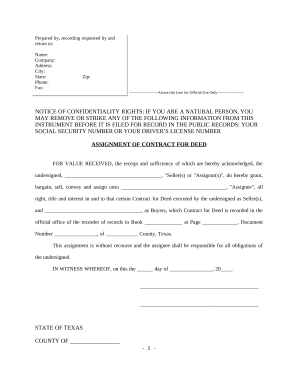

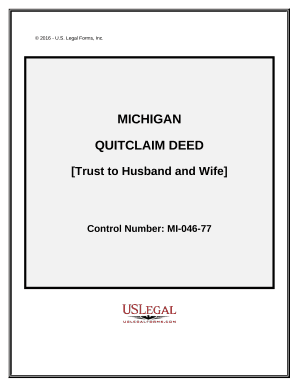

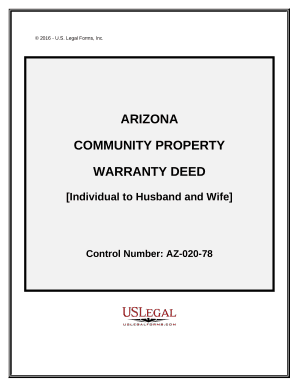

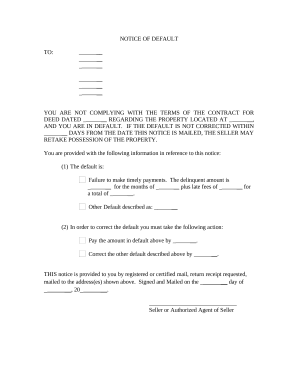

Improve your form administration with the Deed and Property Transfer Forms online library with ready-made form templates that meet your requirements. Access your form template, modify it, complete it, and share it with your contributors without breaking a sweat. Start working more efficiently together with your documents.

The best way to use our Deed and Property Transfer Forms:

Examine all of the possibilities for your online document administration with the Deed and Property Transfer Forms. Get your free free DocHub profile right now!