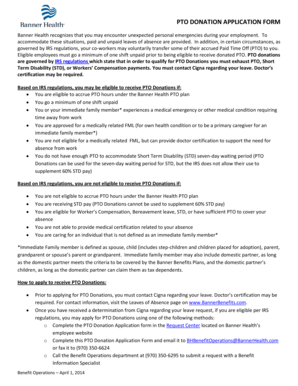

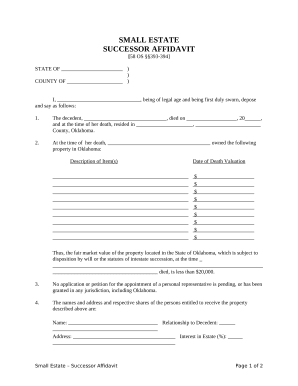

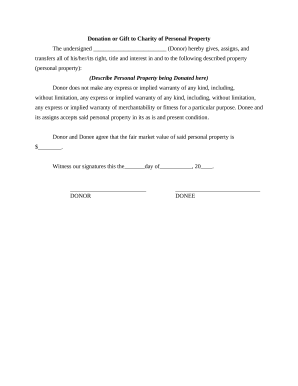

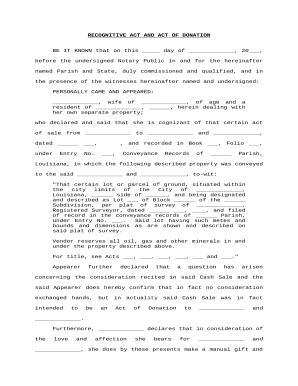

Streamline your donation workflows with Value guide Donation Forms templates. Stay compliant with laws by effortlessly completing forms and sharing templates.

Your workflows always benefit when you are able to get all of the forms and files you require on hand. DocHub delivers a a large collection forms to alleviate your everyday pains. Get hold of Value guide Donation Forms category and quickly find your form.

Begin working with Value guide Donation Forms in a few clicks:

Enjoy easy document managing with DocHub. Explore our Value guide Donation Forms online library and discover your form today!