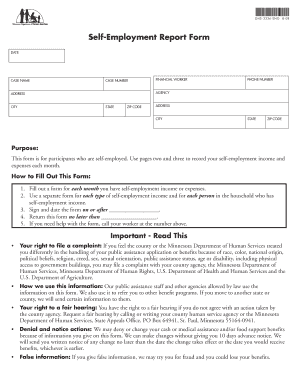

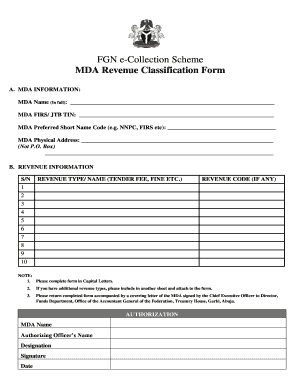

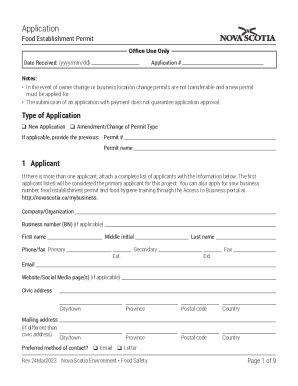

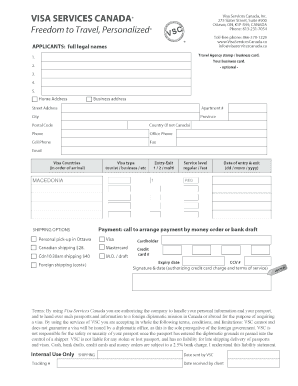

Get relevant Self employed invoice Canada Forms and effortlessly control them according to your requirements. Modify, complete, and securely distribute your forms with local authorities.

Your workflows always benefit when you are able to locate all of the forms and files you may need on hand. DocHub offers a a huge collection of document templates to relieve your day-to-day pains. Get a hold of Self employed invoice Canada Forms category and quickly find your form.

Start working with Self employed invoice Canada Forms in a few clicks:

Enjoy fast and easy document management with DocHub. Check out our Self employed invoice Canada Forms collection and locate your form today!