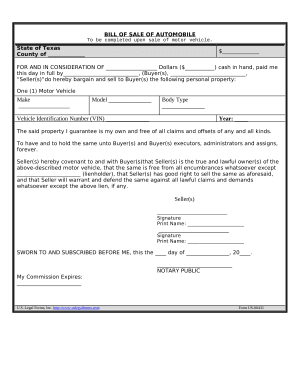

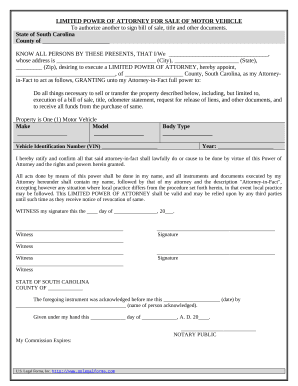

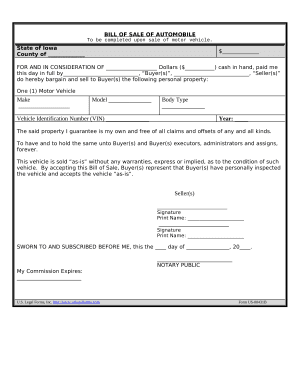

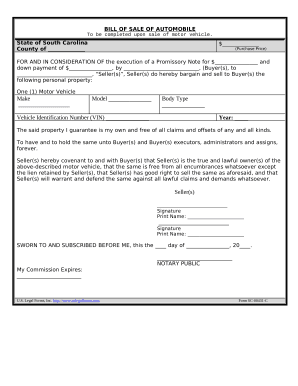

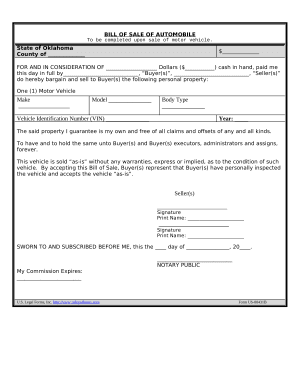

Boost your file operations with our Automobile Transaction Legal Forms online library with ready-made templates that suit your requirements. Get your form template, modify it, complete it, and share it with your contributors without breaking a sweat. Start working more effectively together with your forms.

How to use our Automobile Transaction Legal Forms:

Discover all of the opportunities for your online file management with the Automobile Transaction Legal Forms. Get a free free DocHub profile right now!