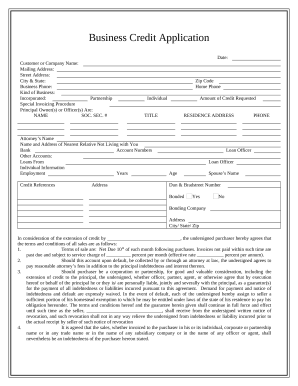

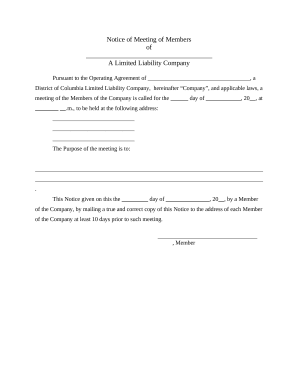

Your workflows always benefit when you are able to discover all of the forms and documents you may need on hand. DocHub provides a a huge collection of form templates to relieve your day-to-day pains. Get hold of District of Columbia Business Forms category and quickly browse for your form.

Begin working with District of Columbia Business Forms in a few clicks:

Enjoy easy document management with DocHub. Explore our District of Columbia Business Forms collection and look for your form today!